Offshore Report

Deepwater tie-back economics improved by comparison of segment cost effects

Subsea tie-back project management recommendations increase economic development of deepwater, multiple-field areas, including marginal prospects.

Oran Tarlton, Oil States Industries, Inc.

With world demand for oil growing and the contribution from deep water increasing, there is increased interest in deepwater subsea tie-backs to cut field development costs, with both marginal and large fields.

Modernized project financial management, in which operating companies take a more active role in adopting a strategy mutually beneficial to contractors, can benefit from fewer adoptions of Engineering Procurement Installation Commissioning (EPIC) type contracts. Competitive awards will assure best-in-class equipment.

Described here, following the introduction, are: 1) Drivers affecting project economics; 2) Project execution; and 3) Summing up project total cost.

INTRODUCTION

Deepwater subsea tie-backs are quickly becoming the preferred method for developing deepwater fields. Both marginal and large fields are candidates for development as deepwater subsea tie-backs, because it typically costs less to develop with this architecture than with other subsea development scenarios. There are over 340 subsea tie-backs worldwide. Two-thirds of these are in the Gulf of Mexico and the North Sea, as highlighted by recent record-breaking projects, Table 1.

| |

TABLE 1. Record breaking subsea tie-backs |

|

| |

Year |

Project |

Operator |

Field |

Water

depth, ft |

Tie-back

length, miles |

|

| |

|

|

| |

1997 |

Mensa |

Shell |

Gas |

5,300 |

68, longest gas |

|

| |

1999 |

Roncador |

Petrobras |

Oil |

6,080 |

1 |

|

| |

2001 |

Mica |

ExxonMobil |

Oil |

4,350 |

29, longest oil |

|

| |

2002 |

King |

BP |

Oil |

5,334 |

17 |

|

| |

2002 |

Canyon Express |

Total |

Gas |

7,209 |

56 |

|

| |

2003 |

Na Kika |

Shell |

Oil/gas |

7,000 |

24 |

|

| |

2004 |

Coulomb |

Shell |

Gas |

7,600 |

25, deepest gas |

|

| |

2004 |

Thunder Horse |

BP |

Oil |

6,100 |

4, deepest oil |

|

|

Offshore oil/gas production now accounts for more than 30% of total world output. Deepwater oil/gas production has been growing steadily for the past 10 years and, in 2004, accounted for 10% of all the offshore oil produced. By 2015, it is estimated that 25% of the offshore oil produced will come from deep water.

Clearly, there is a need to meet the increasing demand for oil/gas products and, equally, there is a need to produce oil as economically as possible. The cost to produce oil and gas is frequently broken down into two categories, capital (CAPEX) and operating (OPEX) costs. Installation costs are typically capitalized as a project development cost. However, for the purposes herein, installation costs will be considered operational costs to separate them from the capital costs of equipment, facilities and pipeline infrastructure. By evaluating the contribution of up-front capital and operational costs, this will bring a focus on their impact to the total costs and suggest how they can be reduced.

DRIVERS AFFECTING PROJECT ECONOMICS

Deepwater development costs are high, and these are of first and foremost consideration when determining if a field is commercially viable. There are a number of drivers used to determine if a field is commercially viable. Each can be considered critical to development success. Among these drivers are geological and reservoir performance, commercial terms and conditions, support/ transportation infrastructure, available technologies, crude oil price, geopolitical/ regulatory considerations and contracting strategies.

Available hydrocarbons. The first gauge of a deepwater field’s viability depends on whether commercial hydrocarbons are available, and if flowrates are sufficient to produce required cash flows to make the field economically viable. Many fields cannot pass this first test as a stand-alone development. Only the largest fields can typically support the capital investment required to produce a stand-alone host facility.

By utilizing a hub-and-spoke approach, many deepwater fields that may not otherwise be economically viable can become commercially attractive, when joined by other fields to a central host facility. Enterprise Energy Products has successfully packaged the hub-and-spoke concept utilizing subsea tie-backs to make smaller fields commercially viable for production in the Gulf of Mexico.

