Service and operating companies join forces to meet deepwater challenges

TECHNOLOGY UPDATEPanel in PrintService and operating companies join forces to meet deepwater challengesPresentations here by executive officers in one major oil company, two service organizations and a major university emphasize the explosive new involvement of the industry’s service / supply / engineering organizations in meeting the technical challenges of deep water around the world. Elf Exploration Angola is moving ahead on its giant Girassol project – a result of major contracts for wells and facilities – scheduled for first oil in 2001. At Texas A&M University, the joint Offshore Technology Research Center, in conjunction with The University of Texas, has tested nearly every production system in – or headed for – the deepwater Gulf of Mexico. At Schlumberger, its Deepwater Center of Excellence is interfacing with the deepwater industry through various JIPs and DeepStar, in addition to its own goals for developing new technology. And Scotland’s Wood Group, now an international organization involving independent companies serving 27 countries, has expanded rapidly through internal growth and acquisitions to offer new solutions to the offshore industry’s technical needs.

Elf moves ahead with Girassol deepwater project in AngolaAntoine Serceau, Girassol Project Manager for Elf Exploration Angola, overviews the impressive new deepwater development in 4,400-ft water off the coast of Angola involving 39 subsea wells and one of the largest FPSOs ever built. Major contracts for system components and management of the project through a team representing the six partner companies are moving Girassol toward first oil in the summer of 2001. And as described, this major operation is advancing the technology for developing deepwater prospects, both off the coast of West Africa and in other international areas.

Q. Mr. Serceau, the Girassol field development off the coast of Angola is a world-class, deepwater development. Can you summarize project status at mid-year 2000? A. The Girassol field was discovered in April 1996, effectively in 1,350-m (4,400-ft) water, 210 km northwest of Luanda, the capital of Angola. This discovery – due to its size, water depth and the environment – is turning out to be one of the most ambitious field developments underway worldwide. The project can be summarized – if this term can be used – into these three main contracts fitting the principal technical breakdown: 1) an EPCI contract for the floating production, storage and offloading unit (FPSO), with an associated offloading buoy, awarded to MPG (Mar Profundo Girassol), a consortium comprising Bouyges Offshore and Stolt Offshore; 2) an EPC contract for the Subsea Production System (SPS) – 39 subsea wells, awarded to Kongsberg Offshore; and 3) an EPCI contract for the Umbilicals and Flow Lines (UFL) system, awarded to AMG (Alto Mar Girassol), a consortium comprising Bouyges Offshore and Stolt Offshore. Two major contracts have also been placed with Foramer and Sedco Forex for construction and operation of two new DP rigs – the Pride Africa drillship and the Sedco Express semisubmersible.

