International: Worldwide drilling

WORLDWIDE DRILLINGPendulum finally swings to positive

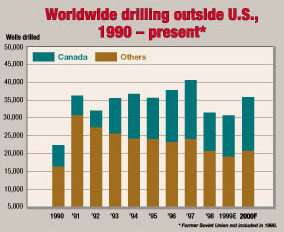

According to preliminary data supplied by governments and operators, drilling outside the U.S. fell 2.5% last year, tallying 30,710 wells. Unlike 1998, last year’s performance cannot be blamed on Canada, because that country registered a drilling increase. Instead, the downturn was spread fairly evenly among several continents, as operators responded to low oil prices by cutting back many drilling projects. This year, World Oil predicts that drilling outside the U.S. will tally 35,837 wells, for a 16.7% increase. Every region is forecast to post a drilling gain, although some will be much greater than others will. Canadian activity will be a major factor in the recovery. North America Fortunes are improving rapidly on the continent, thanks to improvement in Canada and stabilized, steady drilling rates in other countries. Thus, drilling outside the U.S. actually improved 7% last year, totaling 11,788 wells. Natural gas underpins robust drilling activity in Canada, and it figures heavily in Mexican strategic planning, too. Strong crude prices are merely icing on the cake, bolstering E&P activity further. North American drilling should rise 30% in 2000, to 15,272 wells.

