EXPLORATION MARKET REPORT

Beyond the multi-client model�Past, present and future of exploration

An overview of the status of the exploration industry, from the view of the players involved, in a question and answer format.

Jeff Moore, Contributing Editor

In the past two years, the seismic industry, as a whole, has done better financially and has had more crews working than in prior years. But there are important niche issues not usually covered even in the oilfield media, such as business practices, new technology, the multi-client survey model and the relationship between seismic firms and oil companies. These are some key issues that underlie performance, revenue streams and reputation. World Oil recently conducted in-depth interviews with three key seismic industry movers�Apache Corp., Fairfield and WesternGeco�to get a more detailed picture of what is going on in these areas. The respondents were candid and detailed, and the answers were enlightening.

Question: What have been the most recent improvements in seismic industry efficiency? Were they business model or technological improvements?

Regarding business improvements, Mike Bahorich of Apache Corp. said, “The big news, and this means pre-2007, is the M&A activity, particularly with CGG buying Veritas�that’s the biggest, single recent event. And it’s not a bad idea to have a few large players that can invest deeply in R&D.”

Robin Walker, WesternGeco’s Q product manager, spoke of improved efficiencies for the seismic industry as a whole�changes that have occurred because of recent resource shortfalls, not just in boats and land crews, but also in people for data processing. These problems have pressured existing seismic capacity, and have spurred increased communication between seismic companies and their customers. “We are communicating much more openly and learning how we can make best use of the assets available,” said Walker. “It’s a strongly positive thing and a bit of a sea change.”

He continued, “...both sides of the equation�ourselves and our customers�have spent a bit more time actually talking to each other and communicating more than in the past, and really understanding what each others� needs are. We talk about what we both are trying to get out of the project, instead of sitting behind barriers half-a-mile apart, slinging mud at each other.”

Walker said that in the past, seismic companies regularly had assets available to oil and gas companies. “Then they slid into the mentality of always assuming, figuratively, that you can walk out from the airport, and there are taxis lined up outside waiting to take you wherever you want to go. Now, there are fewer taxis at the airport, so to speak, as in fewer seismic assets and personnel to deploy, and the industry has had to adapt to new realities.”

The capacity shortage has also forced seismic companies and their customers to prioritize assets and scheduling, particularly regarding taking a local vs. global view toward planning. Said Walker, “One thing is inevitable, and that is, in a world where the operating model is local asset teams, issues can become localized, so [our customers] lose the global view. Now, they have to take that global view for planning. It’s been good for us as a company, and probably as an industry, that we’ve gone through a painful process, and we’ve come out a bit stronger at the other end.”

On an individual corporate scale, Walker added, “...We do our best to optimize efficiency, in terms of improving technology that reduces technical downtime, and optimize how quickly we get started at the beginning of a job. That’s a constant, ongoing process. We always try to be more efficient.”

Regarding recent, noteworthy, technological advances in seismic, Apache’s Mike Bahorich said that channel output has greatly increased the industry’s effectiveness. “...Decades ago, we were pretty happy with a 24-channel or 48-channel 2D line. And what’s happened since then is that there’s been a steady but significant increase in channel count. And that directly relates to quality and costs, which relate to efficiency�a better picture, in less time�which translates to less money [spent on overhead].”

Bahorich said that Apache is on the verge of a fairly significant technical advancement�of going from a couple of thousand channels on a 3D crew up an order of magnitude in the 20,000-channel range. “We have been using a crew in Egypt that has 20,000 channels, which allows us to cover a phenomenal amount of ground. In addition, we have recently made a deal with Input/Output Inc. and BP to manufacture the world’s first high-density, flash memory, multi-component recording system.”

The system is presently at 10,000 channels, but increasing the channels has correspondingly increased the system’s complexity. “And it’s difficult to have 20,000 channels all hooked to a wire and make everything work at once, because everything’s interdependent,” said Bahorich. “This new system works on flash memory that’s no different than flash memory you could get at a department store. It uses a USB memory stick. So, you could think of it as a memory stick and a sensor.”