Four years have passed since Project Group creation in July 1996, and the project is now 65% complete. Concerning the FPSO, the hull was completed on schedule by Hundai Heavy Industries (HHI) in South Korea and delivered to Fos-sur-mer in France in November 1999. HHI-OD (Offshore Division) has been chosen to build the topsides – most of the equipment has now been delivered to HHI-OD and the construction is ongoing. Concerning the UFL, the detailed design is completed and orders for material have been placed. I would remind you that the UFL system comprises three riser towers – a major innovation considering the water depth – that will be assembled in Lobito in Angola, plus sealine bundles to be assembled in Soyo, also in Angola. Both sites were ready to start construction in July. Concerning the SPS, production equipment has been tested successfully in Bergen (shallow water tests) and in Kongsberg’s premises, and shipments to Angola started in May. Finally, the drilling campaign on Girassol is about to start with the Pride Africa, while Sedco Express is being tested and commissioned. Q. How is the project managed, regarding operator, partners and participation by Sonangol? A. Girassol is part of Block 17, awarded by Sonangol – Sociedade Nacional de Combustiveis de Angola – at the end of 1992 under a production sharing agreement (PSA) – to a group of contractors comprising Elf Exploration Angola, 35%; ExxonMobil, 20%; BPAmoco, 16.7%; Statoil, 13.3%; Norsk Hydro, 10%; and TotalFina, 5%. The partners are deeply involved in project development, first of all by assignment of several partners’ personnel, and through various workshops and meetings. Such meetings allow experiences to be shared and exchanged, and they facilitate preparation of well-founded decision making. Moreover, special "lessons learned" sessions are organized periodically for tackling special points of the project. Regarding Sonangol, our relations are governed by the PSA. Workshops and meetings are regularly held to review overall project progress and address main areas of concern. Moreover, while the project is based in France, the organization of Elf Exploration Angola and the Girassol Project Group is such that several teams based in Angola represent Block 17 and Girassol regarding Sonangol, during regular meetings and contacts, thus easing information circulation in both directions. Q. From reservoir data gathered to date from exploratory and appraisal drilling, what general type of reservoir does Girassol represent? Is it similar to other offshore Africa geology? Does it indicate a strong potential for deepwater-Angola development? A. Despite the deep water, the reservoir is very shallow, 1,200 m under the mudline. The upper Oligocene Girassol reservoir is unconsolidated, and corresponds to distal turbidites – quite frequent in African geology, deposited in channels with NE-SW to north-south trends – extending over an area about 18 km long and 10 km wide. This turbidite system comprises several individual sand complex deposits – three meandriform channel sand complexes with levees facies and several sheet complexes. Oil in place is estimated at 1.55 billion bbl and reservoir simulations provide a base-case scenario with associated, recoverable reserves of 725 million bbl of 32°API oil. Well productivity during tests has been very high, in the range of 10,000 to 20,000 bopd, with even-higher rates up to 30,000 bopd for some wells. This results from very good reservoir characteristics, among the best in Angola. Girassol’s first discovery on Block 17 has been followed by other multiple discoveries such as Dalia, Rosa and Lirio. And even if these reservoirs do not all have the same characteristics, such successes in field discoveries and innovative developments in a 1,350-m water depth allow optimism for future exploration on new blocks. Q. What type of production do you expect from this reservoir, and how has this governed field development design regarding fluid handling? Will you be able to avoid gas flaring? A. As we have already said, reserves are estimated at 725 MMbbl. The project is sized for 200,000 bopd production, and injection of 390,000 bwpd and 8 MMm3/d (282 MMcfd) gas – thanks to 39 subsea wells, comprising 23 oil producers, 14 water injectors and two gas injectors. The oil production plateau is planned to be reached within one year. The FPSO is sized for 2 MMbbl storage. On the seabed, broad lateral reservoir extent leads to use of 26 km of production bundles and 33 km of injection sealines linking the three-riser tower bases to 13 manifolds and the 39 subsea trees. Seventy-seven km of umbilicals connect command and control functions between the FPSO and the subsea production system. Considering the combined effects of seabed temperature, oil temperature at the wellhead and temperature of wax appearance – together with heat loss in the fluids as pressure decreases between wells and FPSO – the design and associated characteristics of the sealines / riser system represent one of the most difficult technical challenges. In addition, several other production chemistry aspects – such as hydrate prevention and remediation, scale deposition and widely varying flow conditions resulting from reservoir depletion and increase of GOR and watercut – make flow assurance aspects critical for project success. Gas injection at the bottom of each production riser has been chosen as the artificial lift system for well flow assistance at high watercut, as well as flow stabilization in case of slugging and restarting operations. As part of our environmental policy, gas flaring will be effectively avoided. Gas will be reinjected and used as pressure support until its delivery to Sonangol when an industrial project will be available to handle it. Q. Regarding lessons learned, have you encountered any technical problems you did not foresee, and what is being done about them? A. Obviously, development of such a project – for which no previous reference exists for either material or equipment – leads to technical problems, but they are not "insolvable." For instance, regarding the SPS, qualification of equipment for 1,500-m water grew in number and duration, fortunately without impact on schedule; and several tests were added to gain full confidence in such equipment. Regarding UFL, setting up the manufacturing of foam that will insulate bundles has been longer than expected, but the production is now stabilized. Other problems encountered were inherent to any project of such a size – they have all been effectively managed. Q. What industry firsts will this facility set? A. Girassol further opens the door for deepwater oilfield exploitation, particularly off West Africa. It is a kind of industrial prototype that will verify assumptions made for development of such oil-bearing structures for a series of future developments on Block 17 and perhaps – or probably – on other blocks in the area. The development is the result of innovative and ambitious technical developments for subsea systems, for the FPSO (one of the largest ever built) and for umbilical / flowline systems. This project will create a reference for the exploitation of deepwater fields everywhere. Q. And Angola itself will obviously benefit. A. Definitely. I said earlier that the yards of Lobito and Soyo in Angola will be locations for riser-tower and sealine-bundle assembly. This will obviously have a very positive impact on the local economy, as several-hundred new employees will work there until May or June 2001. But this will not be the only positive impact! There will also be a long-term economic benefit for the country in that – apart from our own recruitment activities for operational personnel – several Angolan-based contractors will be needed throughout the field life. So, Girassol and the other projects of Block 17 will be very beneficial to the Angolan economy well into the future. In conclusion, I would like to say that Girassol is a very challenging project and one that – I hope – will be the first of a long series of such projects. I am very proud to be involved, and I would like to thank everyone working on the project for the amazing achievements they perform every day. DWT The author

OTRC offers the deepwater industry a world-class research facilityE. G. "Skip" Ward, Associate Director of the Offshore Technology Research Center (OTRC) at Texas A&M University, discusses the facility’s organization, goals and industry participation that have made it a key component in industry’s move into deep water. Several key research programs are noted. OTRC recently conducted a workshop on "FPSOs, present and future." Mr. Ward offers some comments on the benefit of this important gathering and its positive effect on FPSO use in the Gulf of Mexico. Q. Mr. Ward, can you outline the background, organization and purpose of OTRC? A. The OTRC was established under the National Science Foundation’s Engineering Research Center Program in 1988. A joint program between Texas A&M University (A&M) and the University of Texas (UT), it was established to develop knowledge and train engineering graduates through academic and research programs focused on problems related to the economical exploitation of deepwater petroleum resources. The National Science Foundation and the industry have funded the center. Currently, it is sponsored by 35 industrial firms and the Minerals Management Service (MMS).

