International

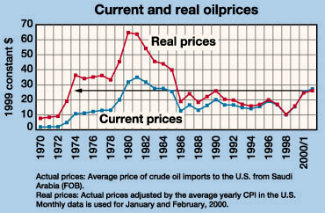

If OPEC members are cheating, why have oil prices been rising?As oil prices hang near $30/bbl for a matter of months rather than weeks, the "blame game" has begun among the "free marketeers" in Western industrialized nations. "How could the free market fail us?" and "Who’s to blame for this mess?" are frequent cries amidst the whining coming from Washington, London, Paris and other capitals, as politicians perceive that their deceivingly fragile economies are in jeopardy. Yet, one never hears complaints from these same people when oil prices go too low, even if the consequences are reduced exploration, cutbacks in field developments and diminished growth in future oil production capacity. These are the very factors that, when coupled with renewed demand growth, bring the world’s economies to a point similar to the one that they are at today. Meanwhile, many oil analysts have egg on their faces – most predicted that the collective production cut by OPEC and non-OPEC countries would have a mild impact. They predicted that higher prices would last only a few months, that OPEC members would cheat, and that non-OPEC output would increase, causing prices to decline. These predictions were dead wrong. World Oil’s contributing editor for the Middle East, Dr. A. F. Alhajji, has examined why analysts’ forecasts were wrong. In so doing, he has posed some interesting questions: Why didn’t OPEC members cheat as economic theory predicts? Why didn’t non-OPEC oil production increase with higher prices? Why did previous OPEC production cuts lead to lower prices, while recent cuts led to a three-fold increase? Why are oil prices on the rise, despite the fact that world oil output increased 700,000 bpd in February 2000? "In February, an OPEC official hinted that production would increase in March," said Dr. Alhajji. "On the very same day, the U.S. DOE announced that it might release oil from the Strategic Petroleum Reserve. Observers expected oil prices to decline, but they went up by almost $1/bbl that day. Right after that, Secretary of Energy (Bill) Richardson – after visiting Saudi Arabia, Venezuela and Mexico – secured a commitment from major oil-producing countries to increase output. Newspaper headlines proclaimed that oil prices should go down. Once again, expectations were incorrect – prices almost reached $32/bbl that day." So what’s going on? "The answer to all these questions is simple – existing production capacity is exaggerated," said Dr. Alhajji. "Even Saudi Arabia’s capacity is highly overestimated. Until the end of May, Saudi Arabia cannot produce more than 8.7 million bopd. The current oil price increase is due to a long period of price stagnation that reached dangerous levels in early 1999. Low prices led to reduced upstream investment and lack of maintenance." Consequently, said our contributing editor, global oil production declined, and many oil wells suffered from severe technical problems that lowered output. Because of low prices, even Saudi Arabia was not able to maintain its capacity, which peaked in 1997. Lower capacity prevented OPEC members from cheating and prevented non-OPEC countries from increasing production. When oil prices increased, countries increased crude output by putting pressure on existing oil wells, and prices decreased slightly. Such pressure led to additional technical problems and output decreased further, which, in turn, kept upward pressure on prices.

Looking back at the March 1999 agreement, only Saudi Arabia, Kuwait and the UAE reduced output voluntarily. Saudi Arabia made the largest cut – all other oil producers were forced to reduce output for various reasons. "In fact, Venezuela produced less than its quota for about two months last year," said Dr. Alhajji. "Despite the hype about everyone living in a ‘Global Village,’ there was no fast, accurate flow of information about the status of oil fields within major producers. Thus, analysts were unaware of technical problems plaguing Venezuela, Iraq, Norway and Russia. This led to an underestimation of the damage caused by low oil prices." The lack of such information (often kept secret) led to the failure of forecasts, including those of the U.S. DOE and the IEA. Comparing the current oil price run-up with previous "oil shocks" yields astonishing similarities, said Dr. Alhajji. "In all of these cases – 1973, 1979, 1991 and 2000 – we have an important political incident that ignited the crisis. Also, in all cases, the following items occurred: Many small incidents took place and prolonged the crisis; political events sparked a panic in the market; Iraq was an essential player in helping to reduce price-crisis effects; major pipelines exploded or shut down; a major waterway was closed or tightened tanker regulations; and spare capacity among producing countries declined while global consumption grew." What’s next? Even if OPEC decided not

to increase production at the end of last month, additional capacity will increase cheating.

Most of that output will be added by May, said Dr. Alhajji, and it is capacity that

was lost because of lack of maintenance when oil prices were low. Given current available

capacity, oil prices may linger around current levels, with slight increases, until May. "Average

oil prices should be between $22 and $24/bbl for the rest of 2000 – they may have

peaked, or are around their peak, now. However, if political turmoil erupts in a hot spot

such as Nigeria, Iraq, Venezuela or Indonesia, oil prices would be on the rise once again."

|

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)