It can be difficult to justify the cost of subsea intervention other than to enhance production. In the West of Shetland, BP established other sources of value for intervention.

Michael Hartley and Trevor Grose, BP

BP operates three oilfields in the West of Shetland (WOS) fields of the northeast Atlantic. To date, any well intervention work has been undertaken by semisubmersibles. However, the WOS fields require better access to intervention capability, so BP has embarked on a plan to improve Light Well Intervention (LWI) access. Although LWI had not been attempted in the WOS, experiences elsewhere on the UK Continental Shelf and Norwegian Continental Shelf indicated that LWI was feasible and attractive for the harsh environment of the WOS. This article explains the process that BP underwent to identify and quantify value-adding intervention options, and explains some of the technical challenges that must be addressed to execute a subsea LWI campaign. Other intervention technologies being developed to address the global subsea well stock are also discussed.

INTRODUCTION

BP has operated subsea wells in the North Sea for over 25 years and has been performing light well interventions for over 20 years. Collectively, the North Sea has the world’s most mature stock of subsea wells, and has led the way in subsea technology.

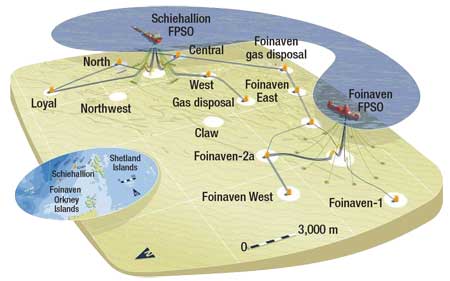

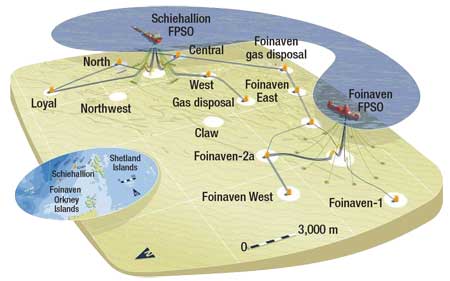

BP operates three fields in the northeast Atlantic: Foinaven, Schiehallion and Loyal. These fields are referred to collectively as the West of Shetland (WOS) fields. Around two thirds of BP’s active subsea wells offshore North-West Europe are in the WOS, and all these wells are tied back into two different FPSOs, Fig. 1.

|

|

Fig. 1. BP’s West of Shetland subsea infrastructure.

|

|

The basic motivation for developing LWI capability is to improve access to subsea wells during their lifetime to increase hydrocarbon recovery. It is well documented that typical subsea recovery factors are up to 30% less than those of typical dry-tree wells. This means there is a substantial prize, which drives considerable effort into closing the gap.

LWI is considered to be any in-well activity that takes place through or within the existing completion. Initially in WOS, this intervention would be done by subsea wireline, with wire through the water and a wireline pressure seal as part of the pressure control equipment on the seabed.

FILLING THE HOPPER

BP uses the concept of a “hopper” of potential jobs, with the expectation that about one in two mature wells will have potential for well intervention work. To justify a commitment to spending on subsea wells, it is critical that the value of the intervention be articulated. This needs to done in such a way that a business case can be developed, allowing jobs to be ranked and compared to non-well activities, and thus supported in the budget process.

Well intervention work can be divided into three areas. These are:

- Integrity related: Repair and inspection of wells, including trees and completions

- Surveillance: Collection of data to help understand current and future well performance

- Production enhancing: Changing the well performance by shutting off water or gas, increasing the hydrocarbon flow by re-perforating or improving lift performance.

The third category also applies to injectors, with respect to improving or restoring injectivity.

It’s relatively easy to construct a business case if the work is production enhancing, or if it is a repair on a well that’s shut in due to integrity-related issues, but extensive work had to be done to establish sources of value for surveillance-type activities.

The following sources were developed to define value:

Reservoir management. Identification of conformance in injectors and producers allows the support team to review the waterflood strategy and implement changes based on no further intervention. For example, a Production Logging Tool (PLT) in a multizone well may identify zonal conformance issues at the normal operating injection rate, but this will improve at a higher injection rate. When the well injection rate is adjusted to higher value, improved conformance is achieved.

Future production enhancement. Identification of conformance in injectors and producers allows the support team to determine the need for further well intervention (potentially simultaneous with logging) to improve waterflood conformance or water/gas shutoff.

Examples would include water isolation at the producer or changing the conformance at the injector to isolate a thief zone; identifying potential additional areas to perforate; and pressure transient analysis to identify areas of the wellbore that are not contributing to injection or production due to skin damage.

Fluid optimization. This could include using PLT data to identify key areas of gas ingress under varying drawdown conditions, or building on water isolation to free up space in plants or risers for increased throughput from existing stock.

