Horizontal wells extend the Tulare Sands play in Belridge field, California

Horizontal wells extend the Tulare Sands play in Belridge field, CaliforniaLarry Knight,

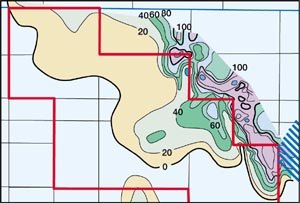

* Jim Martin** and Janet McAlee,*** Nuevo Energy Company Bottom line. The Hopkins Fee in Belridge field had no production when Nuevo Energy Company purchased its interests in this field in Kern County, California, in 1996. Building on its horizontal drilling expertise, in 1997, Nuevo initiated a horizontal drilling program to develop the 10-ft to 35-ft-thick Tulare Sands in the Hopkins Fee. It drilled two horizontal wells in this property in 1997 and has increased the number of horizontal wells it drills there every year since. As a result, production from the property has increased to approximately 2,100 bopd. Reserves range from 150,000 to 500,000 barrels of oil per well. Reservoir characteristics. The Tulare Sands are shallow lacustrine sands. They are continuous in nature and vary in thickness from 10 – 35 ft, Fig. 1. These unconsolidated sands average 35% porosity, 3 Darcys of permeability and 65% oil saturation. Tulare Sands oil is 12° – 13° API gravity and requires steaming to reduce its viscosity and enhance mobility. Initially, the horizontal wells are cyclically steamed every three to six months. In addition, Nuevo has initiated continuous steam injection to heat the Tulare Sands and increase oil flow to the horizontal wells. Once these wells respond to continuous steam injection, cyclic steaming is reduced or discontinued.

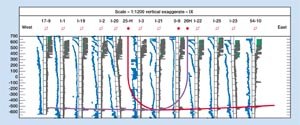

History of Tulare Sands development. The 2,400-acre Hopkins Fee spans 3.75 sections of land owned 100% by Nuevo. To date, about 700 acres have been defined as productive. A large portion of the property is located in a syncline separating South Belridge field from Cymric field. Most of the oil accumulation is located along the northeast boundary. This accumulation is an extension of the southwest limit of the very prolific Belridge field, discovered in 1911. Development of Hopkins Fee Tulare Sands reserves began in 1962. About 40 vertical wells were drilled on the property from 1962 through 1985. The average recovery from each well over its life was 46,000 bbl of oil with an average watercut of 93%. Cyclic steaming was attempted with limited success. Although steamflooding was successful in the main part of South Belridge field, it was never attempted on the wells located in the Hopkins Fee. By the time Nuevo acquired the property in 1996, all of the original oil-producing Tulare Sands wells were abandoned or shut-in. Nuevo’s development efforts began in 1997. While reviewing electric logs from abandoned wells, Nuevo staff determined that high-quality, oil-saturated Tulare Sands extended a long distance downdip toward the southwest. The sands were 10 – 35 ft thick, with good potential to be exploited using horizontal well technology. Several vertical wells were drilled as stratigraphic tests to define dip strike and elevation of the productive sand beds and extent of the oil-saturated sands. These wells showed that the productive area was large enough to support a significant number of horizontal wells. The vertical wells, which were originally intended to produce for a short time and then be converted to permanent steam injection wells, have sustained good oil rates much longer than Nuevo expected, and 16 of these wells are producing today. Locating horizontal wells. Nuevo elected to drill the initial horizontal wells in an undrained area in the thickest portion of the Tulare Sands that had not been depleted by previous wells. The horizontal wells are oriented with the lateral portion of the well running slightly uphill, allowing produced fluids to run downhill inside the liner and keep the well clean. Nuevo drilled several parallel horizontal wells through the sands about 330 ft apart with 1,500 to 1,800-ft lateral sections. This is equivalent to 2.5-acre spacing. Vertical steam injection wells were placed between, and drilled before, the horizontal wells. These vertical wells increase the number of control points along the path of the horizontal wells; provide more accurate formation depths for the horizontal directional program; and heat the reservoir and drive oil to the capture wells. In some places, where the reservoir is more than 3,000 ft wide, two horizontal wells are required to obtain a continuous horizontal drainage line across the width of the pool. These horizontal wells are drilled in opposite directions from the center to take full advantage of the available pay, Fig. 2.

Horizontal drilling operations and completion program. Using a 9-7/8-in. bit, the horizontal wells are drilled to surface casing point. The hole is then opened to 12-1/4 in. to the casing point and 9-5/8-in. pipe is set. Wells are drilled with a build rate of no more than 15° per 100 ft, and therefore are considered to be medium-radius wells. The shoe is drilled out and the lateral section is drilled with an 8-3/4-in. bit using a Xanvis solids-free mud to total depth. Then a 6-5/8-in. slotted liner is run through the wellbore to reach TD, while simultaneously running wash pipe within the liner. Drilling mud is displaced and the wellbore is flushed with 2% KCl (potassium chloride) water. During the flushing, an enzyme breaker is used to break down the mud. This allows production from the well to clean the residual mud from the wellbore, improving production performance. During drilling, an EM (electromagnetic) MWD (measurement while drilling) tool is used to measure well inclination and direction, allowing the well course to be controlled in real time. Using this tool also eliminates time spent waiting for and conducting a wireline directional survey, and it eliminates the cost of this survey. Nuevo promotes a strong team approach to drilling operations among the drilling engineers, geologists, directional drillers and mud loggers. Team members interact onsite during drilling operations to monitor the well in real time and ensure that it is steered as the formation dictates. This approach enables Nuevo to drill a 2,000-ft lateral section in a horizontal well in only 18 hr. Results of horizontal drilling program. As a result of the horizontal drilling program, production in the Hopkins Fee Tulare Sands has increased from 0 to 2,100 bopd from 21 horizontal wells and 16 vertical producing wells in four years. Initial production rates from the horizontal wells have ranged from 400 – 800 bopd, with production rates stabilizing around 100 bopd after six months. By way of comparison, vertical wells in the Tulare Sands typically have initial production rates of less than 50 bopd. Estimated reserves in the Hopkins Fee horizontal wells range from 150,000 to 500,000 bbl of oil per well. The Hopkins Fee horizontal drilling program creates significant value for Nuevo because it enables the company to develop reserves that cannot be developed economically using vertical drilling technology. Vertical wells are not economic because the oil sands are layered with wet sands, and steaming the wet sands produces a high watercut. Horizontal drilling enables Nuevo to target the oil sands for production. In addition, one horizontal well replaces four to six vertical wells. The operator’s team approach to drilling operations, which allows the well course to be directed in real time and eliminates the need for directional surveys, makes the horizontal drilling program cost-effective, as well. Nuevo plans to drill 16 horizontal wells in the property in 2001 and has identified more than 40 additional horizontal wells that can be drilled in the future. Lessons learned. Lessons learned from the Hopkins Fee horizontal drilling program include the following:

And onsite, real-time teamwork is critical to drilling horizontal wells efficiently and staying within the target zones. This teamwork results in faster drilling times, properly located wells and lower costs. PTD

|

||||||||||||||||||||||

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)