Canada. At this time last year, there were stern faces in the Canadian oil capital, Calgary, and bearish predictions of depressed drilling activity. These forecasts proved to be overly alarmist. Instead of declining, drilling actually rose. Figures supplied by the Canadian Association of Petroleum Producers (CAPP) show that there were 11,531 wells tallied in 1999, a 7% increase from 1998’s figure. Primary reason for shifting fortunes can be summarized in two words: natural gas. Burgeoning U.S. gas demand spurred construction of considerable, additional pipeline capacity in Canada. Now, these pipelines clamor for gas to fill them. Producers must respond by expanding gas output, and to do that, they must drill, and drill heavily. World Oil’s survey of Canadian operators shows that two-thirds of their drilling efforts will target additional gas supplies. High crude prices have revived some efforts to drill for oil, but these merely keep the drilling ratio from being even more slanted in favor of gas. One question still begs for an answer: Can enough drilling crews be put to work, to accomplish every company’s plans? Nevertheless, CAPP predicts that 15,012 wells will be drilled, a 30% jump over 1999’s total. Mexico. As expected, figures from state oil firm Pemex show that drilling levels were maintained despite low crude prices. There were 233 wells drilled last year, a 15% increase over the 1998 total. The outlook this year is for about the same level of activity, with 235 wells forecast. One reason that the drilling level remained relatively high was Pemex’s decision to shift drilling efforts toward natural gas. Of 183 wells drilled onshore, 144 were gas completions, including 10 exploratory wells. This compares to only 12 oil wells drilled onshore, plus another 27 offshore. Natural gas is slated to play a more important role in Mexico’s future, as new combined cycle power plants are built, and existing plants are converted to gas usage. Indeed, there is a sense of urgency among government officials to double gas production within the next decade, in order to avoid boosting imports to satisfy power plant demand. At the same time, officials are worried by studies that show Mexican natural gas reserves will last only another 36 years at today’s consumption rates. Meanwhile, Pemex continues to focus its oil development efforts offshore, on the giant $5.3-billion Cantarell heavy oil project in the southern part of the Bay of Campeche. The company also is looking at select sites for additional oil exploration efforts. Cuba. Regardless of oil prices, drilling remains at a comfortable activity level. As was true in 1998, wells drilled totaled 19 last year, all onshore. Of these, five were exploratory, including three oil producers. For 2000, the Ministry of Basic Industry predicts another 19 wells, including four exploratory spuds. One of these is slated offshore. There also are 7,000 km of seismic planned for Cuba’s sector of the Gulf of Mexico. Other countries. In Guatemala, the majority of activity is conducted by Union Pacific Resources. The firm is defining Xan field further and examining prospects on other holdings for further wildcat sites. Nicaragua postponed its 1st Exploration Licensing Round until the spring of 2000. No results have been announced from Costa Rica’s second licensing round. In Belize, activity will be confined to a 150-km seismic survey offshore. South America Saddled with unfavorable economics, South American drilling plunged to a 23-year low, recording only 1,920 wells. (In 1976, the total was 1,788 wells.) The only country with significant activity to post a gain last year was Bolivia. The picture this year is much brighter, with increases expected in all South American countries. Accordingly, regional drilling will rise 33%, to 2,553 wells. Venezuela. Despite dire predictions, Venezuela’s new regime has run the petroleum sector better than expected. President Hugo Chavez’s appointment of former PDVSA mid-level official Hugo Ciavaldini to run the state oil firm last September had been criticized. However, Ciavaldini has proved to be a better manager than most people imagined, and the dramatic rise in crude prices has replenished PDVSA’s coffers. It is no surprise, then, that drilling held even with 1998’s level, at 871 wells. In keeping with its stated goal of adhering strictly to OPEC quotas to keep prices higher, Venezuela has shifted its E&P strategy. There is far less emphasis on expansion of light crude output, with greater effort directed toward developing output of natural gas and Orimulsion, the trademarked boiler fuel. Nevertheless, look for drilling to rise another 23%, to 1,075 wells. Argentina. The country continues to play second fiddle among regional drillers. Activity was off a whopping 36%, at only 550 wells. Wildcat and appraisal drilling continued to account for about 7% of the total. Burdened by relatively mature fields at home and tempted by regional deregulation, Argentine operators have turned much of their attention to other South American countries, like Brazil and Venezuela. Indeed, YPF reduced its 1999 budget 17%. This was before YPF was acquired by Spain’s Repsol. The firm later assured officials that it would continue Gulf of San Jorge operations, where additional reserves in excess of the 1 billion bbl discovered may exist. Meanwhile, new oil finds were struck by Chevron and Petrolera San Jorge in Rio Negro Province. Repsol-YPF and Sipetrol reported a gas find in Magallanes Strait. The outlook for 2000 is a 30% rebound in wells drilled, to 715. Brazil. Drilling may have declined last year in response to low crude prices, but Brazil is definitely on the verge of attracting a gusher of new E&P investment. The country’s deregulation of the industry is forecast to garner $40 billion of new investment over the next five years and create 150,000 jobs. The National Petroleum Agency’s second exploration licensing round is set for first-quarter 2000 and designed to attract smaller independents, as well as the large multinationals. So far, state firm Petrobrás has signed 22 partnership agreements with large private firms (such as Exxon, Shell and Texaco), amounting to about $2.6 billion. Drilling was down 22% last year, at 240 wells. However, a huge turnaround is expected, with ANP predicting activity will zoom 70%, to 407 wells. Colombia. Spurred by the collapse in oil prices, Colombian officials appear to have improved the regulatory climate just in time. Last year, the government significantly reduced its take for smaller E&P projects, to encourage greater investment. Positive results are emerging, already. During the first three weeks of 2000, three new exploration contracts were signed with Hunt Oil, Canada’s QRC and Tecnopetrol. State firm Ecopetrol