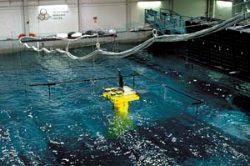

Industry and MMS provide strategic guidance to the center that is used in developing its research plan and programs. Research programs are developed around major thrusts that serve to help organize, focus and integrate individual research projects carried out by the faculty and graduate students. Separately funded Joint Industry Projects are used to further develop research results toward practical applications. The resulting, multi-disciplinary research program emphasizes technology needed for deepwater floating production structures. These have focused on hydrodynamics and fluid / structure interactions, materials and seafloor engineering, as will be described later. About 30 professors (and their students) from many of the different engineering departments at A&M and UT are involved each year in the programs. The center also collaborates with other institutions in the U.S. and Europe. Q. What are the principal physical features of the facility and how have they been used? What percentage of the resource is used for training / teaching and "outside" projects? A. It was recognized that experimental data would be required to support and validate theoretical advances, as well as test deepwater structure designs. Thus, a world-class wave tank was completed in 1991 at A&M. The basin is 150 ft long, 100 ft wide and 19 ft deep, and there is a 55-ft deep pit in the basin. A segmented wave generator can generate both unidirectional and directional waves to simulate realistic storm seas. Winds and currents can also be generated at various angles to the waves. Thus, a wide variety of realistic storm environments can be simulated for different test requirements. The basin is supported by experienced engineers and technicians. The wave basin is available for both industrial and academic research projects – the balance of activity has been about 75% industrial and 25% academic research projects. Numerous model tests have been completed for various industrial clients to test and validate new deepwater structure designs. These include deepwater production structures (TLPs, mini-TLPs, Spars, semisubmersibles and FPSOs) for the Gulf of Mexico, the North Sea and Offshore West Africa. JIPs to test the Spar structure concept were very important in its acceptance as a viable deepwater concept. OTRC is proud that, since the basin opened, most of the deepwater production systems that have been installed, or are being studied, for the Gulf of Mexico have been tested in the center’s basin. Deepwater drilling units, including ship-shaped and semisub vessels, have also been tested there. Education of offshore engineers is a major focus. The educational program has included: graduate students working on MSs and PhDs in the various research projects; undergraduate students involved in the research projects or testing during the academic year; special summer programs for undergraduates and high school students to interest them in offshore engineering; and continuing education courses for professionals. Throughout its life, OTRC has graduated about 90 MS and 60 PhD students. With the recent increase in deepwater activities, the demand for graduates by the industry has significantly increased. Q. How are the services of OTRC made available to the offshore industry? How would a "typical" project be initiated, carried out and funded? A. I’m not sure what a "typical project" means, as can be seen from the above comments and the following discussion of some other projects. Industry and MMS sponsors have the opportunity to help guide and shape the strategy and scope of the research program, which gets translated into specific research projects. Industry and MMS also have the opportunity to participate in JIPs offered by the center and suggest JIPs for it to conduct. Industry-sponsored test projects in OTRC’s basin normally follow the route of an RFP, proposal and contract. These are most often undertaken in support of a specific project. In addition to the research and testing programs previously overviewed, the center has provided other important services for industry. It has helped sponsor industry and government conferences on important topics such as pipeline safety and the assessment and requalification of platforms. OTRC was instrumental in establishing the Geotechnical / Geohazard Forum to promote the integration of geotechnical and geophysical disciplines on seafloor engineering issues and the interaction between industry and regulatory agencies. This forum has been enthusiastically supported; and it recently addressed outdated regulations and collaborated with the MMS to develop revised regulations. The center also sponsors a short course on the design of floating production systems, and it has held specialty workshops to address industry problems and research needs. It has also developed a summer institute that provides participants with a comprehensive view of a deepwater project from discovery to completion. This course is principally aimed at students about to graduate, and new industry employees. Q. Is the facility the only one of its kind in the U.S.? Where else could an organization go for this type of testing and research? A. The combination of outstanding faculties with a broad range of interests, capabilities and experience at two strong universities, bright students, plus the world-class wave basin make OTRC a truly unique organization that is capable of a broad range of research and testing activities to support the offshore industry. Other world-class basins are located in the Netherlands and Norway. Q. What are some of the center’s ongoing basic research projects? A. The research program has been focused in three main area: 1) Hydrodynamics and fluid / structure interactions, 2) Materials, and 3) Seafloor engineering. The Hydrodynamics research program has addressed many aspects needed to design deepwater production structures. The principal focus has been the development of technology to predict wave and current loads on floating vessels and associated components such as riser and mooring components, and overall vessel motion and responses. This program evolved over the years to concentrate on floating production systems of interest to the industry. Initial research concentrated on TLPs – more recently, the program emphasized Spar structures. Research and wave-tank tests on Spars helped establish their viability as deepwater drilling / production structures. The program is now focused on tanker-based FPSOs and understanding their responses to the Gulf of Mexico environment. For Materials, recent research has focused technology needed to design composite tubulars for offshore applications. Results were used in a collaborative project by several commercial firms and a government agency to design / build a prototype section of a composite drilling riser which will soon be tested offshore on a rig in Brazil. Flexible composite tubulars are now being studied. Seafloor engineering research has focused on characterizing seafloor properties for engineering design applications such as foundations and pipelines, and development of new foundation / anchoring concepts for deepwater floating structures. Deeptow surveys and cores have been used to characterize the topology and near-surface geology of several sites in depths exceeding 6,000 ft to provide general background information on the seafloor in ultra-deep water. Research is now focused on suction piles and caissons for deepwater foundation systems. An additional area, Risk, has recently been undertaken as a research project sponsored by the MMS to compare risks of FPSOs with other existing deepwater production systems in the GOM. The results will be used by MMS in its decision making to allow use of FPSOs in the Gulf. Q. OTRC recently conducted a workshop on FPSOs, sponsored by MMS, the U.S. Coast Guard and DeepStar. What was your impression of this effort? A. The workshop attracted some 270 participants. We were very pleased with the level and quality of interest and participation by the industry – it is obviously very interested in the subject. Industry’s sharing of FPSO experiences and the technical discussions were useful to both regulatory agencies and the industry. We were also pleased with the active participation by MMS and the Coast Guard. The policy statements and discussions were useful to both regulatory agencies and industry. Representatives from seven international regulatory agencies with FPSO experience were invited. We were pleased with their active participation and the wealth of information and experience they shared through their presentations and discussions. Their information and experience is obviously a beneficial and valuable source of information, as there is no direct experience in the GOM. Q. Do you think the presentations improved industry and government impressions about the viability and reliability of FPSOs in U.S. waters? A. I think the workshop was a very useful forum for sharing information and discussing FPSOs. The presentations and discussions provided both regulators and industry the unique and direct opportunity to learn about and discuss successful applications in many other offshore areas. The presentations by MMS and the Coast Guard also provided useful opportunities to discuss, clarify and better understand regulatory plans and policies. My personal belief is that the successful international FPSO experiences related at the workshop, and the fact that no major technical needs were identified, is certainly valuable and useful information to regulatory agencies as they consider applications in the Gulf. Q. Did anyone offer a guess as to when an application in the Gulf could happen, or is everything "on hold" until after MMS’s EIS is completed? A. In her opening address at the workshop, Carolita Kallur, Associate Director of MMS, outlined several key FPSO-related initiatives that are important to its decision process for allowing use in the U.S. Gulf. She expressed hope that the targeted completion dates for these initiatives could lead to a decision by February 2001. Q. As a final question, from your perspective, what are some of the other key deepwater technical challenges industry faces this year, as this new frontier continues its evolution toward a "mature" operation? A. Future technical challenges include both technologies to reduce the costs of deepwater development systems in present water depths, as well as enabling the safe and economic development of oil / gas in even-deeper depths. Basic engineering research in the areas of fluid / structure interaction, materials and seafloor engineering will continue to play an important role in meeting these challenges. DWT The author

