Deepwater Activity

Global deepwater activity gains strength

Although still running at high levels offshore Brazil and in the US Gulf of Mexico, deepwater exploration

and development are showing renewed strength offshore the UK, Southeast Asia and selected other countries.

Melissa A. Manning, IHS Energy, Houston; and editorial teams from IHS Energy’s Global E&P

Reporting Service in Houston; Tetbury, UK; Singapore and Geneva

So far in 2005, deepwater E&P activity has been steady, as operators move to extract resources and capitalize on

higher oil and gas prices. Rig availability has tightened, sending prices spiraling. Increasing day rates and a lack of available crews challenge operators, but the

industry is moving forward with cautious optimism.

According to IHS Energy’s databases, 10 of 20 deepwater discoveries greater than 100 million boe in 2004 were

offshore Africa, with three in Angola; one in Angola/ the Congo; one in the Congo; two in Nigeria; one in Mauritania and two in Egypt. Following Africa, Malaysia (three

discoveries), India (two) and the US (two) were most successful in striking new finds. The largest oil discoveries were in Malaysia, the US and Brazil. The largest finds

for 2004, however, were both gas discoveries, in Australia and Egypt.

As 2005 draws to a close, a question arises – has West Africa’s bubble burst? Success rates there are falling,

and key, dry wells occurred in deep water during 2005. There were no 250-million-plus boe discoveries made off West Africa in 2004. After the string of finds during 1997

and 1998, there were disappointments.

While we still await updates on a couple of key wells, the possibility exists that no deepwater finds of more than 250

million boe were made off West Africa during the last two years. Of 12 possible 250-million-boe discoveries made so far in 2005, only two are in deep water.

In Asia, India has seen deepwater success, although some reserve numbers are questionable. And 2005 has been a productive

year for China, where three major oil finds greater than 250 million bbls were struck.

Resource additions from major discoveries. In common with all years from 1999 onwards, over 50% of all major

discoveries in 2004 were made in water depths greater than 655 ft, Fig. 1. The proportion of deepwater successes was significantly less than the 69% record achieved in

2003. Thirteen finds were made in water depths greater than 1,000 m (3,280 ft). Four of these came from water depths of more than 2,000 m (6,560 ft). Although 57% of 2004’s

major discoveries came from deep water, these finds accounted for only 44% of the discovered resources.

|

|

Fig. 1. Over the last several years, 50% or more of major discoveries have been made in water depths

greater than 200 m (655 ft). |

|

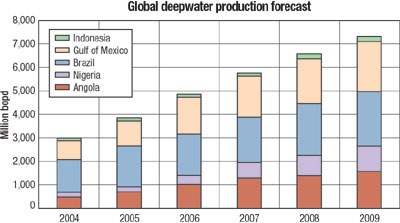

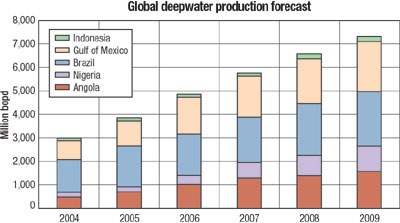

Global deepwater forecast. Deepwater oil/ liquids production in the Golden Triangle formed by the US Gulf of

Mexico, Brazil and West Africa should grow from around 2.9 million bpd in 2004 to about 7.1 million bpd by 2009, Fig. 2. Brazil accounts for a significant portion of

current deepwater production, at 1.4 million bopd. This should grow to nearly 2.4 million bopd in 2009. The US Gulf of Mexico, producing about 1.0 million bopd from

deepwater fields in late 2004, is forecast to be producing around 2.1 million bopd in 2009. Impressive growth is forecast from West African deepwater fields in Angola and

Nigeria.

|

|

Fig. 2. Phenomenal production growth is expected in key deepwater areas during the next four years.

|

|

AFRICA

In 2005, exploration drilling offshore Angola has focused on deep/ ultra-deep waters in the Congo Fan, with seven

wildcats drilled to TD by BP, ExxonMobil and Total. BP and Total succeeded in Blocks 31 and 32, respectively. ExxonMobil apparently failed to find additional resources on

Block 33. The size and proximity of new Congo Fan oil discoveries has prompted operators to plan joint development schemes at several fields.