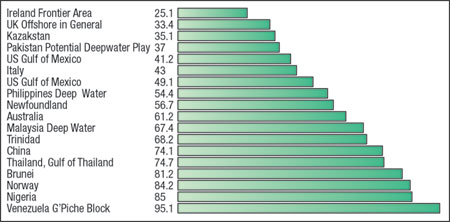

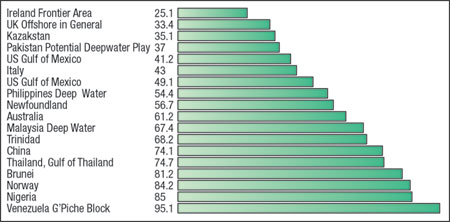

Regulations and commercial terms and conditions can make or break a project in several areas. One of these is governmental regulations and percentage takes. Most governments now view deepwater developments as a source of national income. The percentage take varies from 25% to 95%, as indicated in Fig. 1. As these regions compete for domestic and foreign direct investment, they will see market drivers dictate the amount of investment they receive based on the Return on Investment (ROI) realized by the energy companies. These factors will, in a free market economy, provide the indicators necessary to strategically determine government takes.

|

Fig. 1. Government takes for offshore areas.

|

|

Contractual terms and conditions have also become more onerous in favor of the energy producer by downloading greater proportions of project risk and liability to the contractor. The general consensus that rewards should be commensurate with risks is not holding true. Many contractors are simply having to no-bid projects, because they are unable to accept the inordinately high risk. This limits operators to a few very large contractors willing to accept greater risk by dispersing it across their organization.

Contracting strategies. Secondly, contracting strategies are playing an increasing role in determining the type of subsea development that will be sanctioned. Three contracting strategies have made a major impact on the way recent developments have been carried out. These are: 1) outsourcing engineering services, 2) alliance agreements, and 3) EPIC contracting. The failure of some large EPIC projects in West Africa and Brazil in the last few years has some energy companies reevaluating their contracting strategies. A good contracting strategy balances the quality triangle, Fig. 2, by putting emphasis on each triangle leg. However, any experienced project manager will confirm that a project can have only one driver.

|

Fig. 2. Quality triangle.

|

|

One result of increased outsourcing of engineering services is that a number of the brightest and best have left the energy producers and signed lucrative contracts with consulting engineering firms. The result has been diminished expertise within oil companies. These individuals, some with important lessons-learned experience, have moved from the operator to the contractor. Improved vendor expertise would seem beneficial at first glance. But in an outsourcing environment, the change in employment status will likely produce a change in priorities consistent with the contractor’s best interest.

While contractors are team members, and do share a focus on what’s best for the project, there are likely to be conflicting priorities. First of all, engineering companies sell billable hours and increase their revenue by putting more people on the project. The resources available may not always be the best and brightest that left energy companies when the outsourcing boom began.

Alliance agreements are intended to mutually benefit the producer and the vendor by providing standardized products with pre-existing benchmarked pricing. Another benefit of standardized products is that, with each successive delivery, design and manufacturing bugs are worked out, and installation times improve from lessons learned on previous installations. Ideally, both parties benefit from improved quality, better delivery times, steady revenue streams and predictable costs. The difficulty comes from the fact that deepwater technology is evolving so fast that standardized equipment may not be the best technical solution – and it may not be the most economical.

EPIC contracting has become the norm for deepwater developments since the mid-1990s, and it is not without many detractors. Energy producers are the primary beneficiaries in the short term, because they are able to fix their costs and minimize their risks. As deepwater developments have moved rapidly into deeper waters and the technical challenges have increased, the value of such contracts has increased three- and four-fold.

EPIC contractors are being asked to take on the same responsibilities as before and accept much greater risk in absolute terms. Many contractors have suffered heavy losses associated with now infamous contracts. Given the technical challenges, steep learning curves, and unfavorable contractual terms, the economic return is simply not there.

Additional factors. Some additional drivers that can negatively affect project performance and economics are:

- Bids are equalized/ awarded to a low-price bidder to try for the lowest price. We all understand the need to compare, but frequently the equalization process can undermine benefits of one system over another. In actuality, one system may require fewer components, or need less support equipment, or install in half the time. In this case, the equalization process falsely predicts the more economical component. Remember: Cheapest is rarely the most economical.

