OUTLOOK 2003: International

Canadian Outlook

Indicators are positive, but the bear lurks in 2003

There are plenty of reasons to be optimistic about Canadian activity, yet producers are still nervous

Robert Curran, Calgary

By most standards, 2003 should be a very good year for the Canadian oil patch. Commodity values are up; financials look to be improving; oil and gas stocks were one of the bright spots over the past 12 months; and the drilling industry is currently working near capacity. Yet, international and domestic uncertainties have eroded optimism among producers.

OVERVIEW

Despite coming off a year that compares favorably in many ways with some of the best years in Canadian E&P history, producers seem wary. Uncertainty underscores the oil and gas business north of the 49th parallel in 2003.

The threat of a U.S.-led war against Iraq, along with the Canadian federal government’s decision to sign the controversial Kyoto Accord, has led to two specific concerns. One concern is that commodity prices (oil in particular) may register a sharp decline, once tensions ease in the Middle East. The other concern is that the Canadian energy sector may once again be targeted specifically by the federal government, under the guise of Kyoto.

Nonetheless, most companies plan to spend more, drilling activity has increased, and the recent surge in oil and natural gas prices has provided – in the short term at least – a buffer against leaner times, should they come.

|

What 30 Canadian drillers plan for 2003 |

Natural gas spot prices at Alberta’s AECO-C Hub were as high as C$8/Mcf (US$5.24/Mcf) in January, as bitterly cold temperatures continued across many parts of North America. At the same time, Edmonton Light crude oil prices continued to reflect the ongoing tensions in Iraq, topping C$50/bbl (US$32.75/bbl) in early 2003.

The increased prices have prompted anticipation of improved fourth-quarter earnings from many Canadian firms, and sparked increases in capital spending, as well. Combined with a pressing need for increased gas drilling to meet demand, the industry’s collective drill bit looks like it will be kept very busy this year.

Through third-quarter 2002, earnings were up for Canadian producers, compared to the same period in 2001. Earnings totaled approximately C$2 billion (US$1.31 billion) on cash flow of approximately C$6.3 billion (US$4.13 billion). In 2001, those numbers, respectively, were C$1.7 billion (US$1.11 billion) and C$5.7 billion (US$3.74 billion), according to the Daily Oil Bulletin.

The numbers through three quarters, however, are still well behind 2001 levels, which saw producers experience some of their best ever, six-month results. Through nine months in 2002, earnings were about C$5.5 billion (US$3.6 billion), more than 40% lower than the C$9.7 billion (US$6.35 billion) recorded through nine months in 2001.

But, with most industry indicators positive, fourth-quarter results are expected to be even better. Thus, many companies have announced plans to increase spending in 2003, including Petro-Canada (C$2.6 billion, or US$1.7 billion), Canadian Natural Resources (C$2.3 billion, or US$1.51 billion), Husky Energy (C$1.8 billion, or US$1.18 billion), and Murphy Oil (C$366.4 million, or US$240 million).

A recent study by Virginia’s Friedman, Billings, Ramsey & Co. indicates that Canada will lead worldwide exploration and development spending by achieving an 8.9% increase to C$18.2 billion (US$11.9 billion). The average global increase is expected to be 4.8%.

On the other side of the equation, Talisman Energy (C$2.1 billion, or US$1.38 billion) and ConocoPhillips (C$626 million, or US$410 million) have decreased spending plans. Shell Canada and Chevron Canada also announced lower expenditures for 2003. However, their reductions were due largely to completion of the Albian oil sands project.

Companies are also dealing with their perennial love/hate relationship with the lower Canadian dollar. While this currency increases vulnerability to takeovers by American firms, it also provides a premium on oil and gas exports.

However, Canadian oil stocks are at least somewhat sheltered by their overall strong performance in 2002, especially when compared to the rest of the market. The Toronto Stock Exchange’s oil and gas index posted an 11% gain during the year, second only to gold. Overall, the exchange saw a 14% drop during 2002.

Merger and acquisition activity seems to have been cooled in 2002 by the combination of decreased earnings and the relative strength of oil stocks. According to John S. Herold Inc., Canadian oil and gas deals last year amounted to approximately C$20 billion (US$13.1 billion), or about 30% of the global total. In 2001, the value of Canadian M&A activity was about C$40 billion (US$26.2 billion).

Herold’s survey showed that last year’s merger of PanCanadian Petroleum and Alberta Energy Co. – which formed EnCana Corp. – was valued at C$13 billion (US$8.5 billion), or 65% of the total value of all Canadian M&A activity in 2002. It was also the world’s largest transaction last year.

There has been speculation that the federal government may divest its remaining 19% stake in Petro-Canada. This stake is worth approximately C$1.5 billion (US$983 million). Members of the ruling Liberal party have suggested that proceeds from the sale could be used to pay for some of the costs associated with meeting the Kyoto Accord’s commitments. Petro-Canada also featured prominently in one of 2002’s biggest acquisitions. In May, the company closed its C$3.2-billion (US$2.1-billion) acquisition of Veba Oil and Gas, which increased international holdings.