Future development opportunities. A key area of the value case is the linkage of well surveillance data to the evaluation of infill or sidetrack candidates. Subsea wells generally suffer from a lack of data, and WOS operations rely heavily on 4D seismic when evaluating infill opportunities. However, in some cases 4D data is not enough to reduce major uncertainties or risks of infill options. PLT and saturation log data in key wells can deliver the missing information and allow the infill options to be more accurately assessed and progressed.

Establishing well conditions. The mechanical condition of the upper and low completions (i.e., holdup depths and presence of sand, scale, wax, etc.) can be measured using a caliper or ultrasonic corrosion imaging logs. This facilitates prediction of the other wells’ statuses by extrapolation and thus improves the operator’s ability to plan remedial repairs rather than react to integrity problems as they occur in the wells (e.g., annulus communication detected by a rapid rise in annulus pressure means the completion is already leaking at this point). Establishing well conditions to extrapolate other wells’ statuses also improves the operator’s ability to change the completion design to prevent similar problems.

Callibrating 4D data. Although 4D seismic is used as a field-wide surveillance tool, it is not a silver bullet. It provides a clear view in some fields of potentially unswept areas of the reservoir, ripe for infill opportunities. In other fields, it provides the change in fluid properties, which affects the base reserves delivery.

Although this technique dramatically improves data resolution, some sand and fluid properties remain hard to image correctly, and both PLT and saturation logs can fill this gap and help to calibrate the 4D signal. This will impact both base reservoir management and the pull-through of reserves and resources.

SOURCES OF VALUE

As an example, a number of scenarios were run to demonstrate sources of value from a PLT in one multizone gas/oil well in the WOS.

Reservoir management opportunity. A PLT will establish if the production contribution for each zone will inform the optimization of injection in the three surrounding injectors. If this new injection program is realized, assuming the injection of 10,000 bpd of water and 0.1 bbl of incremental oil per barrel of water, this injection program will yield an incremental 700,000 bbl of oil over 2 years. This scenario has a 30% probability as determined by reservoir modeling and estimation.

Reservoir understanding. Accurate calibration of the 4D seismic data will potentially allow further 4D shoot costs to be avoided, or will provide more confidence and allow additional PLTs to be avoided. This has a probability of 10% based on estimation.

Well conditions. This well is a long horizontal well with erratic production behavior. Understanding the current well status may help the optimization of better completion design. The estimated value of $10 million has a probability of about 30%.

Future wellwork opportunities. A log may confirm that a water shutoff at the injector could improve recovery of oil. Reservoir modeling indicates a potential 800,000 bbl with an estimated probability of 60%.

There is some evidence to suggest that sand production has created a need for a sand cleanout. This could increase oil production in the well by 500 bpd, allowing an additional 300,000 bbl of oil to be produced. A probability of 30% is estimated for this outcome.

Future development. The PLT may inform on the requirement for an additional injection well, which could allow several million barrels of additional recovery. This outcome is estimated at a 30% chance.

Fluid throughput to production. A water shutoff would result in an increase of 600 bopd in production capacity for the life of the well. A 50% probability is estimated for an additional 3 million bbl of oil.

Once the sources of value have been defined, and it is determined that these sources of value indicate a good business case, this triggers more detailed work. To make sure the right options are considered requires building a good business case that includes multidisciplinary input, reflects an understanding of the technical and commercial risks, and ensure that operations can be done within safe practices.

Getting the partners involved at an initial technical level allows them to offer input early in the LWI planning. BP typically involves partners in its regular well reviews, which are often where the initial interest for surveillance is first noted.

In the WOS fields, this process resulted in a sufficient “hopper” of mature jobs for BP management to make a firm commitment to an LWI vessel, resulting in a contract award and a vessel being built. The vessel is currently working on well abandonment-type work, with LWI activity planned for early 2009.

WOS CHALLENGES

LWI monohull-based vessel activity has been carried out in North Sea subsea wells since the late ’80s. Additional work in the Norwegian North Sea in the past five years has added to the activity, as has one season of activity on the Australian Continental Shelf.

The specific challenges of working in the WOS with a vessel on subsea wireline work are:

Harsh weather. Figure 2 shows the percentage of time during the last 50 years that WOS sea heights are below 4 m and 6 m, which are typical operational limits for vessels. The graph also shows the percentage of time for these sea heights that the WOS experiences average wave periods less than certain values. Longer wave periods increase downtime. The graph illustrates that potential downtime depends heavily on the time of year.

|

|

Fig. 2. Percentage of time that the West of Shetland experiences conditions less than certain sea heights and wave periods.

|

|

It should be noted that the statistics compared with theoretical operability provide a good idea of the likely outcome, but the real test is taking the vessel and crew into those conditions and seeing how it works. The modeling is relatively simple compared to the complex nature of multiple wave trains acting in different directions.

