How to buy and sell properties on the Internet

MANAGEMENTHow to buy and sell properties on the InternetIn just over a year, the acquisition and divestiture process has experienced a total paradigm shift, as auctions take advantage of the efficiencies of virtual data rooms and bidding via the InternetRandolph P. Mundt, Piranha Partners, Houston

Personal experience, as well as conversations with buyers and sellers, was the background from which this article was prepared. In addition, responses to a series of questions posed to Internet auction houses provided additional detail. These questions concerned their historical success, the challenges in their business and the future potential for Internet auctions. To put Internet auctions in perspective, information about property auctions in general is provided, which applies to both live and Internet auctions. The process leading up to the sale, the sale itself and various follow-up procedures are also addressed. Finally, statistical information is presented on the success and growth of this emerging industry, as well as some opinions on changes and enhancements necessary for continued improvement and growth of the process. Auction vs. Negotiated sale This is not because the auction process will not work on properties of this size, nor because financially capable buyers do not bid at auctions. In fact, most majors or large independents have acquired assets through the auction process. However, the key to maximizing the price on the part of the auction house is to interest the greatest number of bidders. The mindset of a buyer is such that transactions of this size require custom negotiations, as opposed to the cash-and-carry concept that auctions provide. The non-negotiable nature of the auction contract of purchase and sale simply does not draw the greatest number of buyers or sellers for high-dollar properties. However, as this process continues to mature, property size will continue to increase. While operated properties are routinely sold at auctions, larger packages that require retention of employees; accounting transition agreements by the operator; and issues relating to tax and other legal matters are clearly not suited to auction sales. General Terms A lot consists of one or more properties that are to be sold in one group. It can comprise a single well or hundreds of wells and can contain properties in different counties or even different states. A buyer is a pre-qualified bidder who makes the highest bid at the auction. A seller is one whose property is sold at auction and who has entered into a contract for sale. Most auction houses have rules against a seller bidding on its own property. An auction engine is the software that automatically receives bids and immediately issues a response to a bidding party. Early Internet auctions did not use auction engines and attempted to record and respond to bids on the Internet by hand. A live auction, as used in this article, refers to an auction that takes place at a location with an auctioneer and bidders present. Bidding Terms In a live auction, the gavel is the signal made by the auctioneer that the sale has been completed. On the Internet, there is usually a time clock on the screen next to the property indicating the amount of time remaining to bid. The gavel is indicated by the word "closed" (or a similar word) next to the property. Proxy is an entity that acts as a substitute for another. In the Internet auction world, it connotes a mechanical process provided in the software that allows a bidder to place a bid that will be increased each time a higher bid is placed by a third party. The increase-by-proxy will be increased by the minimum bid increment and is capped by the bidder. Lot Composition The common theory is that parts sold separately are worth more than a large package. Again, this stresses involving the maximum number of bidders to bid up the price. Sales Strategies The Oil and Gas Journal Exchange recently fashioned a preemptive strike format. Under this procedure, bidders have the opportunity to make offers for properties that will be sold in an upcoming live auction. If the bid meets the seller’s minimum, the property is sold over the Internet. If a property does not receive an acceptable bid, it is not sold over the Internet, but included in an upcoming live auction. The ongoing sale format is used by several auction houses. Properties typically are listed for one to two weeks, and at the expiration of that time period, a new auction begins. Properties are offered with a reserve, but if they are not sold, they may show up in a later auction. This is probably the closest format to that used by general merchandise Internet auction sites such as eBay. A few sites have sporadic sales. This simply means that a sale takes place when there are properties to be sold. Auction Locations