BP hit three oil finds in southeastern Block 31 with wildcats Astraea 1, Ceres 1 and Juno 1. To date, the company has hit

eight oil discoveries on Block 31, four in the northeastern part and four in the southeastern portion, providing the opportunity for two joint development projects.

Total discovered oil with wildcat Gengibre 1, bringing the number of Block 32 finds to four. The discovery was appraised

and may integrate a joint development project along with the previous Gindungo 1, Canela 1 and Cola 1 finds. Of three ExxonMobil wells on Block 33, only Calulu 1 was a

discovery. ExxonMobil brought the Kizomba B development project onstream in Block 15. With Kizomba B, Angola has surpassed the 1.2-milllion-bopd mark, and it appears that

ExxonMobil is now the country’s leading producer, ahead of Chevron.

Plans were announced for a licensing round late in 2005. It will include seven blocks – 1, 5 and 6 on the shelf of

the Lower Congo and Kwanza basins; Blocks 15, 17 and 18 (excluding development areas) in deep water of the Lower Congo basin; and deepwater Block 26 in the Benguela

sub-basin. National oil firm Sonangol has asked IHS Energy to assist with this effort.

Chevron conducted appraisal drilling in the Common Interest Zone between Angola and Congo (ZIC 14k/A-IMI). The firm

drilled KX-3, a two-legged appraisal on the Lianzi structure. Murphy has drilled three wildcats on the Mer Profonde Sud (MPS) exploration permit in 2005 to date, one

resulting in an oil discovery. Azurite Marine 1 encountered more than 160 ft of net oil pay that may contain more than 100 million bbls of oil. Drilling of an appraisal

was underway as this article went to press.

Total E&P Congo will share the Leiv Eiriksson semi-submersible with Total E&P Angola under a firm,

six-well contract with Ocean Rig – three wells in Congo and three wells in Angola. Congo operations appear to be on new prospects in the Mer Tres Profonde Sud

exploration permit. With the sanctioning of the deepwater Moho-Bilondo project, Total has awarded its first development contracts.

Gabon. Amerada Hess drilled two deepwater wildcats earlier this year in the Moabi exploration permit. Results from

Mosen A Marine 1 and Titan Marine 1 have not yet been disclosed.

Equatorial Guinea. Between Cameroon and Gabon, this West African country produces 320,000 bopd, 1.1 Bcfgd and

68,000 bcpd. Development of Amerada Hess’ Okume Complex will add another 60,000 bopd to total output. The firm plans to bring this group of fields onstream in late

2006.

Exploration drilling projects are numerous, mainly in deep water. Two recent wells were successful: Esmeralda 1, drilled

by ExxonMobil in Block B, found oil and gas; and well P-2 in Devon’s Block P discovered oil. Noble is targeting the Belinda prospect (Block O), and further wells are

planned. The licensing round planned for 2006 should attract many operators.

Kenya. Discussions of remaining global oil reserves never proceed far without mentioning East Africa’s

unknown potential. Having explored offshore Mauritania successfully, Woodside Energy – like Petrobras – is moving to the other side of the continent. Although

Woodside relinquished three blocks offshore Kenya in 2004, the firm retained four blocks in the Lamu basin. Woodside was planning a 3D survey over Blocks L-5, -7, -10 and

-11. The first well was set to be drilled in late 2005.