Sea currents. The other environmental factor that applies in the WOS fields is the currents.

Table 1 gives current data for one of the fields. It shows the extreme currents that can be expected in a specific period.

| TABLE 1. Extreme currents for one WOS field |

|

|

What is not represented in the table is how the currents vary with direction. The data presented allows the operator to plan appropriately, but, again, the real test is getting the equipment subsea and seeing how it, the vessel and the crew respond to the real-world conditions.

Integrated planning. The final major challenge around operations in the WOS is the impact of other activities occurring there. These include FPSO activity, subsea construction, subsea inspection, drilling activity (sometimes multiple rigs working simultaneously) and seismic surveying.

Integrated planning of all these dynamic activities is a continuous process, and ensuring that the LWI vessel does not clash with other activity requires the operator to be flexible and to carry some contingencies.

TECHNOLOGY DEVELOPMENT

The original scope of intervention work in the WOS was to access subsea wells with wireline. During the process of “filling the hopper,” it became evident that other types of well work were needed. These additional opportunities required extra functionality over and above the base subsea wireline case. These extra requirements have been the subject of a development plan that has been progressed over the last two years.

The technologies being developed for the WOS include:

- Capability to deploy and use a rigid riser from a vessel

- Coiled tubing solution to enable vessel-based operations through the rigid riser

- Pumping capability to inject fluids into wells

- Ability to run trees in the WOS conditions.

The technology development was undertaken in order to allow for follow-up interventions generated by the initial wireline work, and also to allow reactive work to be completed on failed or failing wells. In the last three years, well failures have required wells to be accessed by semisubmersibles, which had to be taken off their drilling programs. In the current rig market, this is not an economic solution, and the potential for doing investigation and repair work with a riser-equipped vessel has great value.

To ensure that solutions developed are suitable for application on BP-operated wells, the development has been assisted by a BP technology specialist. The use of LWI in the WOS and the associated technology development satisfy some of the requirements for use in other BP fields around the world, but there are other areas of subsea well intervention technology currently under review or development.

Unrelated to BP’s technology development for the WOS, several companies are building intervention vessels, among them Aker Oilfield Solutions, Helix Energy Services, the Island Offshore Alliance and TSMarine. Most of these are on the order of 120 m long and about 7,000 metric tons (mt) of dead weight. Aker, however, is building a 157-m, 10,500-mt vessel for heavier well interventions and thru-tubing coiled tubing drilling.

One technology in the works is a reverse derrick deployment system being developed by Geoprober Drilling, which allows a monohull vessel to run a rigid-riser well intervention package in water depths up to 3,000 m, Fig. 3. This is made possible by reacting the loads at deck level, by means of a tensioning system located around the moonpool to provide both active and passive heave compensation. Currently BP has no direct involvement in the Geoprober system.

|

|

Fig. 3. The reverse derrick deployment system being developed by Geoprober Drilling allows a monohull vessel to run a rigid-riser well intervention package in water depths up to 3,000 m.

|

|

CONCLUSION

Although subsea interventions have been done in the North Sea for the last 20 years, the recent and predicted exponential growth in subsea wells has resulted in a corresponding increase in the demand for intervention technologies.

There are several vessels being constructed for LWI work, some of which are dedicated while others are multipurpose (construction/maintenance/intervention). Alternative intervention techniques are being developed, with these techniques at various stages of maturity from detailed design to fledging concepts.

These developments will be key to getting the best out of the subsea wells that are being drilled in ever-increasing water depths.

|

THE AUTHORS

|

| |

Mike Hartley graduated in 1991 from Bradford University with a degree in mechanical engineering. He joined Schlumbergnnnnner as a Field Engineer, and worked in cementing, coiled tubing and stimulating. Mike later worked for Transocean on coiled tubing drilling, for Weatherford with thru-tubing downhole tools, as a Night Drill Rep for Talisman, and as a Well Intervention Engineer for ConocoPhillips in the southern North Sea gas fields. He currently works on subsea intervention strategy, planning and operations for BP. He can be contacted at Michael.Hartley@uk.bp.com.

|

|

| |

Trevor Grose is a Senior Petroleum Engineer, as well as Global Advisor and Community-of-Practice Lead for Reservoir and Well Surveillance in BP’s upstream operations. He has spent 25 years with BP in jobs ranging through production chemistry, operations-based petroleum engineering and reservoir surveillance delivering production optimization and well intervention opportunities. In his Advisor role, Mr. Grose develops best-practice sharing and learning throughout BP and supports technology development/deployment in real-time surveillance/analysis and surveillance strategy development.

|

|

| |

|

|