Service company R&D to play key role in deep waterChuck Alexander, the new manager of Schlumberger’s Deepwater Center of Excellence, talks about how the organization is helping the deepwater industry meet its interesting new technology challenges. Formed two years ago in New Orleans and recently moved to Houston, the Center has already identified, developed and applied several successful solutions to deepwater problems. From his background with a major oil company, Mr. Alexander expands on some of these accomplishments, outlines the scope of the Center’s activities and describes how Schlumberger is interfacing with the deepwater industry through various JIPs and DeepStar. He says the basic goal is to find ways to reduce exploration cost, CAPEX and OPEX; thus, new technologies that eliminate or reduce "trips through the water column" are a high priority. In the quest to meet new deepwater challenges, he sees the role of service companies intensifying. Q. Mr. Alexander, can you outline the background and organization of Schlumberger Oilfield Services’ Deepwater Center of Excellence? A. The Center was started nearly two years ago in recognition of the need to identify solutions that solve the unique problems of deep water. It consists of a core team of six experts based in Houston, and a number of associate members in Schlumberger business units worldwide. Two driving factors led to the formation of the Center. One was the need to identify – and then work to close – the technology gaps, first by providing a knowledge hub to spread best practice and by working with our R&D centers to produce new solutions. The second factor was the need to reduce the high cost of drilling and producing in deep water. We think this second factor can be accomplished in a variety of ways. Among them is development of highly reliable equipment, and integration of deepwater technology and services. In this respect, the deepwater team works with other parties, such as Coflexip Stena (with whom we have an alliance) or Framo Engineering, to develop a solution to a particular problem. Q. What is the scope of the Center’s activities? Do you work exclusively with deep water, and do you focus on particular operational areas, such as reservoir, well completion, drilling, etc? A. As you know, high costs are part of the deepwater arena because of the expense of rigs and other equipment needed to work in several thousand feet of water, coupled with the longer time durations needed. It just takes a lot more time to work in 5,000 or 6,000 feet of water, compared to 500 or 1,000 feet. Another factor that drives up the cost of working in deep water is the high cost of mistakes or poor reliability. What would be a straightforward fix on land or in conventional water depths can become a major expense and delay in deep water, where intervention rigs and ROVs are expensive, and may or may not be available when needed. Our Center takes a comprehensive approach to reducing the cost of working in deep water. In the case of drilling, this means increasing efficiency by reducing the number of trips. Accurate pore pressure prediction allows optimization of the casing program. Measuring reservoir parameters while drilling avoids the need for separate wireline trips during the drilling program. Our approach anticipates problems through judicious interpretation of reservoir measurements made before and during drilling and, again, unnecessary trips are eliminated. Large cost reductions also accrue if wells can be eliminated altogether; and this can be done through careful well planning, use of multilaterals, and downhole flow control and data gathering through Intelligent Completion components. Schlumberger’s goal is to provide this information quickly and in a useful format to our customers. They can then identify areas for improvement and have those changes implemented. When it comes to interventions, our goal is to reduce the need for intervention through intelligent well technology and to reduce the cost of those interventions that are necessary. We already do this in the North Sea and Gulf of Mexico by teaming with Coflexip Stena Offshore and Cal Dive using DP vessels for well intervention instead of drill rigs. We have developed technology in all these areas, and one role of the Deepwater Center is to work with our business units and our customers to find the best-in-class solutions for a given situation. Another opportunity for cost reduction is reducing the number of floating platforms in deep water. Technology now exists to allow long tie-backs, thus eliminating the need for additional host platforms for remote reservoirs. Schlumberger’s recent purchase of 40% of Framo Engineering opens some intriguing possibilities. The coupling of Framo’s subsea separation, multiphase pumping, multiphase metering and subsea water injection technology with Schlumberger’s downhole flow control and reservoir measurement and interpretation capability should provide powerful reservoir management tools. We have always recognized the importance of integrated control of the production process, starting downhole. The end result will be to significantly increase recovery factors. All of these solutions can be applied in any water depth, but they become particularly important in deep water where operating costs are so high. Q. How does Schlumberger interface with the industry in the R&D? A. Another role of the Center is championing development of new deepwater technology. Schlumberger has always had a strong commitment to developing technology. We spend more than $360 million a year on research and engineering. We work with our clients to identify the high-value problems and, in many cases, jointly develop solutions. Currently, we are working with an objective to dramatically improve the drilling process by incorporating all available data to develop a predictive approach to well site operations, providing for contingent positions and facilitating real-time updates. We are also working with other customers in the development of the SenTREE 7 (Mark of Schlumberger) deepwater well intervention system. Schlumberger participates in various JIPs, including Mudlift for dual gradient drilling, which are working on solutions that align with our development objectives. And we are an active member of DeepStar.