- Bid packages are incomplete or lack necessary details to fully evaluate the project. This results in contractors spending more time bidding, or adding contingency into a bid, in anticipation of requirements. When specifications are subsequently released after bids are awarded, both schedules and cost can be negatively affected. Remember: Supplemental specifications rarely reduce cost or accelerate schedules.

- Often, when a project achieves sanction, there is a general over-eagerness to fast-track the project to early production. Remember: Quality, delivery and cost are not independent variables. An astute project manager once said, “Quality, delivery and low cost – you pick two, and I’ll pick one.”

- The belief that damages and incentives minimize delays. This can create an environment in which profits are protected at the expense of quality.

- The assignment of too much risk to contractors who have little or no control over most risks, or are not in a financial position to assume the risk. Remember: Rewards should be commensurate with risks.

- A common owner mistake of demanding re-bids when initial bids exceed the owner’s expectations of project cost. Remember: Quality, delivery and cost are not independent variables.

The presence or lack of infrastructure affects the decision to develop a prospect because of the significant influence on cost. While subsea tie-backs provide an economical development possibility, the presence of some infrastructure is required to tie back to. This explains why the number of tie-backs is more significant in areas with pre-existing facilities. Where no infrastructure exists, the hub-and-spoke approach provides the possibility to distribute infrastructure development costs across multiple fields.

PROJECT EXECUTION

EPIC contracts have been the standard contracting strategy in much of the world, and it appears that they will stay so in the near term. Operators generally divide these contracts into Hull, Topsides, Subsea, Surf and Commissioning. Typically these contracts are awarded to the largest fabrication yards, installation contractors and subsea equipment manufacturers. With distinct lines of responsibility and liability, these contracts create boundaries that can inhibit a more integrated approach. These boundaries also prevent competing technologies from smaller, more specialized equipment manufacturers and service providers.

A new, recent trend in the Gulf of Mexico has shown that an operator-led management team working with a group of contractors willing to work in a team environment can execute a project successfully, and in much less time than in a conventionally employed EPIC contracting strategy. One key is to create a mindset and a commitment to do what is best for the project. This can be achieved, when the operator accepts more of the interface risks and involves the contract participants early on in the process. Emphasis is placed on each contractor taking responsibility for its part of the contract.

This type of contracting strategy was successfully employed on Kerr-McGee’s Gunnison Spar, and it is being used on the Constitution and Independence Hub/ Trail projects by Enterprise Products Partners.

When the owner/ operator steps up to take such an active management role, as well as the integration responsibility for a major project, it reduces the contractor’s performance risks and breaks down competitive barriers that exist between companies. By managing the project directly, the operator is more involved with cross-project integration and, as a result, can mitigate issues before they become problematic. In the Kerr McGee and Enterprise model, an emphasis was placed on maintaining the same contractors and involving them from the project’s beginning. This type of informal alliance fosters the team approach and helps the integration management go more smoothly.

Effects of competition. Another method, and one used by governments to determine who a successful supplier for a major contract will be, is competition. This does not mean the usual sealed bid proposal vs. open proposal type of competition, but a real and physical “put the equipment through its paces” competition. Bids are typically accepted and narrowed to a field of two, based on the proposal’s ability to demonstrate that the specifications can be met and the estimated price is in order. Given that a low price does not always mean a better economic value, competition assures the operator that it will be buying what has been specified.

An award is given to the two best proposals to manufacture a prototype unit. Based on the set of specifications, each manufacturer builds and tests such a prototype. Operators are not obligated to monitor the design and manufacturing process as closely as is typical under an EPIC contract, because they will be evaluating the actual equipment performance. Contractors, conversely, are motivated to build the equipment to specs, as it will mean winning or losing the order.

The first challenge to a competitive-award basis is time constraints related to fast-tracked projects. This is a fair challenge, and one that might preclude a competitive award basis for small fast-track projects. However, for many projects, qualification tests are required prior to production manufacturing, and the competitive award basis would fulfill that requirement. If time is the first challenge to manufacturing competitive prototypes, then cost would certainly be the second.