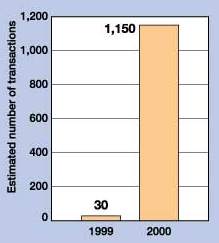

Many of the sites listed provide supporting data packages that supply information on properties to be sold in the auction, such as technical data, maps, land information and revenue and expense statements. Some are available for free on the site after registration; some charge to get the data. Seller’s Agreements In addition, there are indemnity provisions that protect the auction house from claims by buyers if the seller breaches any representation. In return, the auction house agrees to hold the auction and pre-qualify bidders for the sale. There are provisions for settlement of proceeds and the transfer of interest by appropriate conveyance. Auction-house commission schedules are also set forth. Based on several factors (such as property size and particular auction house chosen), fees can run between 2% and 10%. A number of the seller’s agreements also contain exculpatory language that removes any liability on their part if actual or perceived losses are sustained as a result of online system errors or problems. Buyer’s Agreements These agreements make it patently clear that the properties are being purchased on an as-where-is basis. While these agreements are available on the Internet for perusal, most auction houses require the bidder to execute and return an original of this document. Second, all bidders must complete the bidder-qualification form that sets forth several representations on behalf of the buyer showing that it is a sophisticated investor. The first representation deals with current buyer activity. The second deals with the background or profession of the buyer, and the third deals with financial capability. Both state and federal securities laws are clear that the sale of an oil and gas interest constitutes the sale of a security. There are certain requirements that must be met to market securities in this manner. The sale of securities to unsophisticated buyers is both illegal and provides an unhappy buyer a method to rescind the sale and receive damages. The third covenant made in the buyer’s agreement relates to the buyer’s obligation and ability to pay for the properties purchased. Typically, the auction house requires letters of credit or a letter from a banking institution guaranteeing payment of any purchases made by the buyer. This can be troublesome for an individual or small partnership without substantial banking relationships. All banks charge a fee to issue a letter of credit, and if the buyer obtains the letter and does not purchase the property at auction, that fee must still be paid. To obtain the letter of guarantee – which many banks will not issue – a small buyer may have to lock up funds in that institution for some time before and after the sale to provide security to the bank. Neither of these is a good solution for the small, occasional online investor. Finally, there is typically some form of user agreement that outlines the rights of each party in the event of system failure or breach of system integrity. For the most part, all auction houses are absolved from any liability for a system problem that develops during the auction. Frankly, most of the agreements made by a potential bidder are weighted heavily in favor of the seller or the auction house. However, a buyer can factor all of that into its decision to bid or not to bid on properties; knowing that if it elects to bid, it will subject itself to terms and conditions that may be less favorable than those that it could have obtained in a negotiated sale. Data Availability The cost to input and maintain this information on an auction house’s system can be substantial, depending on property size and complexity. Two auction houses provide data packages in a CD format, which can be purchased at nominal cost. Of course, additional sources of commercial, online production data can be used, and recent production history is available online from various state oil and gas regulatory agencies. For example, Texas property information can be accessed through the Texas Railroad Commission via its web site. Three Perspectives From the buyer’s perspective, with which the author is most familiar, Internet auctions allow the buyer to purchase properties without leaving the office, in an anonymous format. The efficiencies are obvious, particularly in event-style auctions where a buyer may only be interested in one property. In addition, the auction houses aggregate properties from many diverse sellers. Most buyers would never have the opportunity to purchase the broad scope of assets available at the auctions. On the negative side, in a negotiated sale or live auction, it is much easier to determine the identity of your competition. This is obviously helpful to a buyer. Finally, most sites require the buyer to bid in increments. In negotiated sales or live auctions, bids that are less than the increment can be accepted. From the seller’s perspective, the Internet auction is clearly the most efficient method to sell large numbers of oil and gas properties. There are no data rooms that must be staffed by company employees. Sellers can sell large numbers of small properties at one time, and compensation to the auction house is performance based. The sale is conducted continuously for days or weeks at a time, assuring maximum exposure to potential buyers. There is no negotiation of the purchase and sale agreement or documents of conveyance, because the seller has set the terms of the sale and it is a take-it-or-leave-it transaction. In addition, since most Internet auctions are conducted with a reserve on each lot, there is complete control over the price to be received on the properties. Several auction houses have told the author that, because of the lack of history, most sellers are reluctant to sell properties without a reserve over the Internet, fearing that lack of participation by bidders will not result in a market value price for the properties sold. It is worth considering that placing a reserve on a property may actually decrease its ultimate sales price. When a property is sold subject to a reserve, a seller can get a free appraisal of a property without the obligation to sell. As a result, a buyer that spends the time and effort to conduct due diligence, run economics and obtain financing, will be reticent to do so without some assurance the property will be sold. As mentioned earlier, the author believes that the maximum price for an asset is obtained by interesting the largest number of bidders. The minimum bid prerequisite may appropriately apply to both larger properties in live auctions and all negotiated sales; however, it should not apply to small-dollar lots, which should be the primary-target properties of Internet auctions. From the broker’s perspective, the considerable efficiencies generated by an Internet auction clearly allows the brokerage house to provide better service to its clients without the "brick-and-mortar" expenses of a live auction. There remain several challenges with which brokers must cope. First, because of the small need for manpower, it is relatively easy to establish an Internet property-brokerage business. As a result, competition is fierce. Recently, the author received calls from several parties indicating a plan or desire to get into this business. Finally, as majors begin to shed assets resulting from recent mergers, they may attempt to market properties via the Internet themselves. The start-up costs are high and the cost to maintain and upgrade systems is expensive. It would seem that, ultimately, costs to the seller would decrease as the mechanism to sell properties becomes more automated and efficient. However, because of the costs of continual upgrades and inputting property data online, it is unclear that such cost efficiencies will exist as these entities are currently configured. Finally, unlike a negotiated sale or a live auction, the closing takes place in stages. While none of the auction houses reported excessive problems because a buyer or seller would not go through with a transaction, recalcitrant sellers or purchasers with buyer’s remorse remain a potential problem. Measures Of Growth Transactions. The growth in the number of properties sold online is depicted in Fig. 1. While it is impossible to track the exact number of properties sold in 1999 – the first year of Internet sales – and 2000, some information concerning the number of lots sold is available. In 1999, there were 40 lots sold in the first and only sale that took place in November, which was sponsored by EBCO, a predecessor to the Oil & Gas Journal Exchange. As can be seen, this industry experienced a boom in 2000.