MIDDLE EAST

Last March, Indian press reports said that Reliance Industries finally signed an EPSA for 8,278-sq-mi Block 18 offshore

Oman, one of two deepwater/ transition blocks originally offered as part of the Gulf of Oman Licensing Round (GOLR) in 2003. Reliance and the Oman Ministry of Oil

and Gas had been negotiating the block following its provisional award in October 2004. Reliance reportedly will spend $35 million for Phase I (reprocessing of existing

data, geological and geophysical studies, and acquisition, processing and interpretation of 290 sq mi of 3D seismic). One exploration well will be drilled in each of two

later phases.

The original three blocks in the 2003 GOLR were merged, and EPSA terms were revised during first-half 2004. The

3,058-sq-mi Block 18A and 5,220-sq-mi Block 18B were combined to form the new Block 18. Boundaries for 9,189-sq-mi offshore Block 41 in the Gulf of Oman remained

unchanged.

Yemen. Last April, Al-Thani Investments signed a Memorandum of Understanding for Al Jawf Block 64, offshore

southern Yemen. In 2001, officials created three new offshore concessions south of Yemen in the Gulf of Aden and the Arabian Sea. Blocks 62 (South Qamar), 63 (Southeast

Mukalla) and 64 (Southwest Mukalla) were part of former offshore seismic survey Block 46. All are tracts lying in water depths greater than 1,000 m.

Twenty wells have been drilled offshore Yemen, five in the Red Sea, 12 in the Gulf of Aden and Arabian Sea, and three

offshore Socotra Island. Only one success has been achieved, in Block 15 (licensed to Oil Search and adjacent to Block 64). In 1982, Agip’s Sharmah 1 tested 3,054

bopd immediately after acidization. A 10-million-bbl reserve figure had been proposed for this oil accumulation, which is likely to be appraised by Oil Search in

2005/2006.

GULF OF MEXICO

With more than 4 billion boe discovered since 2000, the deepwater Gulf of Mexico (GOM) has to be one of the world’s

premier exploration basins.

A prolific basin and an industry-friendly lease sale process are key factors in attracting strong activity. Leasing should

intensify in upcoming years, due to an expected reissuing of undrilled blocks that will expire between now and 2008. During the next three years, 1,956 blocks will expire

in water depths greater than 1,300 ft. These leases extend over all deepwater GOM productive trends, including high-profile pays in the Western Atwater Fold Belt and the

Lower Tertiary play.

This attractive lease sale process has contributed to the discovery of significant new fields, including BP’s Mad

Dog, Atlantis and Holstein, and Chevron’s Tahiti, Fig. 3. All of these fields are on the southeastern corner of the Green Canyon Protraction area in the Western

Atwater Fold Belt. Total recoverable reserves in these fields are estimated to be over 1.5 billion boe.

|

|

Fig. 3. Holstein is one of three BP deepwater fields in the US Gulf of Mexico that can trace its

existence to an attractive lease sale process. |

|

The Perdido Fold Belt, a northeast-southwest-trending zone of compressional folds, is also being explored. Several finds

have been struck, including Great White, Trident and Tobago. However, their economic viability is still being assessed, due to remote locations and water depths that go

to more than 9,000 ft. Several other Perdido Fold Belt prospects should be drilled in 2006 and 2007, including Whale, N. Brontosaurus, Blacktip and Leopard.

The Perdido Fold Belt drilling hit well-developed Lower Tertiary Age reservoirs that persist along a trend that extends

250 mi to the west and up to 100 mi wide. Several finds have been made along this trend, including Chevron’s Jack, BHP Billiton’s Cascade and Chinook, and

Unocal’s St. Malo. All of these fields are undergoing appraisals.

Anadarko and Eni placed high bids totaling $42.9 million for three open blocks in this trend during the 2005 Western GOM

lease sale. This demonstrates interest despite the deep water and its distance from existing infrastructure.

Among the world’s deepwater provinces, the US GOM is one of the most prospective. This fact has not escaped the

attention of Norsk Hydro and Petrobras. Both firms have moved recently to make the Gulf of Mexico a new core area.

