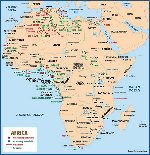

Africa: Others

August 2000 Vol. 221 No. 8 International Outlook AFRICA Others Vanco Energy acquired Namibia’s offshore 2.4 million-acre Block 1711. The firm is curr

AFRICAOthersVanco Energy acquired Namibia’s offshore 2.4 million-acre Block 1711. The firm is currently seeking partners for all of its West African acreage. There was no drilling and no production of Namibia’s 3.0 Tcf of proven gas reserves in 1999. For 2000, one offshore well and acquisition of 501 sq mi of seismic data are planned. Prompted by a successful wildcat in Ghana’s Tano offshore basin, UK-based Dana Petroleum will drill its second well. In January 2000, Ghana Hunt’s wildcat, drilled in 2,900 ft of water, encountered a thin oil column at 9,160 ft. It was considered non-commercial. There were no wells drilled in 1999. No output was reported. Proven reserves are 41.5. million bbl of oil and 276 Bcf.

In Benin, Zetah Benin signed a 25-year production contract for Seme field. The contract calls for one horizontal well in the first five years, plus two vertical wells, three workovers and gas tests. Meanwhile, Chevron inked a joint-venture agreement to build a pipeline to transport Nigerian natural gas to Ghana, Togo and Benin. Production in 1999 was zero, as both wells that had produced 1,230 bopd in 1998 were shut-in. Morocco’s new petroleum laws include a 10-year tax holiday after first production for offshore operators. Modifications in royalty payments – to 10% for onshore and shallow water, 7% for deep water – are said to be the most attractive in Africa. Vanco is converting its reconnaissance permits for Safi Haute Mer and Vanco / Lasmo Ras Tafelney into exploration licenses. Skidmore Energy subsidiary Lonestar will explore a concession covering 2,316 sq mi in the Talsinnt region southeast of Rabat. No drilling was done in Morocco in 1999. Output was about 251.6 bbl from two oil wells, down 5.3% from 1998. Six gas wells produced 4.3 Mcfd. Estimated condensate reserves were 1.88 million bbl, flat compared to 1998, and gas reserves were 47 Bcfg, down 3.1% from 1998. Seismic work in 1999 was 10,172 mi. Six onshore wells are slated for drilling in 2000. The Mauritanian government granted an extension to partners Woodside and British Borneo until April 2001 for drilling the first of three wells on three tracts. About 540 sq mi of seismic will be reprocessed, with an additional 1,351 sq mi of 3-D seismic to be acquired this year. Meanwhile, Dana Petroleum acquired offshore Blocks 1,7 and 8, totaling 13,124 sq mi. Seismic studies in Uganda identified two targets, and Heritage Oil & Gas is slated to drill its first wildcat on the shores of Lake Albert later this year. Government officials report that evaluation of the country’s five exploration areas in its western region is nearing completion. Chevron’s $75-million plan to boost output from the Democratic Republic of Congo includes a combination of new development wells in existing producing fields and delineation wells to increase both production and reserves. Output is expected to climb to more than 20,000 bopd in 2001 – 2002. Production was 22,200 bopd and 21.44 MMcfgd. Oil reserves were 100 million bbl, compared to 105 million bbl in 1998. Gas reserves were 20 Bcf, down 15% from 1998. Madagascar and Seychelles are negotiating a joint invitation to tender for an exploration permit in the deepwater between the two countries in September 2000. A 12,428-mi 2-D seismic survey is anticipated for this year. Madagascar, Kenya, Tanzania, Mozambique and South Africa, Mauritius and Seychelles have been evaluating the countries’ oil potential. Senegal granted Vanco Energy 100% interest in the country’s first deepwater license. Named Dakar Offshore Profond, the eight-million-acre block borders Mauritania and The Gambia. Plans call for 1,243 mi of 2-D seismic by 2002 and additional 2-D and 3-D seismic through 2003. Woodside and partner, ROC Oil, will explore a 4,632-sq-mi area from the Casamance coast to the Mauritanian border, including five offshore blocks. Tullow Oil spudded two wells in late 1999, and found non-commercial gas shows in both. Two onshore wells are forecast for 2000. In Rwanda, output was reported at 47 bcpd and 96.4 Mcf from reserves of 2.12.0 Tcf., flat from 1998. Offshore The Gambia, Fusion Oil and Gas signed a six-year exploration / production license for a 1,930 sq-mi offshore tract in water as deep as 3,280 ft. Fusion shot 684 mi of 2-D seismic that identified large, deepwater turbidite plays. Seismic 3-D acquisition is slated for 2001-2002, and drilling should follow in 2003. South Africa’s oil firm, Soekor, reportedly is planning a tender for tracts off the deep western and southern coasts. State-owned gas-to-fuel converter Mossgas, would have been forced to close its 30,000-bpd plant at Mossel Bay had it not been for a $333-million loan to develop the EM gas field. Mossgas had completed two subsea wells at EM field and one well at nearby EBF field by late 1999. Drilling continues this year, with seven wells planned for production. The fields will be remotely controlled by the FA platform (32 mi away) via a control buoy. In Niger, Hunt Oil’s Manqueni 1 well, drilled to 6,013-ft TD, had some oil shows and found reservoir-quality sands. Hunt slated a second well to further test potential. Hidrocarboneto S.A., an oil company in Sao Tome & Principe, accused Nigeria of selling two offshore blocks located in the disputed territorial waters of the West African archipelago. After months of gridlock, Sao Tome & Principe resumed talks in April on establishing the maritime boundary in the Gulf of Guinea. The Sao Tome government cancelled its E&P management deal with Environmental Remediation Holding Corp. after a dispute with CEO Geoffrey Tirman. Drilling activity resumes in Tanzania. Its Songo Songo gas project, with reserves of 1 Tcfg, is ready for production. Operator PanAfrican Energy plans to bring the project onstream in 2003. The country’s deepwater licensing round, which is receiving strong interest, is scheduled for this August. About 99 mi of 2-D seismic data was acquired on Mandawa Block by Tanganyika Oil Co. A wildcat may still be drilled by the firm this year. Western Geophysical completed the first phase of a 4,350-mi, 2-D shoot off southern Tanzania last year. Plans to construct a $3.5-billion, 652-mi pipeline to export crude from the prolific Doba basin in Chad to Cameroon fell through last year; partners TotalFinaElf and Shell pulled out of the deal. Meanwhile, Malaysian Petronas and Chevron ventured a bold initiative to revive the stalled Doba field project. Chevron gained the 25% stake that Conoco backed away from. After a period of playing both sides, World Bank finally committed $90-million in favor of the deal. Equatorial Guinea has been plagued by poverty, but in recent years, rapid growth of the country’s oil sector has kickstarted the economy. Oil production should reach 300,000 bpd in the next two years. Energy Africa and Triton Energy Ltd. discovered La Ceiba field in Block G with estimated reserves of 300 million to 500 million bbl. Production should start by year-end.