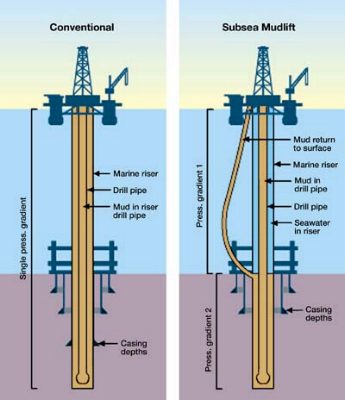

Q. Can you identify any ongoing projects that the Center is participating in? A. Schlumberger has been an active DeepStar participant since 1994. This includes committee meetings as well as submissions to participate in those areas that are our core business. We participate in the Subsea MudLift Drilling JIP. Its basic goal is to remove the effect of water depth from deepwater drilling by using a dual-density circulating system. This system comprises a subsea mudlift return unit that incorporates a modified conventional riser system. On a typical deepwater well in the Gulf of Mexico, implementation of this technology is expected to reap savings of $5 million to $15 million per well, and lead to large-hole completions in deep water. We are also involved in another JIP called DH-DST (DownHole Drill Stem Test). This JIP examines the feasibility of well testing without producing hydrocarbons to the surface. This project will investigate the technology to circulate fluids through a downhole testing system. The system will acquire pressure and flowrate data downhole rather than at the surface without having to flare hydrocarbon fluids or transport collected fluids for remote disposal. The result will be improved operational safety and less impact on the environment. Q. Beyond these, what are the Center’s opinions of the technology status of the GOM (and world) efforts in deep water, i.e., what major technical challenges still face the industry in the process of developing / marketing deepwater oil / gas? A. Most things can be accomplished, given sufficient time and money. However, unlimited time and money have not been hallmarks of the oil industry. On the contrary, project economics demand that net present value, rates of return and other economic measures meet competitive thresholds; otherwise, potential projects are "dead in the water." So, many of the deepwater technical challenges revolve around finding ways to reduce CAPEX and OPEX, and to increase reservoir recovery in a safe and environmentally sound way. For example, we have always been able to run wireline to obtain the vital reservoir measurements during drilling; but it required a separate trip, which meant additional rig time. We provide "measurement while drilling" technology, which allows measurement to be taken while drilling is proceeding, i.e., no extra trips. There are many examples like this one. We feel the next step is to integrate solutions and technologies for greater savings in the future. So, I would have to say that, in many cases, "technical challenges" originate from challenges in field economics. That’s not to say that there are not some truly enabling technologies still to be developed and commercialized. Intelligent Completion Systems are recognized by many as a significant development area. Schlumberger has evaluated this opportunity, and a business plan is in place to support developments, which is resulting in financial return for both us and our customers. Major opportunities exist in creating technologies that will allow more-cost-effective well interventions. Light-vessel interventions and riserless interventions are key areas of improvement. As I mentioned, intervention costs are too high. Development of equipment that is very mobile and that can interact with subsea wells, possibly while using some type of existing platform, is seen as a high priority by our deepwater team. Techniques that will eliminate trips through the water column will allow lower-cost evaluation. Ideas like the Schlumberger PERFPAC system or the Schlumberger QUAD* and QUINT* (*Mark of Schlumberger) combo systems were new technologies at one time, but are today commonplace. Further development of subsea processing and flow assurance technology will allow today’s uneconomical fields to be tied into existing structures. This is particularly true in the North Sea. Q. Do you see the role of service companies intensifying in the rush to solve these challenging problems? Will the new deepwater areas off Africa and Brazil intensify these needs with their different technical / logistic problems? A. Piece-mealing of services and products is yielding to integration of services and system solutions. Service companies are well positioned to take on responsibilities of interface coordinator and solution provider. This would almost always be done under the overall control of the oil company. To the extent that oil companies perceive they are deriving value, that role should grow over time. State-of-the-art technology exists within the service companies. In this era of limited resources, where experienced engineers are harder and harder to come by, service companies still provide a pool of talent and experience that can be drawn upon by the oil companies. There are great prizes in deep water, and for all these reasons, I believe it is likely that we will see an intensification of service company activity in future years. Certainly, Brazil is becoming a mature oil province. Petrobras has been preeminent in developing and deploying deepwater technology. The industry owes a lot to them in this regard. That’s not to say that the Brazilian arena cannot benefit from advances in reservoir management tools and practices. West Africa is on the threshold of substantial deepwater development and, thus, represents one of the industry’s best opportunities. And I think West Africa will be one of the greatest beneficiaries of the new deepwater technology now being developed. In West Africa, service companies and oil companies, alike, are faced with logistical challenges. Setting up operations and housing in green-field sites, mobilizing equipment from long distances and operating without an industrial infrastructure are just some of the challenges that come with the territory. While these can be inconvenient and costly at times, there can also be advantages in being in on the initial wave of an infrastructure build up. Q. What other opportunities and challenges do you see? A. I doubt there has ever been a more exciting time to be in the offshore industry. Technology is coming of age for opening up deep water, and that is still in its early stages of development. Consolidations in the industry have positioned both oil companies and service companies with the capability and financial wherewithal to proceed, given acceptable field economics. The dark cloud on the horizon is a lack of qualified and experienced personnel – this could eventually slow progress. To combat this broadening skills gap in the industry, Schlumberger recently joined up with Heriot-Watt University, Texas A&M and the University of Oklahoma to launch NExT, which stands for Network of Excellence in Training. The mission of NExT is to create a network of recognized excellence in petroleum education to provide the transfer of leading-edge and established technology to the petroleum industry. NExT training combines academic excellence with contemporary professional expertise. DWT The author