“And in addition,” he noted, “It’s a multi-component sensor, so it senses the P wave and the S wave in two directions. So it’s a three-component sensor.” Bahorich said that Apache put Slip-Sweep, a data acquisition method, to great use in 2006. “It gives us the ability to use vibroseis more efficiently and increase the amount of data that can be acquired in a day.”

He explained that the old model for vibroseis is to sweep, and then listen, and then repeat the process on a stop-and-go basis. Then came “ping pong,” where a contractor would sweep, and then listen in one location, and then, when finished listening, begin sweeping in another part of the shot� maybe on the other side of the spread�and the process was continual.

“Slip Sweep,” said Bahorich, “is the next improvement on that process, in which you literally sweep and listen, and before you are even finished listening, you start the next sweep of another set of vibrators. And so, you are literally sweeping right on top of another sweep.” He said that it introduces some noise, but because the vibroseis sweep noise is a chirp, similar to that produced by a police radar gun, it goes from low-frequency to high-frequency, and it’s a complex signal that processors can find in the data. Bahorich said it saves time in shooting surveys. “In some cases, you might get a 30% or 40% efficiency improvement. This is huge�considering that you might be paying $50,000 a day for the crew.”

Fairfield’s Steve Mitchell had some comments. “Obviously, there have been improvements�technological improvements�in instrumentation, as regards reliability and things of that nature that come with advances in technology.” He described Fairfield’s new Z Technology for maritime seismic work as an example. It gets away from cable-type systems and relies, instead, on node systems.

Said Mitchell, “These nodes are totally self-autonomous. They have flash memory in them, and they record all the time. So you start them up on deck, and you put them on the seafloor, and you don’t have to have cables hooked up. They record all the data and store it on flash memory, and then you go back and get the nodes.”

Mitchell said that Z Technology works with digital camera-type flash memory in a waterproof container. “Once you’ve got it back on deck, you plug into it, suck the data, recharge it and kick it back overboard.” Fairfield places the nodes on the seafloor via rope in shallow water, and with remotely operated vehicles (ROVs) in deep water.

Although nodes have been around for a number of years, previously, they had been used mostly for scientific work and for deep crustal studies. Mitchell described Fairfield’s node technology as revolutionary and successful but a bit avant-garde, too. “With nodes, we can get right next to the wellhead. We use the same ROVs that the engineers use to turn the valves on subsea wells to set the nodes on the seafloor.” As to whether nodal technology could saturate the market, Mitchell said, “We’re not there yet. We are still early in the game. There are still those who don’t accept it. Here’s the problem�you are shooting blind, meaning, you don’t look at your data every time you shoot it and say, ‘everything’s OK.’ That’s the psychological hump people have to get over.”

However, nodal technology has been proven successful. Said Mitchell, “When we shot Atlantis for BP, we recovered 99.3% of the data.” Atlantis is the Gulf of Mexico’s third-largest field.

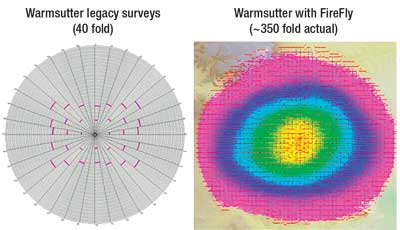

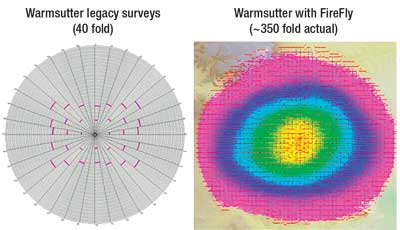

Node technology is beginning to be used in onshore seismic too, with commercial systems from Input/Output (Figs. 1 and 2, FireFly�now in testing with Apache Corp. and BP) and from Vibtech (Unite system now in field trials), which was purchased last fall by Sercel. The benefits of such land systems, said Mitchell, will be tremendous. “A 5,000-channel land crew at a 220-ft group interval is going to have over 210 mi of wire lying on the ground. How many deer, how many rats, how many animals might step on it or chew on it? Then there’s the task of picking it up and putting it down every day, wearing out connections. Those kinds of issues go away when you go nodal and get away from a cable-type system.”