Tuscar Resources’ Obe field began production early this year. Expected output from Obe 4 well is 4,000 bpd. ExxonMobil’s Jade platform in Zafiro field started production from its first well at a rate of more than 12,000 bopd. Currently, there are 22 producing wells in the field. A total of 17 wells is slated for 2001. Chevron signed 5-year production sharing contract to explore the country’s deep water. Vanco Energy gained the Corisco Deep Block award in March. Sasol and Enron have agreed to cooperate on gas and pipeline rights in Mozambique. Under the agreement, which requires local-government approval, Sasol will build a single pipeline from central Mozambique to Maputo, the capital. Enron won rights to develop the 1.6-Tcf Pande gas field, own and operate a pipeline through the desired route, and build a steel facility in Maputo. Sasol already has E&P rights for Temane and Sofala fields and M-10 Block, along with pipeline rights to transport gas from those fields to South Africa. Sasol ousted ARCO from its leading role on offshore blocks M-10 and Sofala Bay and secured a 90% operating stake in each permit. Last year, Cameroon created new E&P legislation with the objective of reviving exploration and raising production, which had dropped about 5% annually between 1985 – 1996 and was at 100,000 bopd in 1999. The country’s national oil company, SNH, opened the third licensing round last September; it closed at the end of June. Elf Serepca joined forces with SNH and Pecten in January and began exploring

the Douala / Kribi-Campo basin, with aims of finding new fields off Idenau and Debundcha. An international

tender was issued for blocks in the Logone Birni basin near Moundou and Douala / Kribi-Campo.

|

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)