Talisman Energy also announced the sale of its Sudan interests for C$1.2 billion (US$786 million) to a subsidiary of India’s national oil company. However, Talisman could not close the deal prior to the end of 2002. The sale was expected to close by the end of January. As improved fourth-quarter earnings roll in, M&A activity is likely to increase this year.

Meanwhile, producers are focused on drilling, and in particular, getting more gas out of the ground. A recent study by Canada’s National Energy Board illustrates an alarming trend. Since late 2001, projected Canadian natural gas deliverability could fall 4% – to 15.9 Bcfd from 16.6 Bcfd – by 2004, even with increased drilling.

A drilling increase will not be sufficient to offset lower productivity on a per-well basis. The report also does not account for future discoveries with high production rates. Rather, it applies a formula to current data. NEB estimates that 10,000 gas wells will be drilled in 2003.

NEW METHODS/OIL SANDS

Natural decline of the Western Sedimentary basin has led to changes in the ways that producers conduct business in Western Canada. The decline in gas-well productivity has led to a search for deeper, more sour, more costly, and higher-risk natural gas. Oil plans have shifted to heavier blends and oil sands.

With the increased interest in oil sands development, Alberta’s government expects output from the massive deposits to more than double, to 1.9 million bopd by 2010. Currently, about half of Alberta’s 1.9 million bpd of oil production (from all sources) comes from oil sands. If all currently announced projects proceed, more than $60 billion will be invested in oil sands development by 2015.

As new players arrive on the oil sands scene, the two largest, oldest projects – belonging to Syncrude Canada and Suncor Inc. – continue to expand. Syncrude has run into cost difficulties with its Stage Three expansion, where expenditures have risen more than 36% to C$5.6 billion (US$3.7 billion). Most of the heavy construction will begin this summer.

Suncor also plans to spend almost C$500 million (US$327.5 million) on oil sands growth projects. Another $215 million is ticketed “maintaining competitive oil sands operations.” This includes a spring maintenance shutdown to one of two upgraders.

Shell Canada experienced some difficulties with the start-up of its Muskeg River project, about 75 km (47 mi) north of Fort McMurray. The plant produced its first bitumen on Dec. 29, 2002. However, after only eight days, the plant was shut down after several explosions and a subsequent fire. The company said that the fire did not cause significant damage to major process equipment or piping systems. Damage appears to be limited.

Shell also said that the repairs would not impact the scheduled start of synthetic oil production from the Scotford Upgrader, near Fort Saskatchewan, Alberta. The fire’s cause appears to have been a hydrocarbon leak in piping near the Train Two solvent recovery unit. Shell owns 60%, partnering with Chevron Canada (20%) and Western Oil Sands (20%).

One negative in 2002 was the announcement by TrueNorth Energy that construction of the C$3.5-billion (US$2.3-billion) Fort Hills oil sands project would be deferred until conditions improve. The company cited several reasons for its decision. These included rising costs with other developments, challenging capital markets and uncertainty about the potential impacts of Kyoto.

Situated 90 km (56 mi) north of Fort McMurray, Fort Hills is a joint venture between TrueNorth (78%) and UTS Energy (22%). TrueNorth is an affiliate of Flint Hills Resources LLC, which is owned by Koch Industries. Imperial Oil also indicated that ratification of Kyoto could adversely impact planned expansion at the massive Cold Lake development.

DRILLING/LAND SALES

With a tough year behind them, and bolstered by improved activity in fourth-quarter 2002 and early 2003, some drilling contractors in Western Canada are optimistic.

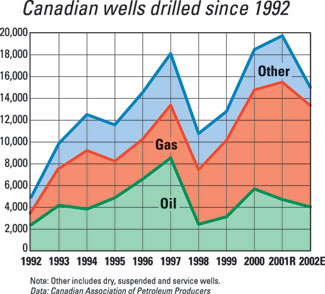

According to the Daily Oil Bulletin, there were just over 14,500 wells drilled last year in Canada. That figure compares to the Canadian Association of Petroleum Producer’s estimate of 15,026. Both numbers are lower than the record year of 2001, yet they represent the fourth-highest total since 1988. The majority of the drilling once again targeted gas, with between 9,100 and 9,300 gas wells drilled (about 62%). There were between 3,850 and 4,050 oil wells (26.5% to 27%) completed and a range of 1,305 to 1,650 dry holes (9% to 9.5%) drilled. In 2001, there were 10,757 gas wells and 4,732 oil wells.

Despite the relatively high numbers, service and drilling contractors suffered, as utilization rates were lower than expected. Both sectors anticipate improved activity and better results in 2003.

The Canadian Association of Oilwell Drilling Contractors forecasts a 22% increase during 2003, to 17,532 wells. This would bring activity close to 2001’s record levels. CAODC based its forecast on an average WTI price of US$25/bbl, and a spot gas price of C$4.40/Mcf (US$2.88/Mcf) at Alberta’s AECO-C hub.