Wood Group expands to serve growing international offshore marketSir Ian Wood, Managing Director of the Wood Group headquartered in Aberdeen, Scotland, outlines the background and evolution of his now-worldwide engineering and industrial services organization that employees more than 7,000 people in 27 countries. Growth of the Group has been recently escalated with significant acquisitions in the Houston area to follow the rapidly expanding deepwater market.

Q. Sir Ian, can you outline the background of Wood Group, how it became involved in offshore activities, and what has been its principal contributions in traditional work areas? A. The Wood family business of fishing and marine engineering, established almost a century ago in Aberdeen, developed in the early 1970s into an engineering business to serve the new UK oil and gas industry. That business now has a yearly turnover of almost a billion dollars, and employs 7,000 people in 27 countries. I visited Houston in 1972 to find out more about the oil industry, and I saw great potential for Aberdeen and the engineering business that has become Wood Group. Today, that organization is an international energy services company with hubs in the UK, Houston, the Arabian Gulf, Venezuela and Asia Pacific. It has evolved and diversified into three, core business divisions; Engineering & Operations Support, serving oil and gas clients worldwide; Petroleum Services, with electric submersible pumps, pressure control equipment and downhole data logging services; and Gas Turbines, serving the industrial and aviation turbine markets. Q. When and why did Wood Group choose to expand beyond the North Sea? A. We have steadily become more international since the mid-1980s. The UK’s oil and gas industry is now a mature industry, and the skills and expertise we have developed are very exportable. As exploration and production activity declines in the North Sea, there are areas of the world where the same skills can be applied for new clients with new challenges. Wood Group now has established businesses in the major oil provinces of the world, staffed by local experts and run as local companies with local knowledge. The North Sea experience has been a springboard for international development, and we have made a series of strategic acquisitions around the world that have enabled us to grow fast. We have a great knowledge based on: the reservoir, the well, the production process, engineering, modifications and maintenance, logistics, safety and environment – and we have the personnel to serve clients anywhere in the world. Our expertise in mature-asset management, especially, is being exported from the North Sea to the U.S., Colombia and Venezuela. In 1995, at our first international conference in Kuala Lumpur, I truly changed my mindset when seven of us from the UK sat down with more than 20 colleagues from Malaysia, Thailand, Viet Nam, China and Australia. The previous idea that I held of our Group being Scottish or even UK-based was no longer correct. I now tell our colleagues around the world to "act local, think global." Wood Group de Venezuela is a Venezuelan company, Wood Group in Houston is a U.S. company and J P Kenny in Perth is an Australian company, and so on. Q. This has been, then, principally to take advantage of the growing international activity? A. Yes. We are now a truly global company. We learned a great deal from adapting our business to the downturn in oil prices in the 1980s, and again in the 1990s. Our diversification has given us some resilience to the market cycles. We have also developed a number of joint ventures and partnership deals to give us a good balance of skills and expertise. We have joint venture agreements with some of the world’s greatest companies, including Rolls-Royce, Pratt & Whitney and TransCanada Pipelines. We have developed an enormous pool of talent about reservoirs and production, to add to our engineering and operations and maintenance skills. We now use this expertise in other parts of the world to help a range of clients reduce their operating costs and improve efficiency. Some of our specialist businesses are in the top three in their markets, and more than half of the Group’s $1-billion revenue is from non-UK sales. Its key to success is an ability to make fast decisions, adapt to change and develop the business in a proactive manner, taking opportunities as they arise. The Group has grown both internally and by acquisition, and operates with an entrepreneurial approach. Q. Your acquisition of Alliance Engineering and opening of an office in Houston was a major part of this international expansion?

