Big challenges in the new millennium

December 1999 Vol. 220 No. 12 Feature Article Index WHAT'S AHEAD IN 2000 Big challe

WHAT'S AHEAD IN 2000Big challenges in the new millenniumPaul L. Kelly, Senior Vice President, Rowan Companies, Inc., Houston

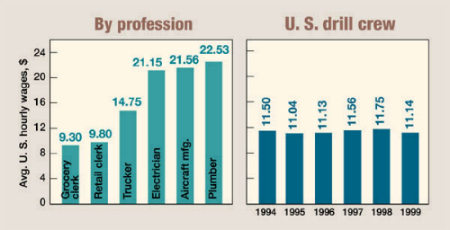

A number of forecasters see the U.S. rig count climbing about 25% from its predicted 50-year-low average of 610 in 1999. Likewise, the Canadian rig count should break 300 in 2000, up from an expected average 235 in 1999. Recovery in the international rig count will lag the North American recovery because many major and national oil companies which do most of this drilling remain skeptical about OPEC sustaining higher oil prices, and several of them remain more focused on mergers and consolidations than investment. Also, when cash flows were reduced in 1998 and early 1999, a number of projects were deferred until 2000. Worldwide offshore rig utilization in the fourth quarter of 1999 was down 13% from a year ago. But in the U.S., natural gas drilling activity in the Gulf of Mexico has stepped up in the fourth quarter, led by independent oil companies. During 1999, Rowan moved three jackup rigs from the southern North Sea to the Gulf of Mexico, where the jackup market is leading a rebound in activity. Our strategy remains the same – to be a niche player featuring a geographic concentration and exceptional equipment capability. We are geographically focused on the proven Gulf of Mexico, North Sea and Atlantic Canada markets. Our equipment strategy, for nearly two decades, has been directed toward the design, construction and operation of harsh-environment, Gorilla-class jackups. We now have four, with two more under construction for delivery in 2000 and 2001. Industry trends. A number of trends which require attention from our industry became apparent during the 1997–1999 downturn. First, studies of gas demand and supply (most recently by the National Petroleum Council) project annual gas demand to rise from 21.4-Tcf in 1998, to the 29–30-Tcf level by 2010, and to 32–33-Tcf by 2015. The industry needs to think through what this means in terms of new-rig construction and personnel requirements in the years just ahead. Rising gas demand represents a huge opportunity if we can meet the challenge and produce / deliver the product to customers. Problems with infrastructure should not be ignored. The collapse in oil prices during the past two years cut short a flurry of new-rig construction aimed, for the most part, at the deepwater market. The chances for additional rig construction were further dimmed when major companies, applying portfolio optimization techniques, examined the "robustness" of their contractual commitments for new, high-priced drilling rigs and either cancelled or renegotiated rates for these contracts. As a result, the credibility of some companies in honoring their commitments has been called into question, and rig owners will be hesitant to incur such obligations in the future. They will also be much more wary about contract terms – so will their lenders. Meeting a 30-Tcf demand in the coming decade will require more land and offshore rigs, as well as an unprecedented level of cooperation and understanding among oil and gas companies, contractors and suppliers. Another no less important challenge in supplying a 30-Tcf gas market concerns attracting capable people to our industry, including such diverse and important personnel as engineers, geologists and geophysicists, tool pushers and drillers, and machinists, electricians, pipefitters and welders. Living with oil prices. Dr. Pierre Jungels, head of UK independent Enterprise Oil, gave some good advice on how to deal with short-term price volatility in a speech in Houston last summer. He said, "Oil prices are always uncertain, no matter what OPEC tries to do. But over a 15-year period, oil prices have stayed flat at around $18 a barrel. "As managers of E&P companies, we should all calm down," he advised. "Every time we have a down cycle, we dump 25% of our staff, then in an up cycle compete against each other for new staff – the bright graduates do not want to work for an industry like that. It also creates poor relations with contractors and leads to a cycle of feast and famine for construction yards." The solution, Dr. Jungels said, is to run the business on the premise of a flat $18/barrel oil price. "You need to have some gas in your portfolio, some long-term cash generators, some near-term, low-cost developments, and some exploration / appraisal work to keep the pipeline going." Employment problems, challenges. According to the Bureau of Labor Statistics, as the result of the last oil price decline, the upstream oil and gas industry lost more than 50,000 jobs as of February 1999 – and there have been more layoffs since then. This has left the U.S. with less than half the number of oil and gas extraction jobs it had during the 1980s. The engineering and geoscience departments of many of the college alma maters of today’s petroleum industry leaders are in total disarray because of our industry’s erratic hiring and firing. We have a tremendous challenge before us in attracting good people to a growing natural gas industry in the face of a healthy economy and shortages of skilled people at all levels nationally. This challenge must be met at company and industry levels with competitive compensation and the message that this industry has become high-tech, with a bright, long-term future. It also calls for much more cooperation with, and support for, the colleges and universities that have been the breeding grounds for petroleum industry personnel. The number of wells drilled is one of the most important factors affecting upstream employment in the oil and gas industry. Current projections for wells drilled in the U.S. in 1999 are in the range of 21,000 wells. Growth in gas demand could boost this by 50%, or more, by 2010. A recent study by EIA 1 estimates that, whatever happens in the short run, employment in the upstream sector will increase, from 325,900 in 1998, to about 350,000 in 2010, in large part because of increased drilling. It is interesting that EIA projects most of the job gains to be "service" jobs – including drilling and geological services – whereas "production" jobs will continue their historic declines. Could this trend be accelerated by oil company operators outsourcing more and more of their work. Critical safety issues. The U.S. Minerals Management Service calculates that about 85% of the workers in the Gulf of Mexico are employees of service companies. This goes a long way toward explaining the high degree of interest on the part of MMS, and oil company operators themselves, in making certain that drilling contractors and other service companies have safety and environmental management plans in place. Whatever changes occur in the employment mix, oil company leaseholders will remain accountable under the terms of their leases. As a result, oil companies themselves are evaluating contractor safety programs as never before. Also, organizations such as the United Kingdom Offshore Operators Association (UKOOA), the International Association of Drilling Contractors (IADC), the Oil and Gas Producers Association (formerly the E&P Forum) and the Gulf of Mexico Offshore Operators Committee have safety and environmental management systems high on their agendas, as well as procedures for the interface of operator and contractor safety and environmental management systems on specific projects. Offshore oil and gas has been a huge success for industry and government. A mistake by one company affects all. Therefore, we can expect safety performance to remain a highly important issue for both government and industry in 2000. Literature Cited