|

Fig. 1. Cableless land seismic acquisition solution offers improvements in operational productivity, HSE performance and image quality. Photo courtesy of I/O.

|

|

|

Fig. 2. If the elimination in cabling results in an increased number of stations on the ground, the resultant fold provides significantly improved subsurface sampling. Dense surveys with long offsets and wide azimuths can be acquired more easily and economically. Image courtesy of I/O.

|

|

Other technology in the seismic maritime arena making it big is WATS, or Wide Azimuth Towed Streamer. Mitchell described it this way: “A regular towed streamer shoot is done in a narrow rectangle. For wide azimuth, you tow multiple streamers from multiple boats, all coordinated and each going in different directions rather than just a narrow rectangle. It provides more data for a better picture of the Earth’s interior than what a single boat could provide. Instead of having your energy source in a narrow, north-south direction, you want it full around, 360°, especially for subsalt imaging. And the deep water in the Gulf of Mexico is a subsalt play. So WATS is something new for the streamer boys.”

Robin Walker said that WesternGeco has made recent technological advances. He referred to the company’s Q-Technology, and noted that Q revenue has doubled every year since 2002, and is now at $750 million. Q-Technology is an advanced suite of technologies and services that enhances “reservoir delineation, characterization and monitoring” both on land and offshore.

Walker said that conventional seismic is “a battle of signal-to-noise ratio,” and that most processing technologies try to clean a mass of collected signals that are polluted by noise. “With Q, every sensor is acquired as a separate digital channel, and we get rid of the noise right at the beginning in the digital domain. Then we can concentrate our data processing flow on adding value rather than removing noise.”

He also said that one of the firm’s ultimate objectives is to better image subsalt prospects, particularly in the Gulf of Mexico. “That theme is improved calibration, better frequency response, and more reliable inversion to acoustic properties, so that our customers can understand the lithology as well as seeing the images.”

Additional recent technologies that the firm has produced are based on electromagnetics: Marine Magneto Tellurics (MMT), and Controlled Source Electromagnetics (CSEM). “The idea behind MMT,” said Walker, “is to gain some idea about the dimensions of a basin when you have little or nothing else. It’s an electromagnetic measurement that relies on the energy constantly bombarding us from the sun.” Controlled Source EM uses an active electromagnetic source towed in relatively deep water; resistance is recorded at a distance on the sea floor to get a resistivity of the whole volume, at the reservoir level. It helps to discriminate fluids, since gas and oil do not conduct electricity, and brine does.

Walker said that this technology is exciting, because when combined with seismic, it better defines subsurface imagery and indicates to a fair degree not just where the fluids are, but which fluids are present. “It’s quite scientifically complicated, and we’re just at the start now. We’re kicking off, and projects are being run around the world.”

Regarding the industry’s conservative geophysics sector, Walker said that some professionals are slow to embrace these new technologies. Specifically, the seismic industry comes up with a technology, such as MMT or CSEM, “...and our customers say, ‘Jolly good. I’ll wait until other companies can also produce it, so I can get it a lot cheaper. Then, I’ll sit and wait for 20 other people to try it, and then we’ll give it a go.’ ”

Added Walker, “Not everyone’s like that, though it’s been that way sometimes in the past.” But he said that customers have, indeed, been willing to try CSEM and MMT. “Our view to the customer has been that, we’ve produced this technology, and you need to use it, or else, it dies. Today’s price of oil obviously helps that sort of enthusiasm.”

Question: What is the status of speculative multi-client surveys?

Speculative surveys have been controversial in some regards in recent years. A few years ago, several seismic companies overextended their capacity and lost financially, because they had more assets and projects than they did buyers for their data. Fairfield, however, is a company that has done well with speculative surveys.

