International

Canadian woes include U.S. firms’ merger macarenaNowhere is operator angst about struggling oil prices more prevalent than in Canada. This point was reinforced as yours truly conversed with local personnel while walking around last month’s National Petroleum Show in Calgary. Fortunately, the news on natural gas prices remains relatively buoyant, so there was still optimism about that sector of Canada’s upstream industry to counteract the oil woes. That optimism is translating into a lopsided shift in drilling activity to gas projects, exploratory and development. Already, early returns on our mid-year survey of Canadian operators show that a healthy share of wells drilled during first-half 1998 were targeting gas. That percentage should become overwhelming during second-half 1998. Nevertheless, concern about crude prices in this heavyoil-laden country is justified and growing. The benchmark WTI crude averaged only about $15/bbl from April 1 through the first half of June. However, in late May and early June, the average languished even lower, between $14.50 and $15/bbl. Of course, Canadian heavy oil fetches rates far lower than WTI. After beginning 1998 at $13.36/bbl, the 22°API Lloyd Blend sank to a $7.59 low in mid-March before news of the OPEC/non-OPEC production cut sparked a recovery. After inching above $11/bbl, the blend slipped again, as doubts about OPEC’s resolve emerged. By late May, Lloyd Blend was under $10, again. Meanwhile, many Canadian firms began pruning their drilling budgets early this year. By mid-March, about C$1.3 billion (US$910 million) had been slashed from capital spending, according to Calgary investment house Peters & Co. The resultant decline in drilling versus last year’s pace translated into less oil production growth. Stagnant crude output chasing weaker prices has cut deeply into some corporate cash flows, forcing financial analysts in Calgary to brace for very poor second-quarter 1998 results. Producers have been shutting in heavy oil wells, postponing plans to drill for crude and, in severe cases, cutting back on well maintenance. Smaller producers have been joined in this behavior by large firms with high exposure to heavy oil, such as Imperial Oil, PanCanadian Petroleum, Ranger Oil and Gulf Canada Resources. By contrast, firms with strong gas portfolios (e.g., Alberta Energy, Poco Petroleums and Anderson Exploration) have fared better. Low oil prices also are encouraging and exacerbating a takeover spree by U.S. firms that began before oil prices plummeted. Healthy gas prices and good opportunities to participate in drilling and pipeline projects (to bring even more Canadian gas into the Lower 48 states) have put U.S. operators in a shopping frenzy. Among U.S. firms that have taken over Canadian companies are Dominion Resources, Pioneer Natural Resources and Union Pacific Resources. Most recent was a C$1.1-billion (US$750-million) acquisition of Tarragon Oil & Gas by Marathon Oil. American firms rumored to be interested in joining the takeover fray were Burlington Resources and Ocean Energy. Meanwhile, Canadian executives reacted to the flurry of takeovers by referring to them as the "merger macarena," a sarcastic takeoff on the Latin American dance term. Given the short-term crude price outlook, U.S. firms will be practicing their acquisition dance for some time to come.

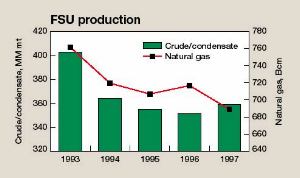

Some glimmers of hope in the FSU. It is too early to tell whether sluggish oil prices will terminate the trend prematurely, but combined crude and condensate production actually improved in some countries of the Former Soviet Union for the first time in this decade. The good news comes from data released recently by the Interstate Statistical Committee (ISC) of the Commonwealth of Independent States. ISC’s official figures indicate that total FSU output was about 359 million mt, or 7.15 million bopd (see chart). That was 2% higher than the 1996 figure, about 1% greater than in 1995, and 1% less than 1994’s output. Primary reason, of course, was a 5-million-t (99,600-bopd) improvement in Russia, although smaller, nice gains were achieved by Kazakhstan and Uzbekistan. Unfortunately, the news is not so good for FSU gas output. In 1997, the countries produced a combined 689 Bcm (24.2 Tcf) of gas, or 1.89 Bcmgd (66.3 Bcfgd). This was 4% less than the 1996 rate, negating improvement achieved during that year. Once again, Russia accounted for most of the difference, producing 30 Bcm (1.05 Tcf) less than in 1996. Small gains were posted by Uzbekistan and Kazakhstan, with other FSU countries declining slightly. Within Russia, giant firm Gazprom accounted for 94% of the country’s gas output. However that production, 533.8 Bcm, was down 31 Bcm (6%) from the 1996 level. Gazprom’s "discovered" gas reserves stood at 33.4 Tcm (1,172 Tcf) at the

end of 1997. They reportedly grew by 1.6% last year, while the firm’s crude and

condensate reserves increased by 46.5 million mt (338 million bbl). Ironically, Gazprom’s

crude and condensate output increased 5% in 1997, to 9.1 million mt (181,250 bpd).

Copyright © 1999 World

Oil |