The three official themes took a back seat to discussion of high prices. The de facto theme was that “It’s not the fundamentals.”

Perry A. Fischer, Editor

The first and second Summits were held in 1975 and 2000. So with this Third Summit, it was natural to ask the question, “Why now?”

As distinguished from a regular meeting, the infrequent Summits are held because of some overriding need or event. Ostensibly, this Third Summit was called for the three official themes, which were: providing petroleum, promoting prosperity, and protecting the planet. However, near-$100 oil prices occupied much of the discussion.

The two-day Summit, held in Riyadh, was preceded by a two-day Ministerial Symposium, which was much more about nuts and bolts, and practical, than the Summit, which was political and came with a promise not to make any of the usual supply decisions.

The Summit. Saudi Oil Minister Ali Al-Naimi said, “The prices today have really no relation to the fundamentals.” He said that Saudi Arabia had an output capacity of 11.3 million barrels a day, but was only producing 9 million barrels a day now. “I hope these figures will help reduce any apprehension in the world, which are groundless, regarding the reliability of supplies.” Naimi added that it’s not supply, but the pessimistic outlook of industry pundits and “gurus” that are creating high oil prices. It was a point that was repeated often and by many during the four-day meeting. During a lengthy interview on Riyadh television, this Editor even went so far as to challenge OPEC to “add half a million to a million barrels a day for six months to a year and prove the peakers wrong, assuming that OPEC actually has the excess capacity to do so. Failure to do so is inadvertently bolstering the claims of these peakers and causing high prices to go even higher.”

There were the expected speeches from member countries. If I might try to read between the lines, it seems that the GCC states (Gulf Cooperation Council-Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates) led by Saudi Arabia are tying to play the role of moderate. Presidents Hugo Chavez and Mahmoud Ahmadinejad are trying to be divisive, while forming a sort of bloc among themselves and a few others such as Ecuador. The two men spoke of “worthless paper” in regard to the US dollar, and Chavez urged OPEC to be more political.

Ecuador’s President Rafael Correa proposed a tax on large oil-consuming nations to pay for environmental protections in other nations, with OPEC managing the fund. “It annoys us a bit, all of this moralizing about ‘don’t cut down your trees’ from the first world, when they’ve already done it.” Correa said. “If Europe wants to breathe clean air from the Amazon countries, then the Amazon countries shouldn’t have to pay for it.”

Historically, cutting back production has been more difficult for members to agree on than opening up the chokes to increase production and revenues. But OPEC can still find ways to disagree. In some ways, this is nothing new-OPEC has never been a monolith. Disagreement among its members is what stops it from becoming the power-wielding organization that it has the potential to be. Fortunately, its members are generally not so stupid so as to wield oil as a weapon. There could be negative consequences for doing that. Instead, it tries to play a more constructive role as a moderator of prices by adding or withholding supply.

Another theme was finding ways to “keep what is good about oil and do away with what is bad in oil.” Hence, the announcement that some GCC members pledged a total of $750 million to a new fund to tackle global warming by financing research for a clean environment. Kuwait, the United Arab Emirates and Qatar each pledged $150 million for the fund, while Saudi Arabia said that it would invest $300 million. It was not clear, perhaps not even known, exactly what the research would focus on. If it is about finding technological solutions to climate change, such as making “clean oil,” and carbon capture and storage, then there will not be a problem. However, if the money funds research as to whether global warming exists or is even a problem, then the results of such research will not be believed.

The leaders “stress the importance of cleaner and more efficient petroleum technologies for the protection of the local, regional and global environment, and the importance of expediting the development of technologies that address climate change, such as carbon capture and storage,” said the statement. OPEC also reaffirmed “the core principle of common but differentiated responsibilities and respective capabilities, in addressing climate change policies and measures, including the implementation of UN Framework Convention on Climate Change and Kyoto Protocol.”

The Symposium. The Symposium had more than 30 presentations, about half of which were the familiar PowerPoint type, showing real data. A few of the presentations presented problems and suggested solutions.

Dr. Adnan Shihab-Eldin-a man with far too many superb credentials to list, including former Acting Secretary General of OPEC-spoke on the topic of “Technological options to environmental concerns.” Among his many points were that Climate Change has become an ideology that is a more compelling and difficult challenge to fossil fuels than energy security, but he nevertheless saw the threat of climate change as real, and did not disagree with the UN’s climate studies. His numerous solutions centered around four themes.

First, Dr. Shihab-Eldin cited every possible improvement in energy efficiency, calling for much higher efficiencies in transportation, electricity generation, lighting, appliances of all types, buildings, agriculture…basically, everything.