Norsk Hydro is paying $2.45 billion for Houston-based Spinnaker Exploration. Hydro said it was looking for a company

exactly like Spinnaker – one with a highly skilled staff (which will be retained), an extensive database, an exceptional track record, high exploration potential and

a leasehold that is largely company-operated.

Spinnaker holds 350 leases in the Gulf of Mexico – 169 on the shelf and 181 in deep water. The company operates 80%

of its shelf blocks and 55% of its deepwater leases. Proven reserves total 62 million boe, with expected reserves of 129 million boe, evenly divided between gas and oil.

Norsk Hydro says it has a “very ambitious” GOM program in place, with plans to spend up to $400 million between 2006 and 2008.

Furthermore, Spinnaker made its first deepwater find in June 2005, when it encountered 110 ft of gas pay in a wildcat on

Mississippi Canyon Block 961. Spinnaker’s “Q” discovery is near the Independence Hub, which will go onstream in 2007.

Four GOM focus areas. The top bidder at the recent Western Gulf sale was Petrobras, which offered more than $30

million in high bids for 53 blocks. In mid-September, the company claimed its first operated well as a success. The OCSG-15860 3ST step-out on Garden Banks Block 244

found 131 ft of high-quality gas reserves. The Cottonwood prospect was drilled to a TD of about 20,670 ft in 2,113 ft of water.

Garden Banks is one of four GOM areas on which Petrobras is focusing. Its other areas are the ultra-deep waters and

ultra-deep gas targets on the shelf, and a frontier play in the Western Gulf. During the last two Western GOM sales, Petrobras has built up a huge leasehold in the Corpus

Christi, Padre Island and Mustang Island areas. Petrobras’s presence in this area bears watching. Between 2006 and 2010, the firm plans to spend $1.5 billion. By

2010, the company anticipates producing more than 100,000 bopd in the Gulf.

Oil and gas facilities in the Central and Western Gulf bore the brunt of Hurricanes Katrina and Rita. The combined effect

was considerable in terms of shut-in production. As of Oct. 17, shut-in output totaled 996,291 bopd and 5.5 Bcfgd, equal to 66.4% of Gulf oil production and 55.0% of Gulf

gas output, respectively. For more details, please see the hurricane aftermath article on page 51 of this issue.

SOUTH EAST ASIA

Deepwater activity in Brunei remains suspended, due to a boundary dispute with Malaysia. This area is unlikely to

see any drilling in 2005 or perhaps even in 2006. The last activity took place in 2003. As holder of Bruneian Block J, Total attempted to drill a well but was run off

location by the Malaysian navy. Malaysia claims the entire Brunei deepwater area.

Malaysia. In February, a Shell/ Petronas Carigali consortium was awarded PSCs for Blocks ND 6 and 7 offshore

eastern Sabah, a move protested by Indonesia, due to a poorly defined maritime boundary. The remaining ND blocks, offshore Sarawak and western Sabah, were awarded to

Petronas Carigali in July.

While Murphy continues development planning for the 400-million-bbl Kikeh oil field on Block K, the US independent has

also successfully appraised the Kakap 1 discovery in the south of that block.

The Kakap structure lies in 2,950 ft of water and extends into Shell’s Block J, where it is known as Gumusut. This

site also saw appraisal activity early in the year. The Gumusut/ Kakap structure will prompt a unitization agreement between Shell and Murphy. Unofficial Gumusut reserve

estimates are 300 million to 500 million bbls of oil.

Following its Gumusut appraisal, Shell drilled deep pool test Malikai Deep 1 on Block G with results unreported. Murphy

took the Ocean Rover semisubmersible and began a multi-well program on Block K. The first wildcat was abandoned with oil shows, but success soon followed with

Kerisi 1, a wildcat drilled north of Murphy’s main Kikeh oil find. An appraisal of 2003’s Kikeh Kecil discovery was then spudded but suspended later, due to

mechanical problems.