“Spec data is still doing very well,” said Mitchell. “At Fairfield, we acquired the same amount in 2006 that we did in 2005. The business model is still strong. The Gulf of Mexico is still strong. I think the spec market worldwide is doing well. It directly relates to commodity prices. No doubt about it.”

“Essentially, the libraries have shrunk,” said Apache’s Bahorich. “But now, of course, the industry has turned around quite a bit. The seismic contractors are doing much better, and they now have the financial strength to acquire a bit more spec.”

Said Hasbi Lubis of WesternGeco, “It is good. It’s done well (especially in the Gulf of Mexico). And it’s also forcing us to go back to the table and discuss ways on how to improve the multi-client offering�for example, re-processing of data, and some new methods in acquiring and improving the quality of the multi-client, similar to what we do in the Gulf of Mexico with wide-azimuth multi-client.”

Regarding spec shooting outside the Gulf of Mexico, Lubis said, “...the challenge is still there. We need to go back and talk to the clients, the national oil companies, on how this business model can really help them.”

In the Gulf of Mexico, seismic companies get to keep the data they collect, and they can sell it and reprocess it with new technologies as they see fit. Outside the Gulf of Mexico, however, it’s very different. Overseas, many countries maintain tight ownership of their hydrocarbons through state-owned oil and gas companies, and they also maintain tight ownership of the intellectual property rights of those hydrocarbons, meaning seismic data. “And so,” said Walker, “the model that seismic companies work under is that they have an exclusive marketing period, where they get the rights to market that data, after which it reverts to the government. This, therefore, impacts our decisions, because we can’t see that intangible future benefit of reprocessing it and adding value many more times.”

Question: What lessons has the industry learned from past spec shooting?

“I think the most painful lesson learned was that we, as an industry, acquired more spec data that we could sell,” said Apache’s Bahorich. “I think that a number of contractors ended up with an unruly balance sheet at that point. And what you’ve seen in more recent years is more caution for shooting extensive surveys.”

Said Fairfield’s Mitchell, “I think the industry has learned where to do spec and where not to do spec. In the last bad times, when everybody had their boats, or when a job started falling apart, companies needed to stay busy, so they started shooting spec. Well, you have to have the proper client base to shoot spec, but obviously, our industry is strong right now, so it’s much easier to pick the right places.”

Mitchell said that there are three bottom-line lessons that his company has learned over the years regarding spec shooting. “First, always stay on top of technology. That is crucial, even when you know it is a very specific, significant cost. Second, you must keep your database fresh and add new data to it. Cash flow may keep you from doing that in bad times. And third, you cannot think month-to-month; you have to think year-to-year. I look at six months in the annual cash flows, not monthly cash flows.”

“I can answer this really quickly,” said WesternGeco’s Walker. “Discipline, discipline, discipline. Multi-client to us is a business. It always has been. Schlumberger has taken a positive but conservative view about multi-client surveys, and it wants to evaluate them on a case-by-case, project-by-project business basis. That’s what we’ve always done. What has been learned by the industry, in general, is that this is not a bad thing to do. We’ve been quite rigid, and I think there is a rigidity of making a proper business case. That is good, because it means that we have to prioritize.”

As an example, Walker cites the company’s WAZ (Wide Azimuth) E-Octopus project that is ongoing in the Gulf of Mexico. “[The project] took a while to put together, because our Houston office management team had to state the business case for putting a vessel on that, rather than doing proprietary work. The initial results from Phase 1 meant that we secured the industry pre-commit funding needed to go straight onto Phase 2 very quickly. That means that within the portfolio of opportunities we have for multi-client, we have to look at the ones that are the best and enforce capital discipline. We must find those projects that are really worthwhile.”

Walker also cites technology development as a reason to shoot multi-client. “One of the reasons for us to shoot multi-client is back to W(wide)AZ, R(rich)AZ, M(multi)AZ�these various Gulf of Mexico configurations�as a way of speeding up the adoption of new technologies by the industry. It gives us a great case study when we go and choose to put our new technology on a multi-client project. Universally, the reaction [from our clients] has been positive. In the past, if you went to shoot a survey just to keep a boat [or other] asset busy, there always was a bit of concern on the oil company’s part that...you [were] actually losing money. They [were] not certain that there [was] any business case. And of course, the concern is that when a better contract opportunity comes along, you’ll walk off that project and go on to the better business. So for our customers, it makes good sense to know that we’ve made an essential business evaluation before we start that contract and that...we have people to finish it.”