Granted, competitive prototyping is not viable for long-lead, big-ticket items, but is viable for most components. Just consider the cost and time delays associated with failed qualification tests. In addition, competitive prototypes would reduce production cycle times, and would be re-usable in service. Given the benefits of competitive prototypes, costs and time are not significant.

Installation cost factor. One of the important components when looking at total cost of subsea equipment is installation cost. Much of the time, subsea equipment is less expensive than the installation cost to put it on bottom. This is true when comparing the cost to design, manufacture and test a diverless connection system, with the cost of installing a subsea jumper.

Take, for example, a 12-in., 200-barg subsea jumper, which is typical of an import or export flowline in a subsea tie-back, Fig. 3. The jumper, which is fabricated by joining two diverless connectors by a length of pipe, costs less than one-half the day rate for a typical DP Class pipelay vessel, which can exceed $225,000 per day. There are many types of diverless connectors ranging from sophisticated ROV-operated, hydraulically actuated collet connectors to diverless flanges.

|

Fig. 3. Vertical M-bend jumper for Kizomba A development.

|

|

At first glance, a buyer might say that a diverless flange is much less expensive. When comparing the purchase price of the collet connector and a diverless flange, that would be a correct answer. But when evaluating total cost of a jumper connection subsea, a completely different result emerges.

Jumpers using collet connectors have historically averaged 4 to 6 hr per connecton. The diverless flange requires several additional alignment and deployment frames needed to pull the pipeline into alignment with the spool and a deployment frame for manipulation of fasteners and stud tensioners. Add to this average installation times near 24 hr, and the difference in total cost is obvious. The total cost per connection utilizing the diverless flange quickly becomes two or three times the jumper cost utilizing more sophisticated diverless connectors.

THE TOTAL COST

When a development project is completed, the total cost can be summed up as all the money it costs to find, design, build, install and operate. By parceling a project into discreet segments, it is easier to manage by dividing the project into functional segments. Each of these segments becomes somewhat reliant on the others through integration areas. As such, each segment contributes to the accumulated costs of the others.

Close, coordinated integration between segments, with a focus on overall cost and schedule, is the best way to manage total costs. Low cost in one segment can actually create higher costs in other segments. Each segment should evaluate the cost drivers within and then coordinate across segments to determine overall cost drivers.

SUMMARY

The worldwide demand for oil is growing, and the contribution from deep water is increasing. Subsea tie-backs provide a good option for deepwater subsea developments. Tied together with a hub-and-spoke approach, the subsea tie-back can make marginal fields viable economically for production, even in areas where there is little supporting infrastructure.

Many contractors have been hurt by the EPIC contracting boom. This is evidenced by their poor financial performance and a wave of consolidations. Overly demanding contractual terms have put a disproportionate amount of risk on contractors, relative to the value of their scope of supply. As a result, many contractors are being forced to no-bid projects or add costs to cover the risks. When contractors are over-burdened with risks that are disproportionate to the value of their contracts, their performance and that of their sub-contractors will decline.

Energy producers can improve project performance by taking an active management role and adopting a contracting strategy that is mutually beneficial to the contractors. By taking an active role in project management, owner operators can achieve better cross-company integration and a greater willingness to put what’s best for the project first. This will lead to an improved project schedule that will ultimately provide better value and lower costs. Competitive awards will assure the producer operator that selected equipment will be the best-in-class, and meet both functional and technical specifications.

Owner operators should evaluate the impact that cost drivers in each project segment have on other segments and then establish overall cross-project cost drivers. The total cost is best managed with an overall view of the cost relationships between project segments.

THE AUTHOR

|

|

Oran Tarlton is the vice president of deepwater technology with Oil States Industries, Inc., with responsibilities for business development and sales. He has 27 years of subsea marine construction and engineering experience. He joined HydroTech Systems, Inc., in 1995, as a project manager with responsibility for major deepwater projects. He was promoted to VP, Engineering, with overall responsibility for engineering at Oil States HydroTech Systems, Inc., until moving into his current position in May 2004. Prior to joining Oil States, he was a commercial diver and project manager with Cal Dive International and a vice president of Furmanite America, Inc. Mr. Tarlton has a BS degree in maritime systems engineering from Texas A&M University.

|

| |

|

|