will attempt to attract further investment with a special tender of 13 active and inactive blocks in July. Drilling totaled an estimated 90 wells last year, a 15% decline. A small increase to 94 wells is forecast in 2000. Western Europe The North Sea and related waters appear to have "bottomed out," but the recovery is going to be slow. Regional drilling was down 11%, and every country experienced a decline except, ironically, the United Kingdom. This year, most of Western Europe’s 17% improvement to 692 wells will be onshore, in Italy, Germany and France. United Kingdom. According to the UK Department of Trade and Industry (DTI), preliminary figures show that British drilling was up modestly last year, at 294 wells. This may seem hard to believe, but DTI is crediting fairly intense infill drilling programs for keeping the well total higher. There may be some truth to this, considering that UK oil production rose 3% last year. Credit for drilling rates certainly cannot go to exploratory efforts. According to analysts at Arthur Andersen in London, British exploration and appraisal (E&A) wells slid 50%, to only 33, their lowest level since 1971’s total of 32. For 2000, Arthur Andersen predicts that E&A drilling will improve to between 40 and 50 wells. Assuming that infill programs continue at their current rate, the overall drilling forecast is for a rate similar to 1999’s, at 298 wells. Norway. A disproportionately high level of development work is also the lynchpin holding up Norwegian drilling. There were 155 wells drilled last year, said the Norwegian Petroleum Directorate, down slightly from 1998’s level. There were only 25 E&A wells spudded in 1999, said Arthur Andersen. That is the smallest number since 22 wells in 1978. Analysts predict that E&A activity will improve modestly, to 28 wells. Overall, drilling is expected to return to 1998’s level, at 160 wells. The largest operator, Statoil, expects to increase activity 11%, thus accounting for about 45% of all Norwegian drilling. Eastern Europe/FSU Already strapped for cash, this region took a major hit from low crude prices. Even after the remarkable price recovery, most nations are using extra revenue to service existing debts. Wells drilled fell 21% last year, and given the current financial plight of local operators, only a 4% gain to 2,822 wells should be expected. Russia. The once-mighty Russian upstream sector continues to be a shadow of its former self. Starting from an already depressed level, Russian drilling took a nosedive last year, falling another 18%, to a mere 2,100 wells. Cash flow shortfalls from low world oil prices left domestic operators precious little in the way of funds to reinvest in exploration and drilling. When oil prices did improve, oil companies used the extra revenue to take care of "other" needs, such as releasing delayed paychecks to workers and paying off bills in arrears. This year, the outlook will improve very modestly, to 2,150 wells. A few of the larger Russian firms, like Yukos, say they will be able to take on some new field developments. Yukos plans to develop several new fields in the central Russian region of Samara. Yukos also will cooperate with Hungary’s Magyaroil to develop the Zapadno-Malobalyksky oil deposit in Siberia. Other FSU countries. The outlook for the remainder of the FSU outside Russia is slightly brighter. Drilling is estimated to have fallen a collective 29% in these countries, tallying only 172 wells. For 2000, a 12% improvement to 193 wells is predicted. Kazakhstan remains the best bet for foreign firms to invest in. Chevron expects to spend another $3 billion over the next four years to drill additional wells at Tengiz field and expand processing facilities. Texaco is slated to begin the second work phase at North Buzachi field onshore, after drilling four wells that confirmed in-place oil reserves of up to 2 billion bbl. Little change in activity levels is expected for Azerbaijan. Awarded rights to begin output from Southwest Gobustan field onshore, Commonwealth Oil & Gas will drill seven new wells. Lukoil and state firm Socar also will draw up a plan to rehabilitate and further develop several offshore fields. Conoco, however, closed its office in Baku after choosing not to sign a $1.2-billion pact to develop Guneshli oil field offshore. Countries outside the FSU. Just like Russia, most of these nations will not see large drilling increases, as they continue to rebuild their cash reserves. As the largest non-FSU driller, Romania should post a moderate increase. An option to acquire 50% of three Romanian concessions was exercised by U.S. company Castle Energy. Romanian firm Petrom claimed to have struck a new oil field in the Black Sea, but little or no data about its potential performance have been released. In Poland, there are now six foreign firms active. The Polish Department of Geology reports that Apache Corp. is the most active and will boost exploratory drilling to five wells from two. Africa Regional drilling was affected greatly by eroded economics, plummeting 35%, to only 540 wells. Every one of the larger producing countries suffered a loss of activity. One exception was the deepwater areas of West Africa, which have been very successful for exploration and are leading the region’s comeback. A 17% rebound to 633 wells, overall, is predicted. Offshore drilling is expected to gain 24%. Egypt. Wells drilled declined 22% last year, to 135, of which about 55 were offshore. Nevertheless, Egypt’s upstream sector is much healthier than that statistic would indicate. There were several discoveries announced last year, among which were oil strikes by Apache (onshore) and Tanganyika Oil (offshore, Gulf of Suez), and a gas find by RWE-DEA (offshore, Nile Delta). BP Amoco and Elf Aquitaine also signed to explore very deepwater areas of Egypt’s Mediterranean acreage. Natural gas field development is thriving, thanks to supply accords signed last year by a BP Amoco/ENI partnership and a British Gas/Edison International group for tracts in the offshore Nile Delta area. Together, the two groups should be producing just under 1 Bcfgd from these projects by 2003. Accordingly, Egyptian drilling is forecast to gain 11%, to 150 wells. Algeria. Drilling already was at a reduced level in 1998, and the effect of reduced revenues caused wells drilled to plunge to only 55 last year. Government officials were startled by the reduction, having expected that liberalization schemes passed in 1986 and 1991 were sufficient to sustain activity. Now, they are considering a further opening of Algerian E&P to private investors, including the bold step of allowing partial shareholding in state-owned firms. In the short run, however, little is expected to change. Hence, drilling is forecast to remain level, at 55 wells. Nigeria. A combination of low crude prices and an uncertain political system caused drilling to slump 36%, to 85 wells. There are signs that Nigeria’s newly elected civilian government is beginning to regain the country’s credibility after years of corrupt military regimes. One sure sign is talks held recently between Nigerian National Petroleum Corp. (NNPC) and U.S.