Far East: Indonesia

August 2000 Vol. 221 No. 8 International Outlook FAR EAST Indonesia An anticipated restructuring of the oil and gas sector did not occur. The House of Repre

FAR EASTIndonesiaAn anticipated restructuring of the oil and gas sector did not occur. The House of Representatives failed to ratify a proposed Oil and Gas Law that would have mandated a more competitive industry and removed state-run Pertamina’s monopoly powers. Effects of 1998’s low oil prices and the lagging economy were felt last year, as licensing and exploration declined. Nevertheless, there were some bright spots. The 2000 outlook is much better. Licensing. As of early 2000, Indonesia had 154 active contracts operated by 82 companies, of which 97 were PSCs. There were only four new license awards last year, including Krueng Mane (North Sumatra) to Lasmo; Ambalat (Kalimantan) to Shell; Bengara (Irian Jaya) to Petromer Trend; and Yapen (Irian Jaya) to Continental. However, three PSCs and four technical assistance contracts were signed in May 2000. The PSCs went to Energy Equity (Bone Bay, offshore Sumatra); Kalrez Petroleum (Bula Block, Maluku Island); and Kufpec (Seram Block, offshore Maluku).

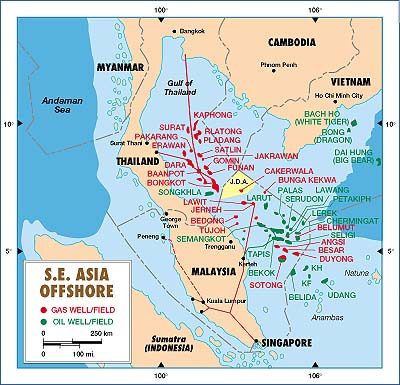

Exploration. Pertamina’s foreign oil contractors directorate said that only $586 million were spent on exploration last year, versus $983 million in 1998. However, a recovery is expected this year, to about $743 million. Greater expenditures are not showing up in seismic activity. The amount of 2-D seismic shot last year fell 29%, to 9,235 mi, and Pertamina expects the number to fall to 5,982 mi this year. Similarly, 3-D seismic work declined 36% last year, to 2,254 sq mi, and only 1,079 sq mi are expected this year. TGS-NOPEC Geophysical Co. began a new, non-exclusive, 1,865-mi, 2-D program last August in the Misool Island region. Unocal enjoyed very successful exploratory drilling over the last year. In June 1999, the firm struck a deepwater oil find in the Rapak PSC, offshore East Kalimantan. Drilled in 4,319 ft of water, Janaka North 1 found 50 ft of high-quality reservoir. Then, last September, Unocal struck oil and gas in the Bangka (Bangka 2; 9,752-ft TD and 267 net ft of gas / liquids pay) and Aton (Aton 3; 8,465-ft TD and 80 ft of oil / gas pay) deepwater prospects. In February 2000, Gendalo 1 struck gas in the Ganal deepwater PSC offshore East Kalimantan. Drilled to a 15,000-ft TD in 4,677 ft of water, the wildcat found two zones that had net gas pay of 242 ft and 144 ft. Finally, in May 2000, Unocal’s Gula and Gada gas finds in the Central Delta Play (offshore East Kalimantan) found 2 to 3 Tcf of reserves. Conoco drilled a pair of discoveries in third-quarter 1999. In the West Natuna Sea, Belanak 6 struck three new pay zones that tested at a combined rate of 5,375 bpd of liquids and 21 MMcfgd. Also in Block B, Conoco struck gas and liquids in the North Belut 3 wildcat. It tested 38 MMcfgd and 2,480 bcpd. In August 1999, Gulf Indonesia Resources hit a gas find in the Corridor PSC in south Sumatra. The Durian Mabok 2 tested 58 MMcfgd and 370 bcpd. Premier Oil in May found oil with its first well in the Northwest Natuna Block (West Natuna Sea). The Ande Ande Lumut 1 logged more than 100 ft of pay from a depth around 3,800 ft. Drilling/development. As oil prices rebounded, Indonesian wells drilled improved 5% (see main table in "World Trends"). Offshore drilling remained steady at 318 wells. This year, Pertamina predicts a 29% drilling increase, including 330 wells offshore.

Unocal last October received approval for Indonesia’s first deepwater development project at West Seno and Merah Besar fields. The firm may begin output at Seno and Merah Besar in years 2002 and 2005, respectively, using innovations that include a lightweight TLP. Conoco will continue to drill a few wells this year, mostly at Belida field. The firm’s major project – the West Natuna gas transportation system – is underway. It involves installing a 22-in. gas pipeline from producing fields to the Belida / Belanch tie-in and then a 28-in. line from there to Singapore. The initial, 325-MMcfd, gas supply contract to Singapore is on a take-or-pay basis. The commitment to deliver gas is July 2001. Conoco’s series of smaller gas fields in West Natuna prompted the firm to use a purpose-built, mobile, gas production jackup (under construction). As part of the West Natuna project, Gulf Indonesia is developing Kakap gas reserves at KF, KH and KRA fields that should go onstream in 2001. Gulf is also developing the Corridor Phase II gas project, set to go onstream in 2001. Another portion of the West Natuna project is being developed by Premier Oil. A new platform will be installed at Anoa field, complete with gas processing and associated gas compression. BP Amoco (ARCO) may put Terang and Sirasun gas fields (1.3 Tcf) onstream in 2001, utilizing Pagerungan gas field’s infrastructure. Pagerungan development continues, as subsea wells are used to extend the field. Santa Fe Snyder is engaged in Phase I development at N.E. Betara, Gemah and N. Betara oil fields. First oil is due before the end of 2000. Kufpec is busy with Phase I development of Oseil heavy oil field, which includes recompletion of three existing wells as producers. First oil is due in 2001. Kodeco is developing the KE-23 and KE-6-5 gas finds. The project will tap 39 Bcf of gas and 400,000 bbl of liquids when it goes onstream in 2001. Production. In line with OPEC’s reduced production, Indonesia’s oil output declined 4% last year. Natural gas production, on the other hand, increased 2.2%, to 8.36 Bcfd. Active gas wells increased 4%, to 775. At least 10 fields went onstream last year. The two largest were TotalFinaElf’s Peciko field (73.3 million bbl of oil and 6.1 Tcf of gas) offshore Mahakam and ExxonMobil’s North Sumatra Offshore field (910 Bcf of gas), off the coast of northern Sumatra. Caltex began output from Piala field (10 million bbl of oil) on the Rokan Block. The company’s output averaged more than 760,000 bopd during 1999. At Duri oil field, Area Nine (of 13 sections) is being developed for steam flood. Caltex continues to pursue tertiary recovery at giant Minas oil field and other light oil fields. Maxus Energy (Repsol/YPF) put four fields onstream in the South East Sumatra Block. These include Retno, East Rama, Yani and Atti (combined reserves of 11.4 million bbl). Indonesian reserves totaled 8.38 billion bbl of oil and 80.8 Tcf of natural

gas at the end of 1999.

|