A. Yes. The acquisition of Alliance was a significant first step in the international expansion strategy for our Engineering & Operations Support Division. Alliance has been an excellent addition to the Division and, of course, Houston is a key window to the world for the oil business. The company’s specialist engineering talent and its positive reputation in the industry provide a springboard for further growth. Alliance has clients around the world and provides services for independents as well as major oil companies. It works on both onshore and offshore production projects. It provides engineering support to Wood Group’s Colombian, Venezuelan and North American operations. And its Gulf of Mexico expertise – combined with our North Sea experience, management and project control systems – provides a "best of both worlds," fit-for-purpose approach for our clients. When you add operational expertise to strong engineering talent, you can create a positive advantage. Q. What major deepwater areas (countries) is the new organization involved in and what design contributions are included? A. Alliance provides oil and gas engineering services in the deepwater areas around the world, including Brazil, West Africa and, of course, the Gulf of Mexico. For one of its technical thrusts, in particular, topside weight reduction has been a focus for deepwater projects. One pound saved on the topside results in saving several pounds in hull weight. People don’t always think of this, but weight reduction not only saves money, it also saves time and reduces complexity. The weight reduction techniques are not only valuable to operators for deepwater applications, but also in areas like the Caspian Sea. The movement of equipment and materials into areas such as the Caspian and for Arctic production can be logistical nightmares. If one can achieve the same result using less weight, it has tremendous cost and schedule benefits. In addition to weight reduction, Alliance expertise includes gas processing and treating, water treating, oil treating, heavy and waxy oil production and compression. The Group’s expertise in operations and maintenance support provides an excellent resource for design. And Alliance is also a perfect fit with its sister company J P Kenny, which specializes in design of subsea production facilities, risers and subsea pipelines. That company is in the top three in the world in its specialist subsea engineering sector. It has been involved over the past two decades in most of the major marine trunklines of the world. Q. What important technical challenges do you see the deepwater industry facing? A. For one big challenge, the industry as a whole – not only deep water – is facing a skill shortage for the job ahead. If not managed professionally, this could threaten the operational integrity and / or safety performance of these huge investments. It requires performance reliability solutions that only people with the right experience and talent can solve. The industry, as we are, should focus on training engineers and operating personnel to meet these challenges, with safety always of paramount importance. There are a number of things that we are doing as an industry to tackle this skills-shortage problem, for example:

The industry recognizes the skills-shortage problem, and we are prepared to lead this focus on people and technology development. For the most part, we now have the technical solutions for tough deepwater problems and are preparing our people to continue to meet client needs. Our Group and other UK companies have derived significant benefit from the UK’s PILOT project. This is a government / oil-industry initiative in which I have been involved, which has been tasked with ensuring that opportunities for business growth for UK companies overseas are clearly identified. This will mean developing and adopting new technologies, especially subsea technology, and making sure that all the players – operators, contractors, suppliers and unions – work together to export the skills and expertise learned in the North Sea over three decades, and maintain Aberdeen’s position as the number two location, behind Houston, as a world-class center for oil industry services. Q. As we were about to go to press, you had one other important announcement to make. A. Wood Group has significantly enhanced its deepwater exploration and production engineering capability with the acquisition in July of 80% of Houston-based Mustang Engineering. Mustang is the Group’s largest acquisition to date, and adds a sizeable world-leading engineering business to the Engineering & Operations Support division. When the deal is completed, this will be great news for Mustang, and great news for Wood Group and our customers. Mustang is one of the world’s leading engineering design companies for offshore facilities; and it has a particularly strong deepwater engineering capability. There are significant synergies with Wood Group’s own engineering businesses worldwide, and there is also an excellent cultural fit between it and Mustang. The move will take our total U.S. staff to over 3,000 people. Mustang is best in class at getting clients to first oil (greenfield engineering). Wood Group is best in class at post-construction (brownfield) engineering, operations and maintenance. Bringing these companies together will give clients great potential for reduction in "life cycle cost," and it gives the Group a formidable position in the Gulf of Mexico, as well as adding capability in both Brazil and West Africa. The combination of the U.S. fit-for-purpose, standardized design approach and the North Sea’s highly innovative, cutting edge design capability will provide an unparalleled life-of-field support service for our oil / gas clients. Mustang is also looking forward to working closely with our two other Houston-based companies. J P Kenny, an international best-in-class deepwater pipeline and subsea system engineering company, augments Mustang’s topsides capability. Alliance is a top-rated structure, facility and shallow-water pipeline design firm. DWT The author

|

||||||||||||||||||||||||||||||||

Antoine

Serceau, Girassol project manager, Elf Exploration Angola, joined the Elf Group in 1980 as engineer

for the Congo Projects Group. From 1981 to 1985, he served Elf Aquitaine Norge on Heimdal as construction

manager during onshore and offshore project phases. He was nominated Gabon projects group manager from 1985 to

1988, and he supervised the AGMP, Rabicap Lopez and Cap Lopez projects in this capacity. In Den Haag, he

worked for Elf Petroland for four years as projects department manager in charge of Block K6, F15A and K5

field developments. After two supplementary years in Pau, he took over management of the Froy project in

Stavanger for Elf Petroleum Norge. Returning to Pau in 1995, he assumed responsibility for Girassol in late

1997.