-based Citibank about a possible $200-million loan. The new regime has worked hard for the last six months, to ensure that multinational joint-venture partners are paid on time. Anticipating the development of several new offshore oil fields, some in deep water, the joint-venture partners late last year proposed hiking the 2000 E&P budget to $5 billion, from the $3.5-billion figure agreed upon earlier. At a minimum, the forecast calls for a 6% gain in wells drilled, to 90. Middle East Two "camps" of Middle Eastern producers seem to have developed during the last year. One group, epitomized by Saudi Arabia and Abu Dhabi, seems content to keep total control of their upstream operations. The other camp, led by Iran and Kuwait, is keen on attracting foreign investment into their respective upstream sectors, and has worked to improve regulatory conditions. Wells drilled were down 9% last year, although they did finish above the 1,000 mark again, at 1,156. Ironically, Iran and Kuwait were the only major producers that increased their drilling. This year, a slight increase to 1,188 wells is forecast, although this will be the smallest percentage gain of any region worldwide. Oman. Drilling activity slipped 15%, to 280 wells, but the sultanate was still the region’s top driller. For 2000, a 7% improvement to 300 wells is predicted. Keeping activity high will be the usual slate of oil and gas development projects run by dominant operator PDO. In addition, Gulfstream Resources will develop Hafar, Nadir and Sahwah gas fields on Block 30 of central Oman. Novus Australia has picked up an onshore/offshore block near Bukha offshore field. Saudi Arabia. With reduced OPEC quotas in effect, there was no reason last year for the Kingdom to boost oil production capacity. Thus, a number of upstream projects were deferred, and drilling shrank 21%, to 224 wells. Emphasis is shifting to natural gas expansion, where officials are willing to let foreign firms participate. Current Saudi Aramco gas output capacity is about 4 Bcfd. If plans are realized, that capacity will be expanded to 7 Bcfgd by 2002. Per the new realities, drilling activity is expected to stay nearly even, at 225 wells. Iran. Even as the U.S. government struggles to continue enforcing unilateral trade sanctions against Iran, a growing number of non-U.S. firms are ignoring the threat in favor of signing up for field development deals. A prime example is Shell, which bid $800 million to develop Soroush and Nowruz oil fields. At the end of 1999, roughly 45 buy-back projects, plus various development phases at South Pars oil/gas field, were on offer. Fueled by improved production revenues, state firm NIOC and partners increased their drilling 8%, to 134 wells. A further gain to 140 wells is slated this year. Far East Thanks to stagnant Chinese activity, the Far Eastern forecast does not look as impressive as it should. Regional activity grew 2% last year, and 5% growth to 12,438 wells is expected this year. Outside China, drilling will jump 27% higher. Field development activity will be quite strong in Indonesia and Thailand. China. Government officials recognize that onshore oil finds have become scarce, and crude output is ready to decline significantly. As an alternative strategy, they are shifting development efforts toward natural gas onshore while still attempting to develop more crude output offshore. State firm China National Offshore Oil Corp. said it will launch a massive development effort this year, for both oil and gas, that will yield annual increases of 40 million toe by 2005. Drilling last year was up minimally at 9,995 wells. Another small increase is on tap for this year, to 10,140 wells. Indonesia. Social upheaval associated with last year’s election of a new government has calmed, and the country appears headed down the right path politically and economically. Despite a regional recession, last year’s wells drilled were actually slightly higher than 1998’s level, at 1,043 wells. This year, Indonesia’s E&P sector is poised to harness a recovering Asian economy and a blossoming gas market. Several field developments are underway, including Conoco’s ambitious West Natuna project that will supply gas to Singapore and Malaysia. State firm Pertamina says that drilling should grow another 30%, to 1,359 wells. Thailand. The natural gas bandwagon continues within Thailand. Drilling slipped only 8% last year, to 205 wells, as Unocal, PTTEP and Shell continued development and infill drilling programs. This year, they have heightened competition from Chevron, which bought into the B8-32 offshore concession and took over the operatorship. Not surprisingly, drilling throughout Thailand will be on the increase, with a 35% jump to 276 wells forecast. South Pacific As Australia’s activity goes, so goes the regional drilling total. So when efforts stumbled in the land of Oz, the regional tally tumbled 34%, to 175 wells. On the other side of the equation, Australia’s recovery, both onshore and offshore, will push South Pacific drilling 18% higher, to 239 wells. While better than last year, such an activity level is still far short of 1997’s record-setting pace. Australia. This year’s modest recovery is rooted in strong gas-oriented activity, plus renewed upstream interest generated by the current exploration bidding round. Of 57 tracts offered, 20 saw bidding on them close last October. The remaining 37 blocks will be open for bidding until April. Meanwhile, WAPET struck what is described as a major gas find in its Geryon 1 wildcat in the WA-267-P offshore permit. Woodside Petroleum also plans to proceed with development of Legendre North and South oil fields this year, on the North West Shelf. Overall, Australian drilling is expected to rise 26%, to 220 wells. In New Zealand, Orion is said to have hit a major

gas find on the east coast of North Island, making it the first commercial discovery not in

the west coast’s Taranaki basin. Countrywide, activity should stay even with 1999’s

figure. In Papua New Guinea, a large drop-off in development work is expected, while

exploratory drilling should remain steady, at six wells. Oil Search is beginning an 18-month

program to explore untested structures beneath Kutubu oil field, as well as in other nearby

Highland lease areas.

Copyright © 2000 World

Oil |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||