Shell took the rig on a sub-let from Murphy to return to the Ubah structure (Block G), which it tried to test earlier with

the Ubah 1 wildcat. However, the well reportedly was drilled slightly off-structure. As this article went to press, Shell was operating a sidetracked hole in Ubah Crestal

1.

On the Kebabangan (KBB) oil discovery, in 490 to 1,085 ft of water offshore northwest Sabah, the Kebabangan JOC spudded

appraisal KBB 4 in mid-August. The well will help determine the oil reservoir’s viability beneath established gas reserves. Shell discovered the oil column in 2002,

but its PSC at that time covered only discovered gas. The area was re-licensed to the Kebabangan JOC last March.

Indonesia. Unocal completed its long-term drilling campaign in the western Makassar Strait off Mahakam Delta.

Recent discoveries now await appraisal, once details of the Chevron takeover have been finalized. Existing plans for phased development of several previous finds should

remain unchanged.

Further north, Eni completed its first appraisal of the Aster oil and gas find in the Ambalat PSC during early 2005. The

site is just south of the disputed zone with Malaysia, in the deeper waters of the Tarakan basin. Eni plans appraisal drilling in the near future.

Elsewhere, Inpex plans further appraisal of its Abadi gas find in the Timor Sea Masela PSC while development options are

considered. The next focus for deep water will come with the closure of the current Migas bidding round, under which four PSCs are available on the western, Sulawesi side

of Makassar Strait.

Myanmar. Thirteen deepwater blocks in the Exclusive Economic Zone are offered for open bidding by the Energy

Planning Department. The blocks (AD-1 through AD-5 and MD-1 through MD-8) are adjacent to, and west of, the existing A and M block series. Water depths range from 1,640

to 9,845 ft. Most blocks are in water depths greater than 6,560 ft.

Philippines. Last August, a group led by Australia’s Ottoman Energy was awarded SC 55, which lies mainly in

deep water, offshore Southwest Palawan. Ottoman was expected to seek farm-ins ahead of any potential drilling.

On Aug. 31, the Department of Energy (DOE) launched the Philippine Energy Contracting Round 2005 (PECR-2005), comprising

four contract areas covering 20,845 sq mi in the Southwest Palawan and Sulu Sea basins, as well as frontier areas in the East Palawan basin. Large portions of these

tracts lie in deep water.

Thailand. The 19th Thai Bidding Round opened on July 1 and includes three deepwater blocks on Mergui Terrace, on

the western seaboard. Part of the area was last held by Kerr McGee as W07/38, up until March 2002.

Vietnam. A licensing round for nine deepwater blocks in the Phu Khanh basin closed in May, but awards are still

awaited. Four of the nine blocks are likely to be signed, with front-runners rumored to be Petronas Carigali/ Unocal, Pogo, VSP, KNOC and ONGC-Videsh. This remained

unconfirmed at press time.

BARENTS SEA

A three-year drilling hiatus in the Barents Sea ended last January, when Norsk Hydro spudded a wildcat on its Obelix

prospect. In March, Hydro said the well had been abandoned at a 4,970-ft TD after finding only traces of hydrocarbons.

Obelix was drilled by Ocean Rig’s Eirik Raude semisubmersible in 1,293 ft of water, 120 mi north/ northwest

of Hammerfest, Fig. 4. That rig moves to PL 233 to drill a second Barents Sea well, Statoil’s 7131/4-1 on the Guocva prospect. NPD says it will test several

relatively shallow zones.

|

|

Fig. 4. Ocean Rig’s Eirik Raude semisubmersible has plenty of work to keep it busy in the

Barents Sea, drilling a wildcat for Statoil and appraisals for Eni. |

|

Meanwhile, Eni contracted Ocean Rig to keep the Eirik Raude in the Barents Sea for appraisal drilling at Goliath

field. Eni was awaiting necessary permits from Norway’s Pollution Control Authority before drilling. Discovered during 2000, Goliath has proven and probable reserves

estimated at 95 million bbl of oil and 40 Bcf of gas.