Copyright © 1999 World

Oil |

Paul

L. Kelly is senior vice president of Rowan Companies, Inc., responsible for

special projects and government and industry affairs. He represents the oil service /

supply industry on the U.S. DOI’s OCS Policy Committee (serving as chairman from

1994 to 1996). Mr. Kelly also serves on the U.S. Coast Guard’s National Offshore

Safety Advisory Committee and chairs NOSAC’s Subcommittee on IMO/ISO Issues. In

addition, he is a director of the Alaska Oil and Gas Association and IADC. He sits on

API’s Executive Committee of Exploration Affairs and advises the executive

committee of the Gulf of Mexico Offshore Operators Committee. From 1985 to 1987, Mr.

Kelly served as managing director of British American Offshore Ltd., London, Rowan’s

main contracting entity in the North Sea. He is a director of the British American

Business Association in Houston (serving as president in 1989). He has served on

various subcommittees of the National Petroleum Council and is currently a member of

the Coordinating Subcommittee on Natural Gas. Mr. Kelly has written widely on the

subject of energy and has appeared on behalf of industry in numerous Congressional and

federal agency hearings. He holds BA (Political Science) and law degrees from Yale

University.

Paul

L. Kelly is senior vice president of Rowan Companies, Inc., responsible for

special projects and government and industry affairs. He represents the oil service /

supply industry on the U.S. DOI’s OCS Policy Committee (serving as chairman from

1994 to 1996). Mr. Kelly also serves on the U.S. Coast Guard’s National Offshore

Safety Advisory Committee and chairs NOSAC’s Subcommittee on IMO/ISO Issues. In

addition, he is a director of the Alaska Oil and Gas Association and IADC. He sits on

API’s Executive Committee of Exploration Affairs and advises the executive

committee of the Gulf of Mexico Offshore Operators Committee. From 1985 to 1987, Mr.

Kelly served as managing director of British American Offshore Ltd., London, Rowan’s

main contracting entity in the North Sea. He is a director of the British American

Business Association in Houston (serving as president in 1989). He has served on

various subcommittees of the National Petroleum Council and is currently a member of

the Coordinating Subcommittee on Natural Gas. Mr. Kelly has written widely on the

subject of energy and has appeared on behalf of industry in numerous Congressional and

federal agency hearings. He holds BA (Political Science) and law degrees from Yale

University.