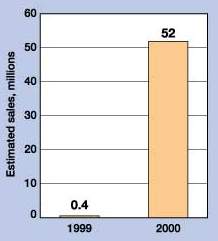

Sales. Likewise, the value of Internet sales (Fig. 2) has soared from a mere $400,000 in 1999 to an estimated $52 million in 2000. These numbers include sales at both exclusively Internet auctions, as well as hybrid auctions sponsored by the Oil and Gas Clearinghouse. As far as could be determined, the largest lot sold over the Internet was for $6.5 million.

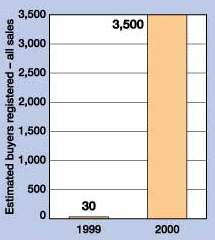

Many of the large mergers in the past several years have property-sales limited due to pooling-of-interest restrictions. Continued growth in Internet sales is expected for 2001, particularly with expiration of many of those restrictions currently in force. Buyers registered. As one would expect, the number of registered buyers also has skyrocketed, Fig. 3. However, this number may be somewhat misleading, in that this is the sum of the number of registered buyers for all Internet auctions reported by each of the auction houses. Many bidders are registered with all or most of the auction houses and therefore have been counted more than once. Alternatively, this number can be interpreted as indicating the breath of interest in these sales.

Future Considerations Continued dramatic improvement is likely during the coming year, but it will be expensive. As discussed, the number and size of properties auctioned over the Internet continued to increase throughout 2000. As buyers – and particularly sellers – become more confident that the price received in these auctions clearly reflects the market price (and that it is as good or better than could be obtained at a live auction or negotiated sale), the size and number of properties will continue to increase. Oil and gas prices could also play a role. A substantial weakening in oil price would likely result in many more properties offered for sale. Finally, consolidation of entities and strategies by

the auction houses is probable as this industry begins to mature. To some extent, each firm is trying a

different approach, and over time, the two or three best strategies will be adopted by all. The cost to

continue to improve technology is high, and this is clearly a volume-driven business. Unless there is a

dramatic increase in the number of smaller properties on the market, there may not be enough market share for

everyone.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||