NORTH SEA

Ireland received some good news, when two Atlantic Margin licenses were awarded in the Northeast Rockall basin

Round that closed May 31, 2005, one to a Shell-led partnership and the other to Island Oil & Gas.

The Ministry for Communications, Marine and Natural Resources awarded Frontier Exploration License (FEL) 2/05, about 93 mi

northwest of the Donegal Coast, to a Shell (operator), Eni and OMV joint venture. The 360-sq-mi tract includes four blocks and adjoins the partners’ License 2/94,

site of the Dooish discovery, which is under evaluation. OMV said that plans are underway to acquire 3D seismic over the new license in 2006.

In addition, Island Oil & Gas was awarded FEL 05/3 (100%) for Blocks 18/10, 19/1 and 19/6. This 276-sq-mi tract, named

Killala, is 43 mi off Ireland’s west coast and 22 mi north of Corrib gas field.

Ireland has worked hard to make its waters attractive for investment, so FELs have 15-year terms, with no drilling

required in the first five-year phase. The 25% tax rate is among the world’s lowest. These incentives are just part of Ireland’s ambitious, multifaceted,

hydrocarbon self-sufficiency campaign.

Ireland has major obstacles to overcome, including historically limited drilling, and political and environmental issues.

Shell has expanded its Irish interests, despite problems with its Corrib development, 143 mi southwest of the new license. Shell has been plagued with delays and

protests, and news of the Rockall basin award drew immediate criticism.

Discovered in 1996, Corrib, with proven and probable reserves of 1.5 Tcf, is believed capable of meeting half of Ireland’s

gas demand for 10 years. However, environmental concerns have crippled the project, which consists of a subsea development connected to on onshore gas terminal. Just

recently, Shell suspended offshore pipeline installation until after Christmas, despite receiving governmental go-ahead. Many Corrib setbacks have been caused by

overlapping jurisdictions.

Noting that there is no point in finding gas if you can’t get it to market, the Petroleum Affairs Division (PAD) is

reviewing its licensing and permitting regime to ease the problem. This is one reason that the deadline for the next offering in Irish waters is not until March, when

some 25,000 sq km of frontier acreage in the Slyne, Erris and Donegal basins will become available.

UK. If some analysts believed that Kerr-McGee’s exit from the UK North Sea earlier this year was the

beginning of the end for major operators in this province, they were proven wrong when the Department of Trade and Industry (DTI) announced the 23rd Licensing Round’s

results. This lease sale had the largest number of offers since licensing began in 1964. It also included the largest single license in UK Continental Shelf history,

awarded to ExxonMobil and Shell.

High oil and gas prices influenced the intensive bidding, as DTI reaped the rewards of revamping its licensing structure

with the introduction of “promote” licenses two years ago and “frontier” licenses in last year’s 22nd Licensing Round. In all, DTI offered 152

production licenses to 99 companies, including 24 firms that are North Sea newcomers. There were 70 offers for traditional licenses, double the 35 made in 2004. Promote

licenses continued to draw small firms, including some formed expressly to take advantage of the generous terms. Seventy-six such licenses were offered, along with six

frontier licenses.

ExxonMobil (75%, operator) and Shell (25%) teamed up to lease 20 contiguous blocks totaling 1,853 sq mi in the

under-explored Mid North Sea High. A number of other majors also participated in the round, including BP (two traditional licenses), BHP and Marubenia. Acting alone,

Total was awarded two more traditional licenses. Although BP is unloading its 33% stake in Statfjord field, the company’s North Sea commitment remains strong. As

many as 30 billion bbls of oil remain in the North Sea. Backing up its intention to pursue these remaining reserves, the firm is opening a new headquarters in Aberdeen.