Antoine

Serceau, Girassol project manager, Elf Exploration Angola, joined the Elf Group in 1980 as engineer

for the Congo Projects Group. From 1981 to 1985, he served Elf Aquitaine Norge on Heimdal as construction

manager during onshore and offshore project phases. He was nominated Gabon projects group manager from 1985 to

1988, and he supervised the AGMP, Rabicap Lopez and Cap Lopez projects in this capacity. In Den Haag, he

worked for Elf Petroland for four years as projects department manager in charge of Block K6, F15A and K5

field developments. After two supplementary years in Pau, he took over management of the Froy project in

Stavanger for Elf Petroleum Norge. Returning to Pau in 1995, he assumed responsibility for Girassol in late

1997.

E.

G. "Skip" Ward, associate director of the Offshore Technology Research Center, Texas A&M

University, College Station, Texas, earned a BS degree in ME from Lamar University in 1964, and MS and PhD

degrees in ME from the University of Houston in 1966 and 1968. From 1968 to 1994, he was employed by Shell

Development Co., E&P Research, as a researcher in offshore engineering. He became involved in research

coordination and management, and managed the Offshore Engineering Research Department for nine years. From

1994 to 1998, in Shell’s Deepwater Design Division, he managed a structural engineering group involved in

designing deepwater structures. Upon his retirement in 1998, he accepted his present position with OTRC. Mr.

Ward has actively supported the industry through participation in committees, boards and work groups with

OTRC, the Marine Board, API, AGA, and AOGA. He has authored / coauthored several technical reports, conference

presentations and articles.

E.

G. "Skip" Ward, associate director of the Offshore Technology Research Center, Texas A&M

University, College Station, Texas, earned a BS degree in ME from Lamar University in 1964, and MS and PhD

degrees in ME from the University of Houston in 1966 and 1968. From 1968 to 1994, he was employed by Shell

Development Co., E&P Research, as a researcher in offshore engineering. He became involved in research

coordination and management, and managed the Offshore Engineering Research Department for nine years. From

1994 to 1998, in Shell’s Deepwater Design Division, he managed a structural engineering group involved in

designing deepwater structures. Upon his retirement in 1998, he accepted his present position with OTRC. Mr.

Ward has actively supported the industry through participation in committees, boards and work groups with

OTRC, the Marine Board, API, AGA, and AOGA. He has authored / coauthored several technical reports, conference

presentations and articles.

Chuck

Alexander, manager, Schlumberger Deepwater Center of Excellence, earned a BS degree in mechanical

engineering at Purdue University and an MS in underwater physics at the U.S. Naval Postgraduate School. His

career in the oilfield industry began in 1974 as an engineer with Santa Fe Engineering Services. In 1980, he

joined Mobil Oil Corp., where he held positions of increasing responsibility, including project and subsea

manager for Mobil’s first operated floating / subsea development. He assumed his role as manager of the

Deepwater Center in April 2000. A patent is pending on the Tension Leg Riser, a deepwater production riser, of

which he a co-inventor.

Chuck

Alexander, manager, Schlumberger Deepwater Center of Excellence, earned a BS degree in mechanical

engineering at Purdue University and an MS in underwater physics at the U.S. Naval Postgraduate School. His

career in the oilfield industry began in 1974 as an engineer with Santa Fe Engineering Services. In 1980, he

joined Mobil Oil Corp., where he held positions of increasing responsibility, including project and subsea

manager for Mobil’s first operated floating / subsea development. He assumed his role as manager of the

Deepwater Center in April 2000. A patent is pending on the Tension Leg Riser, a deepwater production riser, of

which he a co-inventor.

Sir

Ian Wood, managing director, Wood Group, Aberdeen, Scotland, earned the BSc degree with honours in

psychology from Aberdeen University in 1964. He joined the family business, John Wood & Sons in 1964 and

became managing director in 1967. His more-than-16 industry appointments include membership in the Government

Oil / Gas Industry Task Force (1999), the Offshore Industry Advisory Board (1989 – 1993), and the

Offshore Energy Technology Board (1986 – 1992); and he was chairman of Grampian Enterprise Ltd. (1990 –

1995). He chaired the British Trade International Oil / Gas Export Board (previously OSO) in 1997, and he was

a member of PILOT (that succeeded the UK Gov’t. Oil / Gas Industry Task Force). Among his many awards

are: Knighthood (1994), Grampian Industrialist of the Year (1978) and Corporate Elite "World Player"

(1996). Sir Ian Wood is chairman of both John Wood Group PLC, with 7,000 people worldwide, and J. W. Holdings

Ltd. (fishing, ship repair), with 500 employees.

Sir

Ian Wood, managing director, Wood Group, Aberdeen, Scotland, earned the BSc degree with honours in

psychology from Aberdeen University in 1964. He joined the family business, John Wood & Sons in 1964 and

became managing director in 1967. His more-than-16 industry appointments include membership in the Government

Oil / Gas Industry Task Force (1999), the Offshore Industry Advisory Board (1989 – 1993), and the

Offshore Energy Technology Board (1986 – 1992); and he was chairman of Grampian Enterprise Ltd. (1990 –

1995). He chaired the British Trade International Oil / Gas Export Board (previously OSO) in 1997, and he was

a member of PILOT (that succeeded the UK Gov’t. Oil / Gas Industry Task Force). Among his many awards

are: Knighthood (1994), Grampian Industrialist of the Year (1978) and Corporate Elite "World Player"

(1996). Sir Ian Wood is chairman of both John Wood Group PLC, with 7,000 people worldwide, and J. W. Holdings

Ltd. (fishing, ship repair), with 500 employees.