Second, he called for development of advanced, Generation III and IV nuclear reactors, which are much safer to operate (not surprising for a man with a PhD in nuclear engineering). He also called for the full spectrum of renewable technologies to be implemented and supported by OPEC. He made the remarkable statement that “A breakthrough in cellulosic biofuels could pose a challenge to oil’s dominant role in the transport sector.”

He then described carbon capture and storage of all types, basically, the UN’s IPCC gamut, including this Editor’s personal favorite, CO2 flooding for oil recovery. He said that “billions of additional barrels of oil could be recovered in this way.”

And finally, he called for research in geo-engineering the Earth as an “insurance policy” to counter global warming, just in case a worst-case scenario was to emerge.

Pierre Terzian, an oil analyst with the Paris-based newsletter PetroStrategies, tried to explain some of the reasons behind high oil prices. Unlike several speakers, who lauded the positive effects of high prices, such as encouraging conservation and technology development, Terzian pointed out the obvious: namely, that the rich and poor will not suffer alike due to high oil prices.

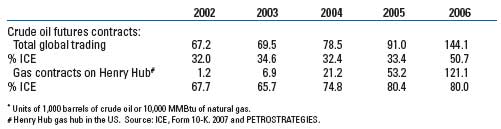

He noted that, in 2005, OPEC had only 500,000 barrels a day of spare capacity; by 2007, it had 3.4 million barrels a day. Despite this inventory rise, oil prices doubled. His reasons for high prices were (Tables 1 and 2):

- The Commodity Futures Modernization Act (CFMA) of December 2000 in the US gave birth to Exempt Commercial Markets (ECMs). CFMA is now referred to as the “Enron loophole.”

- The volume of US futures exchanges increased by 442% in seven years.

- There is increased concern over climate change.

- There are tighter fundamentals (since 2002) and higher geopolitical risks.

- Increased oil volume is traded on futures markets compared to fundamentals.

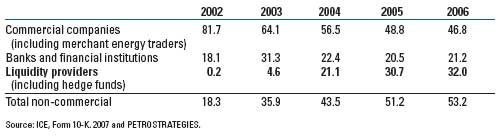

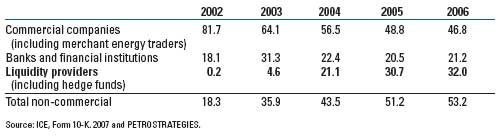

- Non-commercial players, especially “liquidity providers” such as hedge funds, dominate futures markets.

- There is regulatory disparity between ECMs and regulated markets.

| TABLE 1. Futures market for oil and gas including OTC (millions of contracts*) |

|

|

| TABLE 2. Who are the OTC traders on the ICE? (%) |

|

|

Regarding how to bring prices down, it was generally agreed that OPEC has no ability to, nor should it even try to, interfere in trading markets. However, Terzian noted a general awareness that Western politicians now recognize the above market problems. US congressional reports in 2006 and 2007 have criticized the current legislation and accuse “speculation contributing to rising energy prices.”

There are several “close the Enron loophole” bills proposed in Congress, although none has been voted on yet. In Washington on November 8, 2007, the new French president attacked “the vagaries and excesses of financial capitalism that currently leaves too much room for financial speculation.” He asked the US to “show strong commitment to the introduction of necessary rules and safeguards.” The New York Mercantile Exchange (NYMEX) complained in congressional testimony that it would be a good idea if NYMEX and the ECMs had to operate by the same rules. The CFTC held hearings in September 2007, acknowledging that ECMs should be re-examined. In October 2007, the CFTC recommended to Congress the following legislative changes:

- Large trader position reporting

- Position limits or accountability levels

- Self regulatory oversight

- Emergency authority.

All of the above are to “prevent manipulation and disruptions.”

Terzian’s presentation was different from all the others-and seemed unusual in that I had to travel to Riyadh to get a good overview of what was happening in the US with respect to oil prices.

Ending the Symposium was Ali Aissaoui, head of research for Arab Petroleum Investments Corp. (APICORP), who gave a highly technical and informative talk titled “Today’s market dilemmas and tomorrow’s economic challenges.” Of all the data presented, this one graph epitomizes the upside-down fundamental logic that now characterizes oil prices. Ordinarily, when inventories go down, prices go up, and vice versa. Now, that’s exactly reversed, Fig. 1.

|

|

Fig. 1. Normally, when inventories rise, prices fall. Since 2003, that fundamental supply and demand “law” has been reversed.

|

|

|