Another large player receiving traditional licenses was Chevron. Three tracts are partnered with Statoil, OMV and DONG,

another with Maersk and Talisman, and yet another with KNOC, marking that national oil company’s entrance to the North Sea.

Among other noteworthy awards are the following:

- BG, three traditional licenses.

- Apache, five traditional licenses.

- Nexen, five traditional licenses.

- Petro-Canada, four traditional licenses.

- Maersk, three traditional licenses.

- Newfield Exploration, two traditional licenses.

- DONG, two frontier licenses covering 17 blocks between the Shetland and Faeroe Islands.

- Talisman, three frontier licenses, with the obligation of acquiring 3D seismic.

- Hurricane Exploration and Australia’s Sunshine Oil, one frontier license for acquisition and reprocessing of 2D seismic, and

drilling an exploration well.

The Hurricane/ Sunshine license was one of 17 well commitments that DTI was able to gain, the highest number promised in a

decade.

West of Shetlands. Chevron will conduct exploration and appraisal drilling West of Shetlands, beginning in

second-quarter 2006. Chevron (operator), Statoil, OMV and DONG struck a find in 2004 on the Rosebank-Lochnagar prospect, encountering two oil and gas zones with 171-ft

net pay. The 213/27-1 well found 27°-to-36° API oil, as well as non-associated gas. Follow-up drilling will determine its commerciality.

LATIN AMERICA

The most significant deepwater exploratory trend in Brazil during third-quarter 2005 – one that will continue

into 2006 – is the subsalt wildcat drilled in the ultra-deepwater area of the central Santos basin by Petrobras and partners to test the syn-rift sediments. The

prospect was generated from a 20,300-sq-km, 3D spec seismic survey that the partners acquired in the ultra-deepwater area of four blocks (BM-S-008, BM-S-009, BM-S-010 and

BM-S-011).

Petrobras has been drilling the 1-RJS-617D (1-BRSA-329D-RJS) ultra-deepwater directional wildcat, the first of a

five-to-six-well program to test the Santos basin’s ultra-deepwater trend, including sub-salt, syn-rift sediments. The key to the new play will be attractive

reservoirs at 2,000-m-plus water depths.

Petrobras planned a second rank wildcat within the BM-S-011 tract, as soon as operations concluded on the 1-RJS-617D,

which was expected to be in late September/ October 2005. Subsequently, an ultra-deepwater wildcat will be spudded on the BM-S-009 contract.

Petrobras began drilling the 1-RJS-617D in January 2005. In early September, it was reported that this well may be a

significant discovery with oil and gas shows logged, the most significant of which are believed to be from the subsalt section. The oil is reported to be a good-quality

light crude. Petrobras filed an oil and gas shows report with ANP during July and then filed a gas show report with ANP in mid-August 2005 after reaching a 22,687-ft MD

(21,020-ft TVD). The 1-RJS-617D now holds the Brazilian record for deepest well drilled in the country.

Trinidad and Tobago. The Ministry of Energy and Energy Industries said that the ultra-deepwater bidding round

slated for first-quarter 2006 will probably comprise acreage covered by the portion of the 2002 seismic survey that was acquired on a 4-km-by-4-km grid. Plans call for

the offering in the Trinidad and Tobago Deep Atlantic Area (TTDAA) to be divided into 1,000-sq-km blocks. The area is east of deepwater acreage relinquished in recent

years by Shell, ExxonMobil and BP after several very expensive dry holes.

CONCLUSION

Given high commodity prices, recent exploration efforts and good lease sales, the near-term outlook for deepwater E&P

activity remains buoyant. Best bets for greatest incremental improvement, regionally, are offshore Brazil, the US, the UK, Ireland and some portions of Africa. Greatest

impediments to even larger expansion of global deepwater activity will be geological limitations, diminished marine rig availability, inflexible economic terms in a few

countries and weather concerns.

|