The Petroleum Services Association of Canada has forecast a similar activity increase, projecting 17,500 wells. PSAC believes that one of the 2003 trends will be more deep gas well drilling in the Alberta foothills, as well as to the north and in northeastern British Columbia.

Last year, based on 14,500 wells being drilled, weekly rig utilization was just 50%, or an average of 315 active rigs. In 2001, utilization was 63%. For 2003, CAODC forecasts the drilling fleet to average 663 rigs, resulting in average utilization of 59%.

Government land sale bonuses also decreased last year from 2001 levels, but this area should improve during 2003. In 2002, spending fell by more than 43%, to C$893.1 million (US$585 million) for 4.29 million hectares ($208/hectare). This rate compares to last year’s record high of C$1.58 billion (US$1.03 billion) for 5.18 million hectares, or $305 per hectare, according to DOB records.

Alberta collected C$501.5 million (US$328.5 million) for 2.77 million hectares (C$181/ha, or US$119/ha), down 53.6% from C$1.08 billion (US$707 million) for 3.9 million hectares (C$278/ha, or US$182/ha) in 2001. British Columbia fell to C$288.5 million (US$189 million) on 849,048 hectares (C$340/ha, or US$222/ha), down 34.3% from last year’s record total of C$439 million (US$287.5 million) for 854,000 ha (C$514/ha, or US$337/ha). Saskatchewan was the only province to buck the downward trend, garnering C$102.9 million (US$67.4 million) on 653,659 hectares (C$157/ha, or US$103/ha), versus C$56.2 million (US$36.8 million) collected on sales of 372,525 ha (C$151/ha, or US$99/ha) in 2001.

SURVEY RESULTS

In late 2002 and early 2003, World Oil conducted its annual survey of Canadian producers. Compared to association forecasts, the sentiment among respondents was somewhat bearish, with producers indicating they would drill 2,143 wells in 2003, down 10.9% from 2002 levels. This would roughly translate to an industry-wide total of only about 13,385 wells to be drilled in 2003. This runs contrary to past years, when World Oil’s survey numbers have demonstrated a more bullish outlook than other forecasts.

Gas drilling is expected to comprise 54% of the total, compared to 44% last year. The survey also shows more exploratory drilling will occur, with about 14% of the wells expected to be wildcats, versus 10% in 2002. Among respondents, activity is expected to decline 10% in Alberta and 19% in Saskatchewan. However, wells will increase 17% in British Columbia.

PRODUCTION

Last year’s lower drilling levels appear to have affected production rates, as well. Oil and equivalent throughput (not including a big jump in East Coast offshore production) was virtually flat, while natural gas output slumped slightly. Concerns about producers being unable to meet natural gas demand may prove to be true. Furthermore, it may be sooner than expected, if this decline proves to be more than a one-year phenomenon.

However, with spending up and drilling activity high, there is more reason for optimism at the outset of 2003 than there has been for some time.

Combined crude oil and equivalent production increased 6.3%, to 2.36 million bpd, versus 2.22 million bpd in 2001. Looking just at conventional crude and condensate, this portion gained 5.7%, to average 1.64 million bpd. The increases are due primarily to an 84.6% hike in East Coast production. Output in British Columbia also rose 9% to 60,000 bopd, compared to 55,000 bopd in 2001. Production improved 1.3% in Alberta, to 1.57 million bopd. This rate compares to 1.55 million bopd in 2001. Output also gained less than 1% in Saskatchewan, to 430,000 bopd. On the East Coast, crude production jumped 94.6%, to 290,000 bpd. Output in Manitoba and Northern Canada was essentially flat.

Offshore production, spurred by increases at Hibernia and new output at Terra Nova, doubled in 2002. Bullish East Coast officials are predicting that their production will account for more than 40% of Canada’s light and medium oil supplies by 2005.

Synthetic production rose 26.1%, to 425,000 bopd, compared to 337,000 bopd in 2001. This increase can be traced to an 80,000-bpd boost at Suncor’s oil sands facility. In the fourth quarter, production averaged 227,600 bopd, which exceeds design capacity.

On the natural gas side, output fell 1.1% to 17.2 Bcfd from 17.4 Bcfd in 2001.

OFFSHORE

On the East Coast, two companies have announced plans to increase spending. Husky Energy has earmarked C$560 million (US$367 million) for 2003, while EnCana has announced it will drill three to six wells, each of which will likely cost in excess of C$30 million (US$19.7 million).

Two major developments – Hibernia and Terra Nova – increased production last year. Hibernia averaged about 184,450 bopd, up 24% from 148,700 bopd in 2001. Terra Nova’s output was about 105,400 bopd, much higher than was initially anticipated for the field’s first year of production.

The Canada-Newfoundland Offshore Petroleum Board recently approved a maximum production increase at Terra Nova to 150,000 bopd from the previous maximum of 125,000 bopd. Furthermore, work continues to increase production levels at both offshore projects. Late last year, drilling began on a second delineation well in the far eastern portion of Terra Nova. An appraisal well was also spudded in the Avalon section of Hibernia.

Mr. Curran is a Calgary-based freelance writer.

|