Question: What would the seismic contractors and oil companies like to see from each other?

“There is the normal ebb and flow of good times and bad times,” said Mitchell. “And when it’s good times for the contractors, we obviously are looking for better terms and contracts than we did in bad times. We give up more in bad times. It costs a lot of money to park equipment. And the question always gets down to, ‘Do I park it and eat that cost, or do I run it for a little bit below cost?’ Depending on which side of the fence you sit on, times are good now, and contractors are asking for and getting things that we used to not get. But it is part of the normal ebb and flow. You can’t look at it from one year to the next. You have to look at it through an entire cycle.”

Said Apache’s Bahorich, “Well, I think there are tremendous benefits by sharing both technical and business ideas,” meaning increased communication. “For example, the 10,000-channel, multi-component system (mentioned earlier) was a joint project between Apache, BP and Input/Output. Obviously, we are working with seismic contractors, as well as those who actually shoot the data. So, those sorts of business models can help bring the technology to bear more rapidly and at less risk to all parties, because we are all sharing the idea and sharing the cost.”

Walker echoed what Bahorich said about the benefits of good communication. He inferred that it has an impact on quality control, value and fair pricing of services. “...For people to have the freedom to suggest different ways that they would address [a] particular problem is great, because that means that our customers have a real choice. As we all know, when things get over-commoditized, just like economy class with airlines, you end up with, ‘the cheapest always wins,’ and no real choice, or progress.”

Walker said that with increased communication, seismic and energy companies can avoid driving cost bases down to a point where there is no value left in seismic services, or so little value that the loss in value is far greater than the reduction in cost that seismic companies achieve. However, that increased communication has not necessarily meant the planning phases of projects have been made easier. “Now, it’s a little more complicated for our customers when they do an evaluation, because the easiest thing is to state that the technical requirements are the same and then just take the cheapest [alternative],” said Walker. “So, having people put in different alternatives may not absolutely correspond with the base case that’s been required, but [those alternatives] may be different, and may be better, for very different reasons.” Walker insisted that this might make things more complex, but the outcome is frequently highly beneficial.

Walker said that such communication would certainly help in the international arena, where foreign governments expect international oil companies to strictly adhere to PSCs or whatever type of contract vehicle is governing a project. “...The result of this is that oil companies have to deal with governments, in ways where, if they want to do something different, they have to justify it. This makes it more difficult to entertain different technical solutions other than on [what] was proposed in the basic bid. So that means that we, as a community, need to work closer together to understand the government contracting processes and limitations.”

Question: What other trends are surfacing in the seismic industry?

“What I see happening is long-offset, wide azimuth,” said Fairfield’s Mitchell. “I’m not seeing 4-component or converted wave, or sheer wave picking up tremendously. We’ve still got struggles with truly understanding that technology as an industry.” He thinks that the industry will overcome these problems out of necessity. “[This technology] will become more meaningful as we look in deeper, more difficult geologic environments, such as subsalt.”

“At present,” explained Walker, “people are bullish about the price of oil and gas, and that makes things possible that would not be otherwise. We see that people believe that seismic has terrific value, not just in the exploration phase, but in development and production. The so-called 4D seismic technique is absolutely considered part of the business cycle by many, particularly in the North Sea. It’s becoming accepted elsewhere outside the North Sea. I think that we will see a significant increase in that technology, because it simply makes good sense in terms of the value delivered.”

|

THE AUTHOR

|

|

Jeff Moore is a strategic consultant in Arlington, Virginia. He is author of the book, Spies for Nimitz, which depicts America’s first modern intelligence agency. He has also written numerous articles on energy, mining and security in Asia for such publications as World Refining, Asia Times, Asia-Inc, and Jane’s.

|

|